The crypto market supports for considerable activities as virtually $3 billion in Bitcoin and Ethereum alternatives run out today.

With significant agreements and optimum discomfort factors determined, just how will these running out alternatives influence the marketplace’s volatility?

Volatility Decreases as Significant Crypto Options Near-Expiry

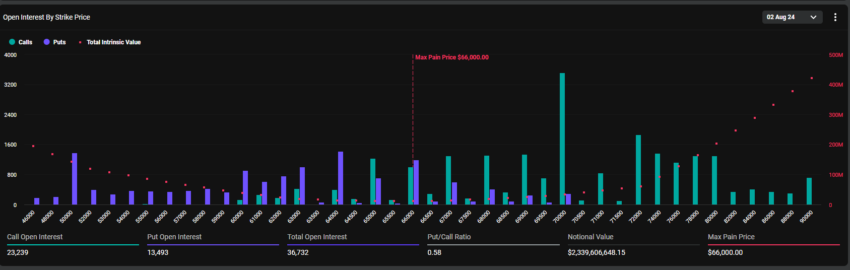

According to Deribit information, about $2.34 billion in Bitcoin alternatives are readied to run out today. The optimum discomfort factor for these alternatives stands at $66,000, gone along with by a put-to-call proportion of 0.58. This expiry consists of 36,732 agreements, which is especially less than recently’s 61,320 agreements.

Furthermore, Ethereum sees the expiry of 183,756 agreements with a notional worth of $577.2 million. The optimum discomfort factor for these agreements is $3,300, with a put-to-call proportion of 0.55.

Learn More: An Intro to Crypto Options Trading

The optimum discomfort factor in the crypto alternatives market stands for the rate degree that brings upon one of the most monetary pain on choice owners. At the exact same time, the put-to-call proportion suggests a greater frequency of acquisition alternatives (phone calls) over sales alternatives (places).

Crypto alternatives trading device Greeks.live provides some understandings right into today’s running out alternatives. They kept in mind a virtually 15% decrease in the Dvol Index from 62% to 48% given that July’s regular monthly distribution, showing a substantial reduction in market volatility. Present suggested volatility (IV) degrees are amongst the most affordable this year, with just 3 weeks listed below the existing degree.

Greeks.live experts highlight that market volatility has actually decreased as vital occasions such as the Bitcoin 2024 Meeting and FOMC conferences have actually landed efficiently. Nevertheless, Adam, an expert at Greeks.live, kept in mind that the marketplace presently does not have “locations,” and the Ethereum exchange-traded funds (ETF) will certainly require to wait on constant favorable inflows.

” The historic fad recommends that this quarter must be a lot more confident total, however with little temporary chance, it is the correct time to get some tool to lasting phone call alternatives,” he added.

Bitcoin began the month at $66,342 however dipped to $62,000 throughout Asia’s twelve o’clock at night session today. At the time of creating, it has actually supported at around $64,714.

At the same time, Ethereum experienced a sharper decrease. From $3,317 on August 1, it went down to $3,097 prior to recoiling to $3,178.

Learn More: 9 Finest Crypto Options Trading Operatings Systems

Historically, alternatives agreement expiries often tend to trigger sharp however short-term rate activities. The marketplace generally supports quickly after. Eventually, investors need to remain alert, examining technological signs and market view to browse possible volatility successfully.

Please Note

In adherence to the Count on Task standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to offer exact, prompt info. Nevertheless, viewers are suggested to validate realities separately and speak with an expert prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.