According to a current Immunefi record, the crypto market has actually dealt with substantial economic problems considering that the start of 2024. Losses as a result of hacks and scams have actually gone beyond $1.19 billion.

The losses videotaped in the very first 7 months of this year revealed a remarkable 16.3% rise contrasted to the very same duration in 2023, when losses totaled up to $1.02 billion. These numbers highlight the consistent and expanding hazard cybercriminals position to the crypto market.

CeFi Suffers The Majority Of as Crypto Losses Skyrocket in July

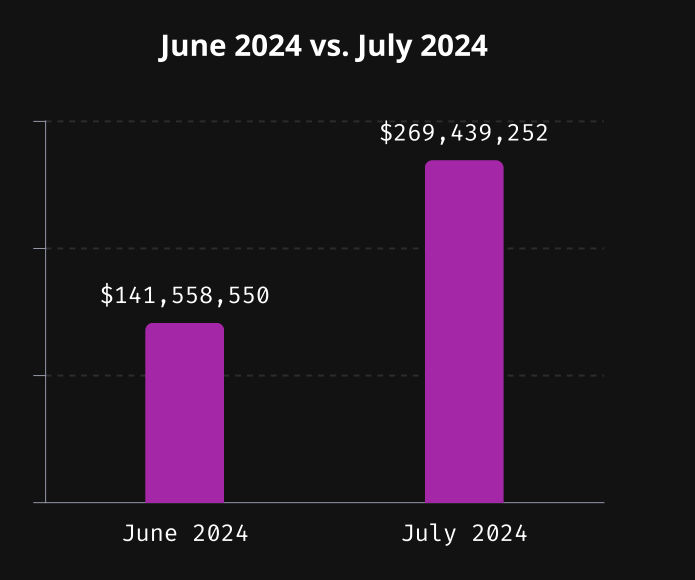

In July, Immunefi reported that the crypto field endured losses of $269.4 million in 14 different events. This mirrors a 90% rise from June, making July the 2nd most destructive month of 2024. One of the most substantial losses remained in Might, getting to $358 million.

In spite of the regular monthly surge, the year-over-year contrast reveals a 15.9% reduction in July losses. The mass of these current losses can be credited to a significant hack on the Indian central exchange WazirX, which endured a ravaging $235 million loss.

Find Out More: 15 The Majority Of Usual Crypto Rip-offs To Keep An Eye Out For

Central financing (CeFi) has actually birthed the burden of these strikes, going beyond decentralized financing (DeFi) in regards to the overall quantity of funds shed. In July, CeFi represented 87% of the failures, while DeFi systems saw $34.4 million in losses spread out throughout 13 events.

Moreover, the record mentioned that hacks stay the primary reason for these losses, with $266.5 million shed to such events in July alone. In contrast, scams and frauds just represented 1.1% of the failures for the month.

Immunefi’s record likewise clarifies the participation of North Oriental cyberpunk teams, especially the well-known Lazarus Team, in several of one of the most substantial strikes. The WazirX hack, for example, is believed to be managed by North Oriental cyberpunks.

The record exposes that Ethereum and BNB Chain were one of the most targeted blockchain networks in July. These blockchains jointly represented 71.4% of the failures. Ethereum alone endured 7 strikes, standing for fifty percent of the overall events, while BNB Chain experienced 3 substantial violations.

ChainSwap’s creator and chief executive officer, Fitzy, shared his viewpoint with BeInCrypto concerning this scenario. He recognizes that while Web3 innovation drives technology, it likewise opens up methods for economic criminal activities and scams. He clears up that Web3 devices aren’t naturally criminogenic however instead are manipulated as brand-new tools by fraudsters.

” Web3 devices do not create criminal offense, it is simply made use of as a brand-new tool to devote some frauds. The typical point throughout all these tools is that the most effective method somebody can secure themselves from frauds and scams is to wage care. Sufferers of frauds and scams are generally the ones that do not understand any type of much better,” Fitzy discussed.

Furthermore, Slava Demchuk, Chief Executive Officer of AMLBot, mentioned that the substantial losses as a result of cyberpunk strikes and scams in this market reveal the immediate requirement for solid safety actions. He recommended that past carrying out basic software application safety and file encryption, carrying out constant audits and infiltration examinations is essential.

” Individual training in managing delicate information and more stringent worker employing procedures are essential also. For example, the Fractal ID hack subjected susceptabilities in KYC information handling, bring about dripped details on the dark internet. Likewise, the Coinspad hack showed the dangers connected with poor worker vetting when a brand-new, well-paid worker manipulated the system from within,” Demchuk stated.

Find Out More: Leading 5 Defects in Crypto Safety And Security and Exactly How To Stay clear of Them

Resembling Demchuk, Fitzy likewise warned private financiers to secure themselves from frauds and scams, especially in decentralized applications.

” For central firms and systems, federal governments require to locate brand-new means to keep an eye on tasks for this brand-new property course and firms around it. For decentralized applications, the most effective method for individuals to remain secure is to have care and understanding on their own. Indicators like quantity, variety of individuals in the area, reliable owners or companions– are all excellent indications for an application that is most likely secure to utilize,” he included.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to give precise, prompt details. Nonetheless, viewers are suggested to confirm realities separately and speak with a specialist prior to making any type of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.