Although Americans have actually grumbled around high housing prices for years, their worries have actually tackled a fevered pitch lately. Initially look, these worries appear practical: home prices have actually boosted by greater than 50% because completion of 2019. This is a yearly development price of practically 14%– much greater than the long term ordinary price of 4%. We have actually lately endured an uncommonly quick run-up in home costs.

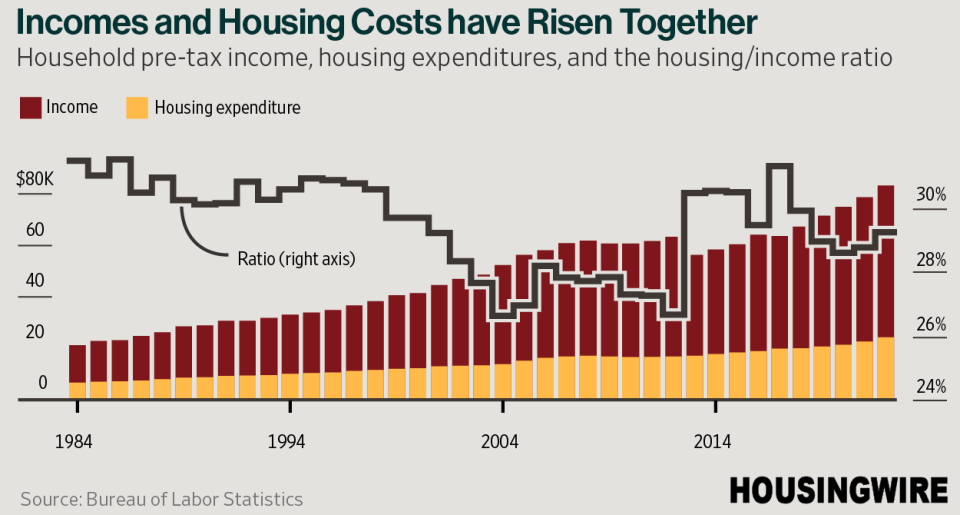

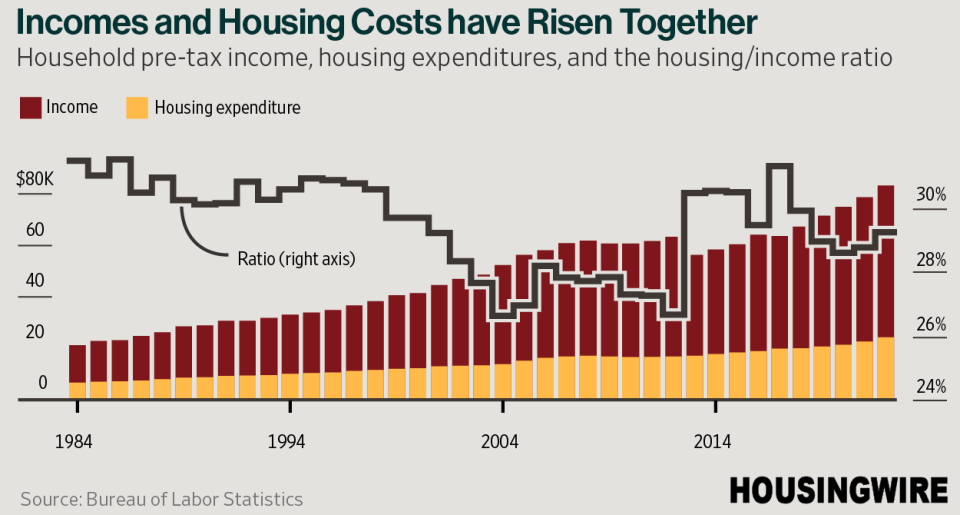

Yet, when we consider real estate price as a percentage of after-tax earnings, the majority of houses aren’t investing anywhere near 50% even more. As a matter of fact, huge sections of the populace are investing the exact same percentage, or much less, of their earnings on real estate than in the past.

Just how can we settle these 2 truths: home costs are much greater, however the majority of houses are investing the exact same or much less of their earnings on real estate? There are 3 descriptions.

Revenues have actually boosted

Price has to do with both prices and incomes— and the last have actually likewise boosted significantly over the previous couple of years. According to the Bureau of Economic Evaluation (BEA), over the last 5 years, the ordinary individual after tax obligation earnings has actually climbed from regarding $16,000 to practically $21,000 today– a 30% rise (if these numbers appear reduced, it’s since this is a personal, not a home action, and it wants tax obligation). We have not had this sort of individual earnings development over a five-year duration in twenty years.

As a matter of fact, the surge in earnings is not simply a barrier versus greater home costs, it’s a reason. It’s not likely we would certainly have had this sort of sharp rise in costs without a simultaneous rise in earnings. Incomes are the solitary ideal forecaster of home costs.

Rate of interest effect

Funding a home today is undoubtedly far more pricey than simply a couple of years earlier. The average home in 2019– valued at $212,000 and funded with a three decades home mortgage for 3.75%– would certainly lug a month-to-month price of under $900. That exact same home today sets you back $323,000, and funded at today’s price of 6.75% would certainly lug a month-to-month price of practically $1,900. For the average home at the dominating price, real estate prices have greater than increased.

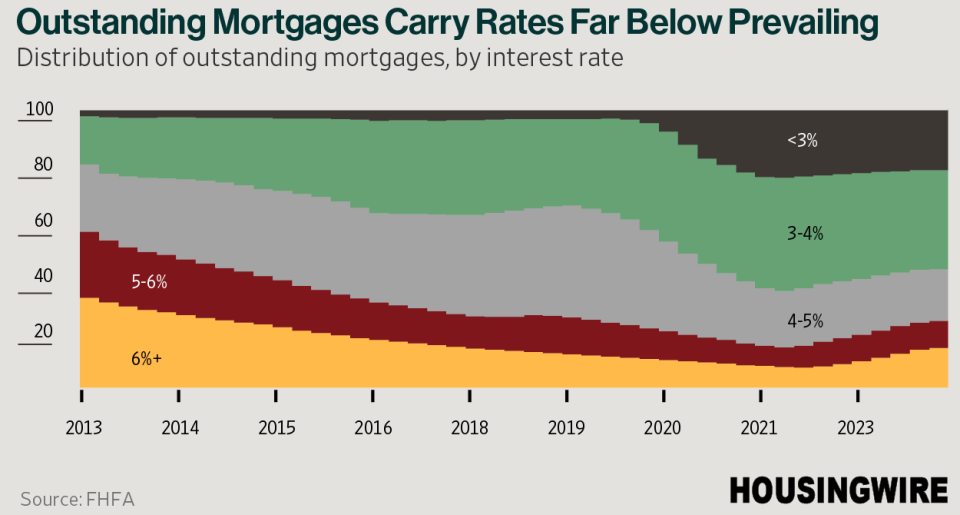

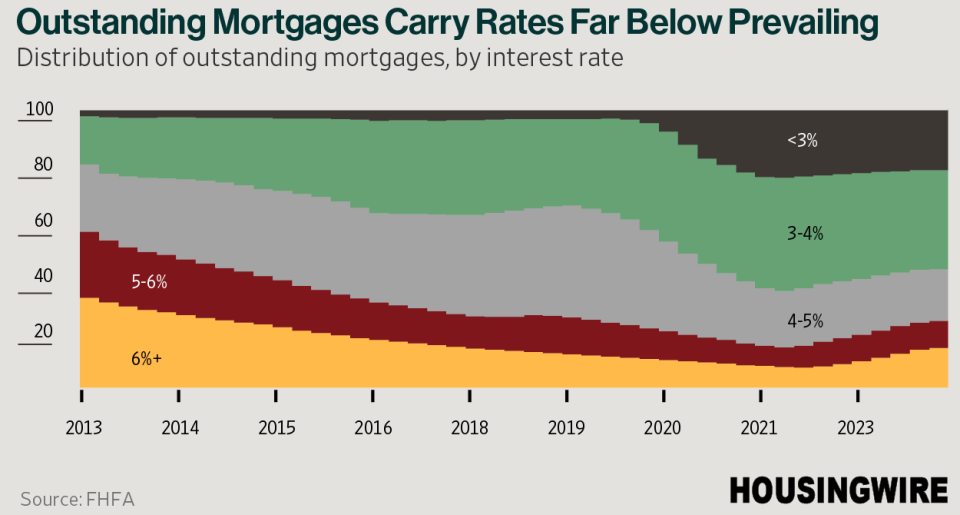

Yet among the terrific facets of homeownership is having the ability to time your entrance right into the marketplace, and to lock-in prices then in time. In addition, home owners have the alternative to ratchet their prices also reduced by re-financing when the economic situation slows down and mortgage rates loss. Numerous home owners have actually taken precisely these possibilities over the previous couple of years, acquiring and re-financing when prices were fairly reduced in 2020 and 2021.

Therefore, also if the minimal price of a home loan is 6.75% today, the ordinary home owner is funded closer to 3.5%– also less than the dominating price at the end of 2019. Which lacks making up those that directed pandemic stimulation right into paying for their home mortgage equilibriums, or paying them off totally (this does not effect total assets, however does lower the real estate price to earnings proportion).

Leas

While home costs are approximately 50% greater than in late 2019, rents have not kept up. This might be the result of a rise of pandemic-delayed multifamily structures rolling off the building pipe right into conclusions. Despite the chauffeur, leas are just up simply over 30% because prior to the pandemic– supplying alleviation to those that were incapable or reluctant to get.

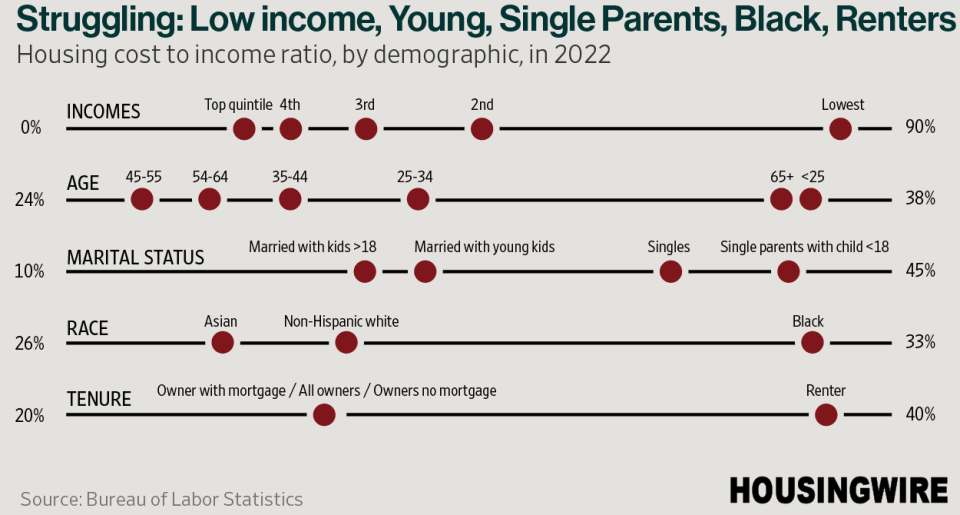

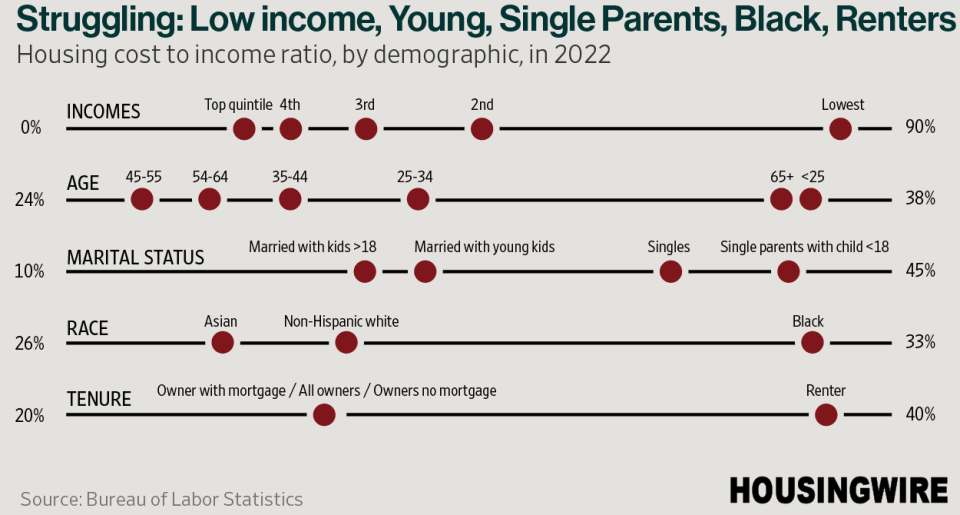

Certainly, the accumulated stats leave out the truth that some market teams are having a hard time greater than others. The graph listed below programs that the demographics investing greater than ordinary percentages of their earnings on real estate consist of low income households, the young (and the old, though retired people have reduced earnings), solitary moms and dads with children, and Black individuals. Occupants likewise invest even more of their earnings on real estate than proprietors.

Still– these are exemptions to the more comprehensive, long term, accumulated fad: an amazing security in real estate prices as a percentage of earnings, over years.

Aziz Sunderji creates the real estate e-newsletter Home Economics He was previously a bond market planner at Barclays Financial investment Financial Institution and a Wall surface Road Journal press reporter.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.