WLD, the token that powers Worldcoin, the crypto task co-founded by OpenAI chief executive officer Sam Altman, is under enhancing bearish stress as investors wagered versus it.

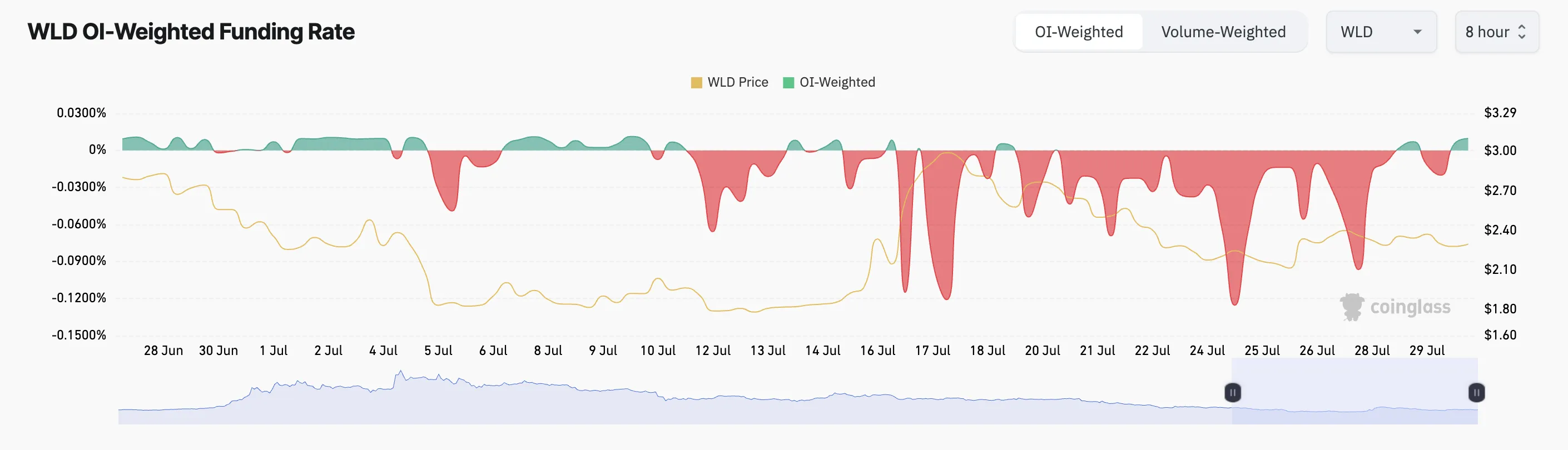

In the altcoin’s by-products market, there has actually been a significant rise in the need for brief placements, shown by unfavorable financing prices throughout significant cryptocurrency exchanges.

Worldcoin Investors Wish For Even More Cost Decreases

According to Coinglass, WLD’s financing price has actually been mainly unfavorable considering that July 11.

Financing prices are a device made use of in continuous futures agreements to make certain a possession’s agreement rate remains near its area rate. When they declare, it suggests extra investors are acquiring the property, anticipating a boost than those acquiring and expecting a decrease.

On The Other Hand, when a possession’s financing price is unfavorable, it shows extra investors are taking brief placements. This recommends that even more investors prepare for a decrease in the property’s rate contrasted to those acquiring it, wanting to cost a greater rate.

The rise sought after for WLD brief placements started after Devices for Humankind (TFH), the programmer behind Worldcoin, revealed its strategies to launch 2 million symbols daily from July 24. This mirrors the uncertainty in the token, as lots of investors have actually selected to wager versus it.

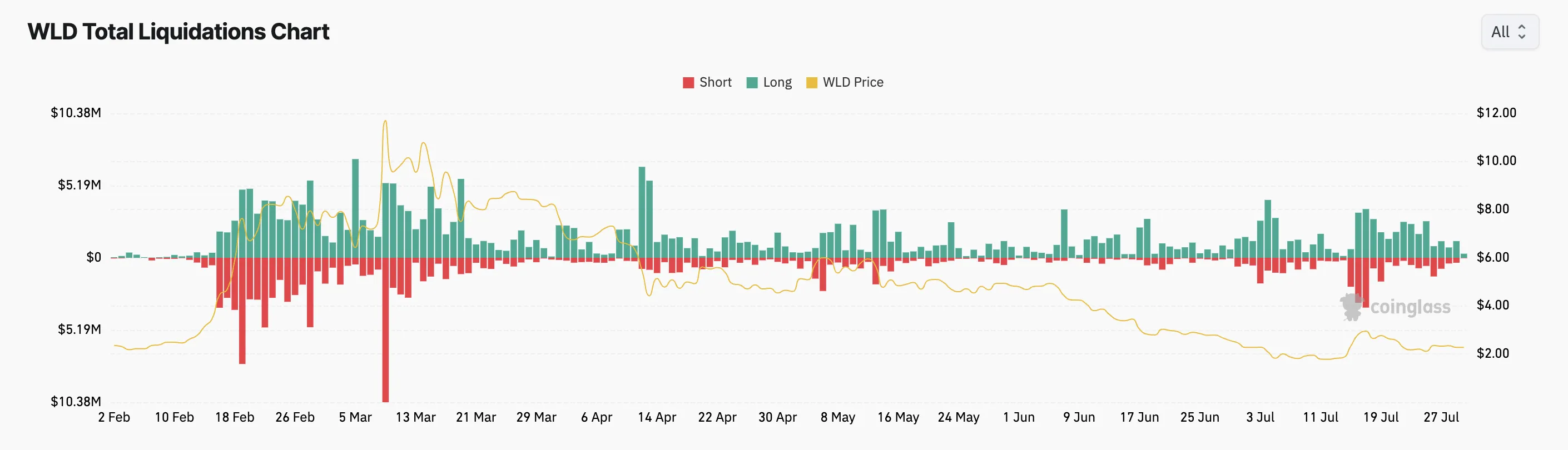

WLD’s marketing stress has actually increased in the previous couple of days, triggering its rate to go down. This has actually resulted in the liquidation of a number of lengthy placements.

Find Out More: Exactly How to Acquire Worldcoin (WLD) and Whatever You Required to Know

Liquidations happen when a possession’s worth actions versus an investor’s placement. When this takes place, the investor’s placement is powerfully shut because of not enough funds to keep it.

Lengthy liquidations occur when the property’s rate drops past a particular degree, requiring investors with employment opportunities to bank on a cost boost to leave the marketplace.

According to Coinglass’ information, in the previous 7 days, WLD’s lengthy liquidations have actually completed around $11.46 million.

WLD Cost Forecast: The Area Market Is None Various

Bearish belief is likewise existing in WLD’s area market. Analyses from the altcoin’s Allegorical Quit and Opposite (SAR) indication evaluated on an everyday graph verify this. At press time, the dots of this indication lie over WLD’s rate.

A property’s Allegorical SAR indication recognizes possible pattern instructions and rate turnaround factors. When its dots are put over a possession’s rate, the marketplace remains in a drop. It shows that the property’s rate is dropping, and the decrease will certainly proceed.

If WLD’s rate remains to drop, it will certainly trade listed below the $2 rate degree. Its following rate target will certainly be $1.80.

Nonetheless, if market belief changes from unfavorable to favorable, WLD’s rate might rally previous $3 to trade hands at $4.20.

Please Note

In accordance with the Count on Task standards, this rate evaluation write-up is for informative functions just and ought to not be thought about monetary or financial investment guidance. BeInCrypto is devoted to exact, objective coverage, however market problems undergo transform without notification. Constantly perform your very own research study and talk to a specialist prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.