Area Ethereum ETFs (Exchange-Traded Finances) have actually registered their very first eco-friendly day after a four-day adverse touch. A week after its launch, the huge discharges, led by Grayscale’s Ethereum Depend on (ETHE), have actually beat the impressive begin of the ETH-based financial investment items.

Ethereum ETFs Efficiency Outshined By Discharges

The authorization of area Ethereum (ETH) ETFs was bordered by conversations regarding its need and feasible efficiency after the launch. Several professionals expected that the financial investment items would certainly not accomplish the exact same numbers as their Bitcoin-based equivalents, mentioning an absence of a “clear story,” limelights, and need.

Relevant Analysis: Is Solana Centralized And Poor Technology? Specialist Unmasks Cases

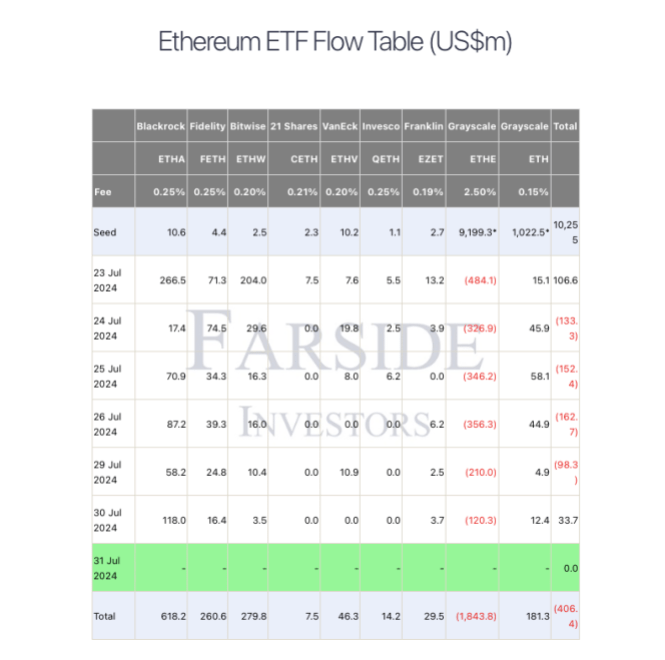

Some sector numbers, consisting of Bitwise’s CCO Katherine Dowling, and American business owner Anthony Pompliano, taken into consideration that the Ethereum ETFs would just do around 20% -30% of the BTC-based funds. The financial investment items had an impressive begin, conference professionals’ assumptions on their very first day. The funds signed up $1.05 billion in quantity, around 24% of what Bitcoin ETFs did on launch day, and $107.8 million in inflows. This accomplishment was accomplished no matter the $484 million internet discharges signed up from ETHE.

Nonetheless, Ethereum ETFs finished with red numbers after their 2nd day live. The funds saw a 5% quantity decline on Wednesday and an unfavorable web circulation of $113.3 million. Regardless of the discharges, some experts recommended that the efficiency exceeded assumptions, as the quantity really did not substantially go down after the day-one craze.

According to Farside Capitalist’s information, ETH ETFs’ discharges exceeded the favorable internet circulations in the list below days. By July 29, the financial investment items had an ordinary everyday discharge of $137.8 million and a complete discharge of $440.1 million amongst all 9 ETFs.

First Eco-friendly Day Ends Adverse Internet Circulation Touch

The four-day adverse touch upright July 30, after area Ethereum ETFs registered their very first eco-friendly day given that launch. Led by Blackrock’s iShares Ethereum Depend on (ETHA)’s $118 million inflows, the funds saw a favorable web circulation of $33.7 million on Tuesday.

Ethereum ETF's internet circulations on July 30. Resource: Farside Investors

ETHE had an unfavorable web circulation of $120 million, the most affordable given that the area ETFs launch. Furthermore, the fund had a 75% decrease in discharges from its $480 million adverse efficiency on the first day. This decrease recommends that the Grayscale’s blood loss, worth around $1.84 billion on July 30, is decreasing, and the funds can proceed with a favorable touch.

At the same time, ETHA crowned itself the best-performing Ethereum ETH after recuperating from an unsatisfactory 2nd day. A week after its launch, the fund has actually had a complete favorable web circulation of $618.2 million.

As ETF Shop Head Of State Nate Geraci stated, ETHA has actually currently placed itself in the leading 15 inflows of all ETFs introduced this year. “Leading 15 out of approx. 330 brand-new ETFs. Leading 4 inflows all area bitcoin ETFs, btw,” the blog post checks out.

Elderly crypto expert at Steno Research study, Mads Eberhardt, highlighted that Blackrock’s ETHA and Integrity’s FETH have actually seen one-third of the inflows of their particular Bitcoin equivalents.

Eberhardt emphasized that this efficiency has actually been accomplished regardless of a number of drawbacks versus Bitcoin ETFs:

This has actually taken place regardless of total much less focus to the Ethereum ETFs, a less-than-optimal month to launch, complete recognition by the market that Grayscale’s Ethereum ETF need to be drained pipes in the temporary, and, oh yes, the reality that Ethereum has half the marketplace cap of Bitcoin at ETF launch with also worse liquidity.

Inevitably, the Elderly expert thinks that discharges from area Ethereum ETFs will certainly diminish at the end of this week, and “When it does, it’s up just from there.”

ETH is trading at $3,330 in the five-day graph. Resource: ETHUSDT on TradingView

Included Photo from Unsplash.com, Graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.