Bitcoin (BTC) volatility goes to multi-month highs, with the cost activity whiplashing futures investors on both sides, long and short alike. It comes in the middle of geopolitical stress, which influences a boost in safe-haven need.

TradFi and crypto market individuals need to support for effect as the globe enjoys growths in the geopolitical room.

Bitcoin Bends To Geopolitical Stress

Bitcoin cost volatility has actually been boosting, preserving a consistent climb given that June 24. Information control panel BiTBO reveals that the last time volatility degrees were this high remained in very early Might. This statistics suggests exactly how quickly the BTC cost rises and fall within a specific duration.

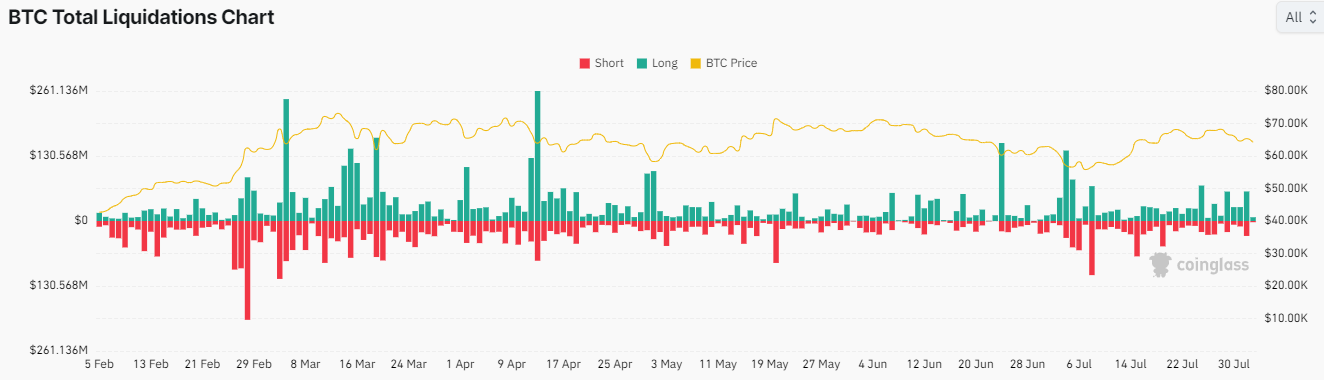

Coinglass data reveals that volatility has actually brought about the liquidation of over 90,000 investors, with overall crypto market liquidations getting to $267.95 million. In the Bitcoin market, virtually $60 million in lengthy placements were sold off, contrasted to regarding $30 million in other words placements.

Learn More: Just How To Acquire Bitcoin (BTC) and Every Little Thing You Required To Know

This comes in the middle of recurring chaos in between Israel and Hezbollah, producing a risk-off situation. Current records show that Hezbollah terminated a battery of rockets right into Israel’s Western Galilee late Thursday.

With significant rise and concerns of a bigger battle, markets are experiencing expanding unpredictability and skyrocketing uneasiness degrees. A comparable overview took place throughout the Russia-Ukraine dispute and the Iran-Israel legend. This shows that economic markets, consisting of crypto, are affected by geopolitical stress and problems that motivate anxiety and danger hostility.

” The size of Iran’s strike on Israel will certainly inform us exactly how much the autumn will certainly enter Bitcoin and markets,” one expert said.

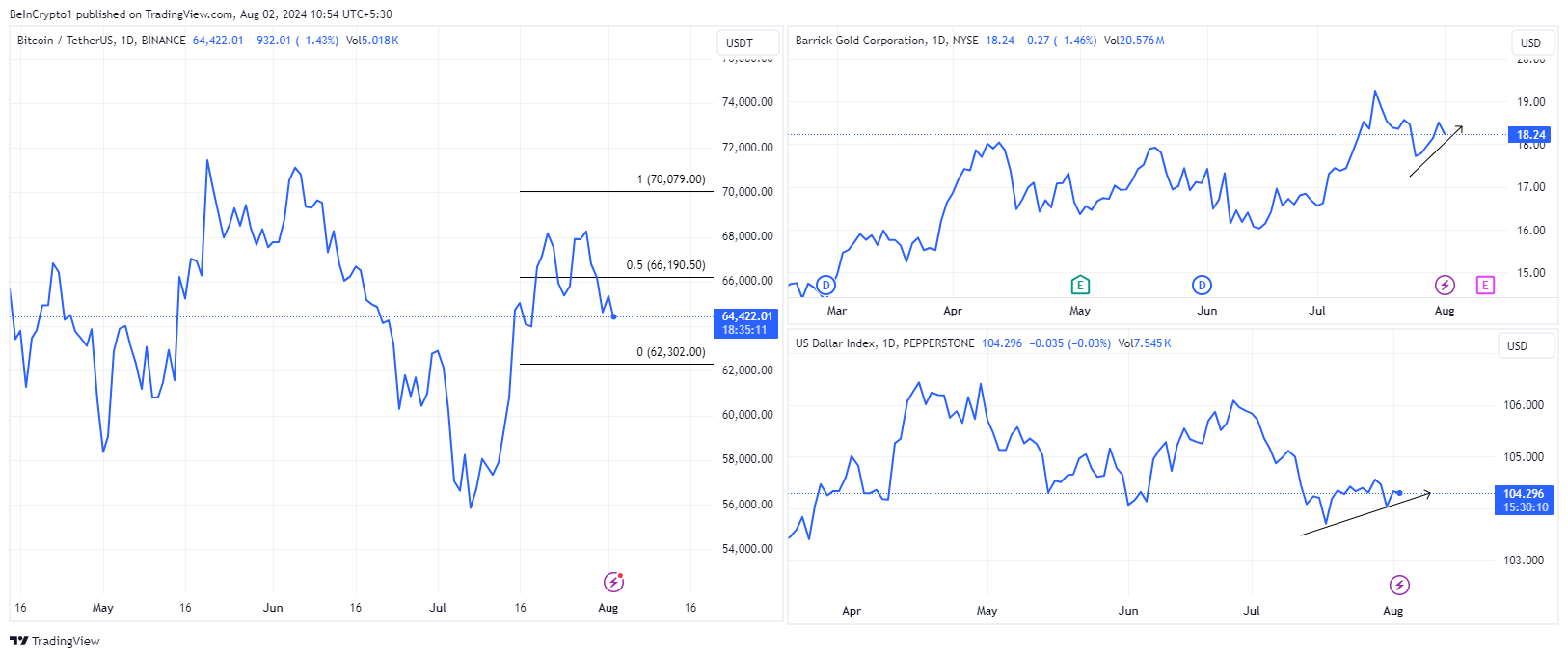

On The Other Hand, the United States Buck Index and rare-earth elements like gold are climbing. The United States Buck Index, which gauges the USD’s worth versus 6 international money, increased 0.54% in the recently. This triggered Bitcoin to collapse by 5% as a result of its inverted connection with the USD. The basic ambience of anxiety and danger hostility is influencing Bitcoin as capitalists look for to decrease danger and relocate in the direction of standard safe-haven properties like gold.

In the following couple of days, for that reason, it would certainly be vital to keep track of the dispute’s intensity. International reaction, market belief, and financier actions will certainly likewise affect cost activity.

Nonetheless, geopolitical unpredictability or dispute might likewise prefer alternate properties like Bitcoin. It might drive fostering, comparable to what took place throughout the very early months of the Russia-Ukraine dispute.

Learn More: Leading 9 Crypto-Friendly Countries For Digital Possessions Investors

nvestors might transform to alternate properties like Bitcoin as a sanctuary to safeguard their wide range from standard market volatility. This might increase the need for Bitcoin and crypto as a whole, successfully boosting their worth.

Please Note

In adherence to the Trust fund Job standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to give exact, prompt info. Nevertheless, viewers are encouraged to confirm truths separately and talk to an expert prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.