Outside way of life and devices firm Clarus (NASDAQ: CLAR) disappointed experts’ assumptions in Q2 CY2024, with earnings down 2.5% year on year to $56.48 million. The firm’s full-year earnings advice of $275 million at the middle additionally was available in 1.2% listed below experts’ quotes. It made a non-GAAP loss of $0.03 per share, below its loss of $0.01 per share in the exact same quarter in 2014.

Is currently the moment to purchase Clarus? Find out in our full research report.

Clarus (CLAR) Q2 CY2024 Emphasizes:

-

Income: $56.48 million vs expert quotes of $59.34 million (4.8% miss out on)

-

EPS (non-GAAP): -$ 0.03 vs expert quotes of $0

-

The firm reconfirmed its earnings advice for the complete year of $275 million at the middle

-

Gross Margin (GAAP): 36.1%, up from 8.6% in the exact same quarter in 2014

-

Market Capitalization: $231.3 million

Administration Discourse” Versus a background of constricted customers in the outside room, we made step-by-step development in the 2nd quarter performing Clarus’ calculated campaigns to look for to produce lasting worth,” stated Warren Kanders, Clarus’ Exec Chairman.

At first an economic solutions service, Clarus (NASDAQ: CLAR) layouts, makes, and disperses outside devices and way of life items.

Recreation Products

Recreation items cover a large range of items in the customer optional field. Preserving a solid brand name is crucial to success, and those that distinguish themselves will certainly take pleasure in consumer commitment and rates power while those that do not might discover themselves in ragged edges because of the non-essential nature of their offerings.

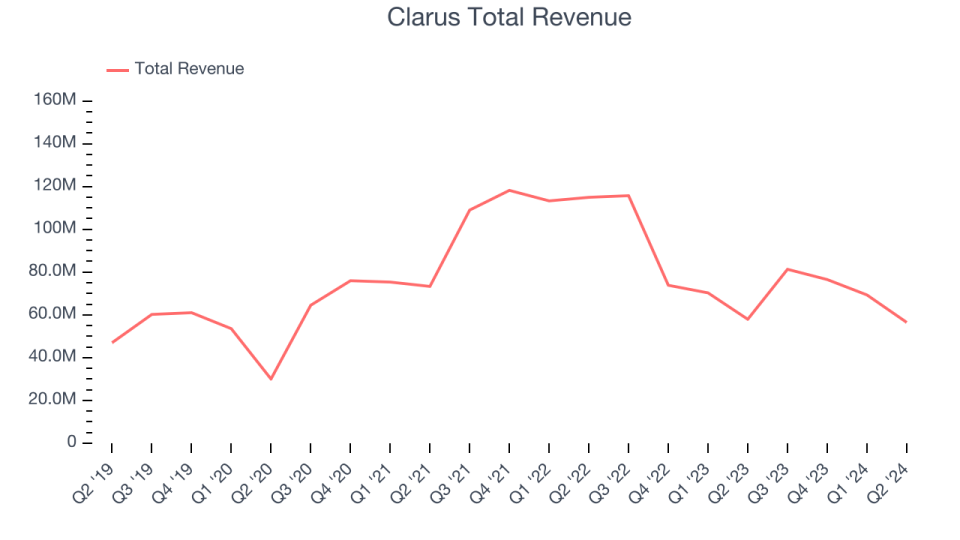

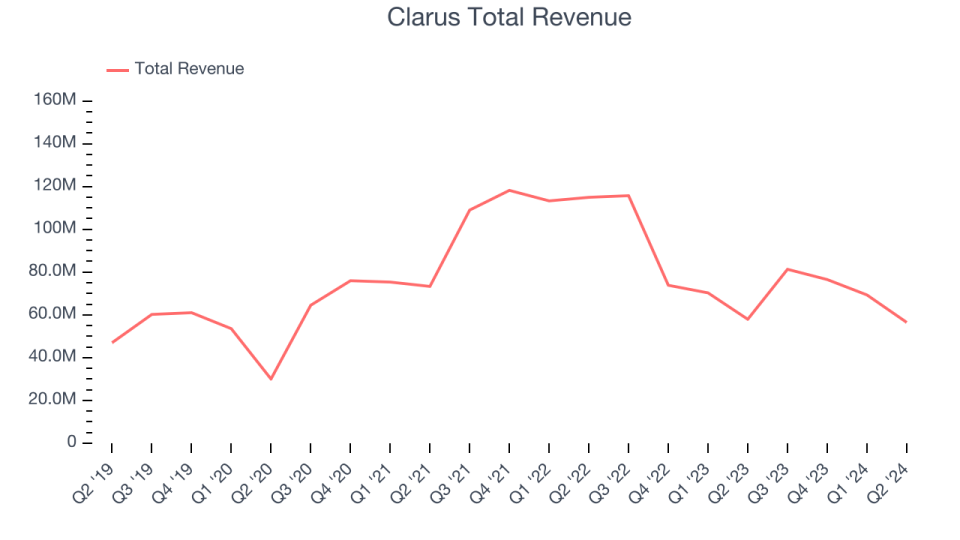

Sales Development

A business’s lasting efficiency can show its service top quality. Any kind of service can install an excellent quarter or more, however numerous long-lasting ones have a tendency to expand for several years. Over the last 5 years, Clarus expanded its sales at a weak 5.1% intensified yearly development price. This reveals it fell short to increase in any kind of significant means and is a harsh beginning factor for our evaluation.

Long-lasting development is one of the most crucial, however within customer optional, item cycles are brief and earnings can be hit-driven because of quickly altering fads and customer choices. Clarus’s background reveals it expanded in the past however relinquished its gains over the last 2 years, as its earnings dropped by 21.1% every year.

This quarter, Clarus missed out on Wall surface Road’s quotes and reported an instead unexciting 2.5% year-on-year earnings decrease, creating $56.48 numerous earnings. Looking in advance, Wall surface Road anticipates sales to expand 3.7% over the following twelve month, a velocity from this quarter.

When a business has even more cash money than it understands what to do with, redeeming its very own shares can make a great deal of feeling– as long as the cost is right. The good news is, we have actually discovered one, a discounted supply that is spurting cost-free capital AND redeeming shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

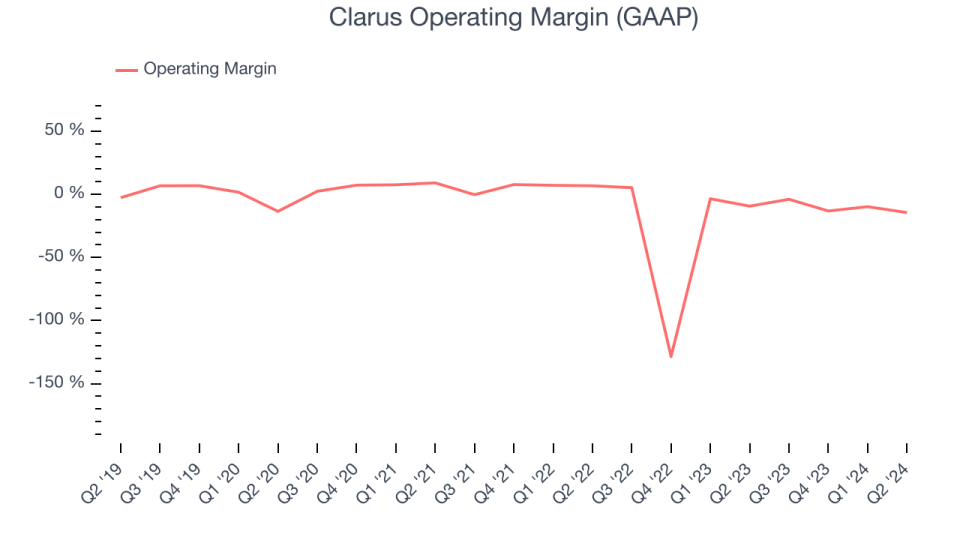

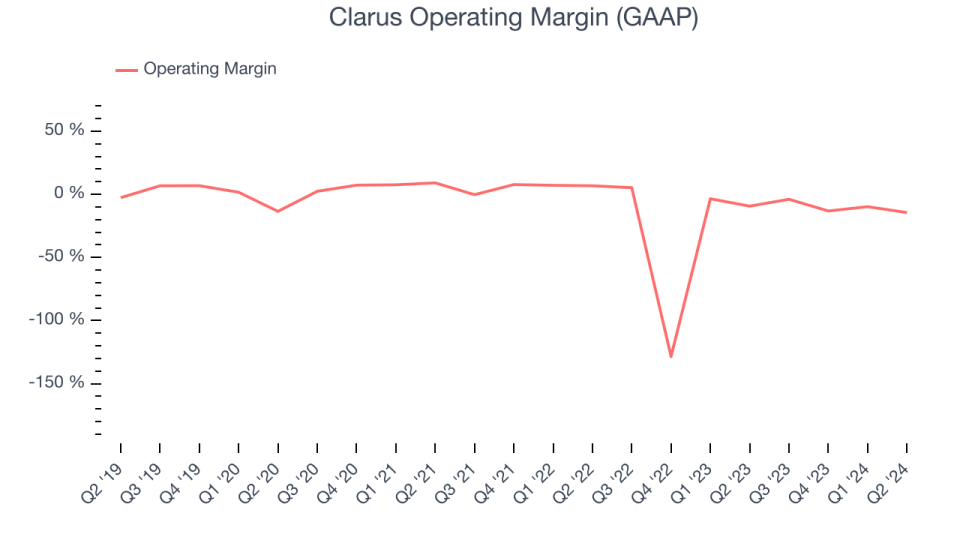

Operating Margin

Operating margin is a vital action of earnings. Think about it as earnings– the lower line– leaving out the influence of tax obligations and passion on financial obligation, which are much less linked to service principles.

Clarus’s operating margin has actually been trending up over the in 2014, however it still balanced adverse 20.7%. Its big cost base and ineffective price framework imply it still sporting activities insufficient earnings for a customer optional service.

This quarter, Clarus produced an operating revenue margin of adverse 14.4%, down 5.1 percent factors year on year. This tightening reveals it was just recently much less reliable since its costs raised about its earnings.

Secret Takeaways from Clarus’s Q2 Outcomes

We had a hard time to discover numerous solid positives in these outcomes. Its earnings however missed out on and its EPS disappointed Wall surface Road’s quotes. In spite of this, the firm declared complete year earnings advice. On the whole, this was a weak quarter for Clarus. The supply stayed level at $5.77 instantly complying with the outcomes.

So should you purchase Clarus now? When making that choice, it is essential to consider its evaluation, service high qualities, in addition to what has actually occurred in the current quarter. We cover that in our actionable full research report which you can read here, it’s free.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.