Online knowing system Udemy (NASDAQ: UDMY) reported cause line with experts’ assumptions in Q2 CY2024, with profits up 9% year on year to $194.4 million. On the various other hand, following quarter’s profits advice of $192.5 million was much less excellent, can be found in 3.8% listed below experts’ price quotes. It made a non-GAAP loss of $0.04 per share, below its loss of $0.01 per share in the very same quarter in 2014.

Is currently the moment to acquire Udemy? Find out in our full research report.

Udemy (UDMY) Q2 CY2024 Emphasizes:

-

Earnings: $194.4 million vs expert price quotes of $194.2 million (tiny beat)

-

EPS (non-GAAP): -$ 0.04 vs expert price quotes of -$ 0.01 (-$ 0.03 miss out on)

-

Earnings Assistance for Q3 CY2024 is $192.5 million at the middle, listed below expert price quotes of $200.1 million

-

The business dropped its profits advice for the complete year from $800 million to $779 million at the middle, a 2.6% decline

-

Gross Margin (GAAP): 62.3%, up from 57.4% in the very same quarter in 2014

-

Complimentary Capital of $42.3 million, up 142% from the previous quarter

-

Month-to-month Energetic Customers: 1.29 million, up 1.28 million year on year

-

Market Capitalization: $1.40 billion

” Earnings for the 2nd quarter of 2024 can be found in at the high-end of our advice variety and we outmatched our expectation for Adjusted EBITDA,” claimed Greg Brown, Udemy’s Head of state and chief executive officer.

With training courses varying from spending to food preparation to computer system shows, Udemy (NASDAQ: UDMY) is an on-line knowing system that links students with specialist teachers that focus on a variety of subjects.

Customer Membership

Customers today anticipate items and solutions to be hyper-personalized and as needed. Whether it be what songs they pay attention to, what motion picture they enjoy, or perhaps discovering a day, on-line customer services are anticipated to thrill their clients with straightforward interface that amazingly accomplish need. Membership designs have actually even more raised use and dampness of several on-line customer solutions.

Sales Development

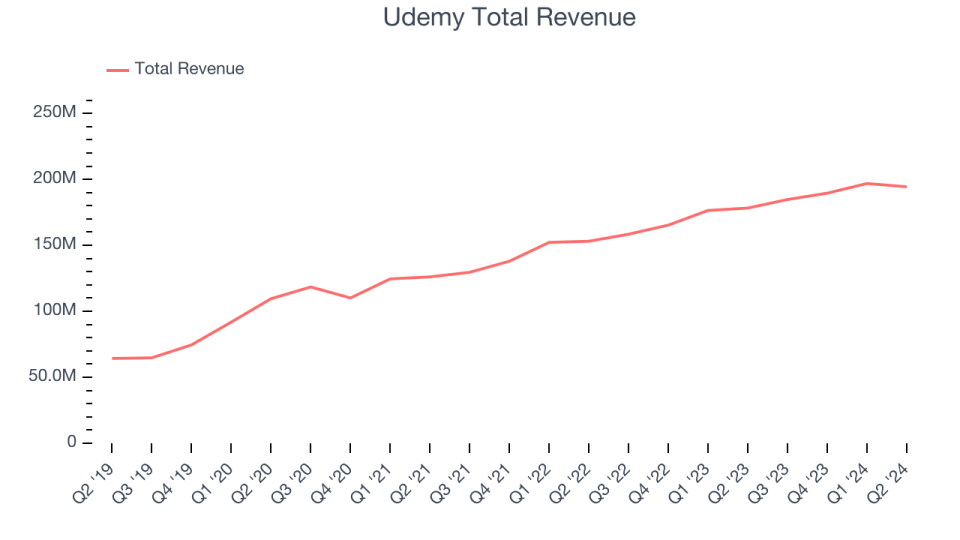

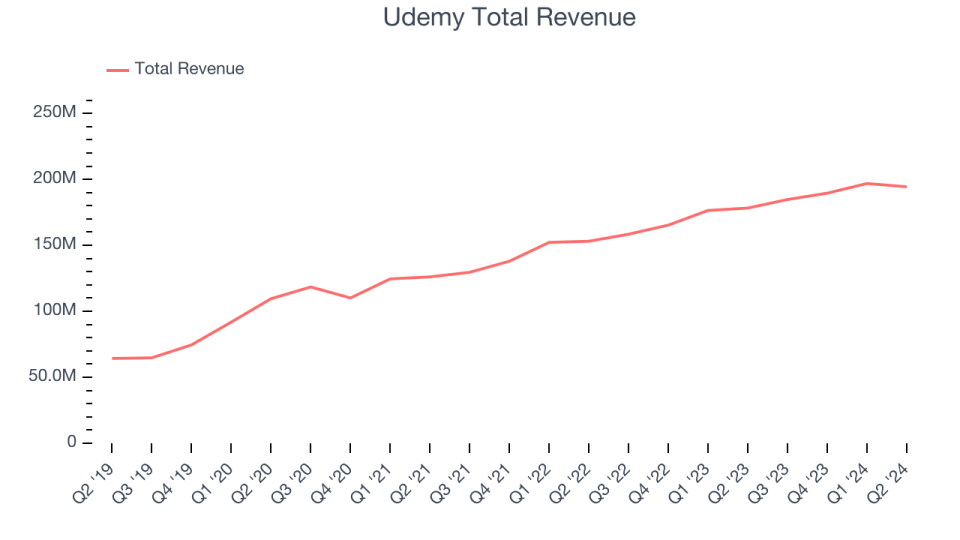

Udemy’s profits development over the last 3 years has actually been average, balancing 17.1% yearly. This quarter, Udemy reported average 9% year-on-year profits development, according to experts’ assumptions.

Assistance for the following quarter shows Udemy is anticipating profits to expand 4.2% year on year to $192.5 million, slowing down from the 16.6% year-on-year rise it videotaped in the similar quarter in 2014. Ahead of the revenues outcomes, experts were predicting sales to expand 10.5% over the following twelve month.

When a business has even more money than it recognizes what to do with, redeeming its very own shares can make a great deal of feeling– as long as the rate is right. Thankfully, we have actually discovered one, an inexpensive supply that is spurting complimentary capital AND redeeming shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Secret Takeaways from Udemy’s Q2 Outcomes

We had a hard time to discover several positives in these outcomes. Udemy not just reduced its full-year profits advice yet likewise missed out on Wall surface Road’s EPS price quotes. Generally, this was a negative quarter for Udemy. The supply traded down 13.5% to $8 promptly after reporting.

So should you buy Udemy today? When making that choice, it is necessary to consider its evaluation, organization high qualities, along with what has actually taken place in the current quarter. We cover that in our actionable full research report which you can read here, it’s free.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.