United States supplies rallied on Wednesday amidst a technology rebirth that sent out the Nasdaq rising, as capitalists gotten ready for the Federal Get’s choice on whether to reduce rate of interest.

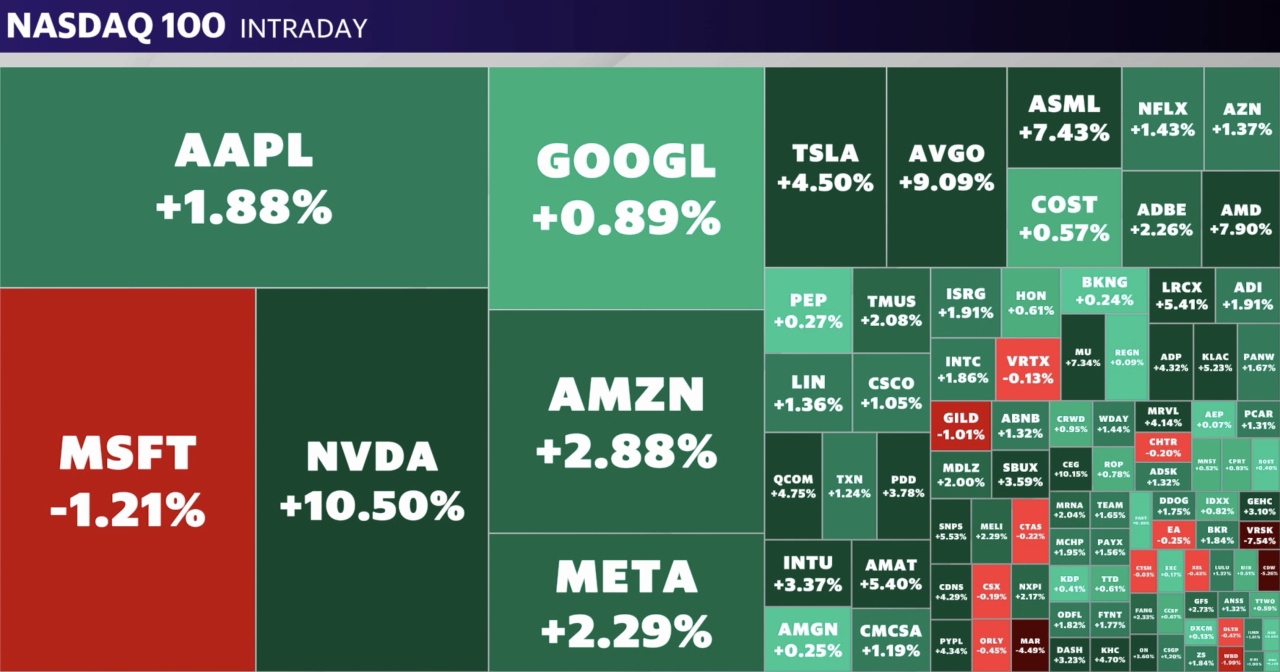

The S&P 500 (^ GSPC) increased by 1.7% while the tech-heavy Nasdaq Compound (^ IXIC) rose greater than 2.6%. The Dow Jones Industrial Standard (^ DJI) increased an extra moderate 0.5%.

Technology supplies remain in the climb once more after taking a damaging in current days. The very first profits from “Spectacular 7” megacaps mixed anxieties the AI increase would certainly verify a breast, after disappointing high hopes.

A swath of favorable information is stimulating a resurgence for chip supplies, with AMD (AMD) shares obtaining an increase from an AI-driven profits beat. Nvidia (NVDA) climbed up over 11%, reclaiming ground shed in a high decrease on Tuesday in the halo of the outcomes.

Additionally on Wednesday, Morgan Stanley kept in mind that the current 25% drawdown in Nvidia supply offered a “great access factor,” noting a belief change in what’s been an or else difficult July for the AI leader.

In other places, Dutch chip equipment huge ASML’s (ASML, ASML.AS) supply rose concerning 6% after Reuters reported the United States will certainly spare some international allies from brand-new China aesthetics.

As that stress reduces, the limelight is transforming to the Fed, which is anticipated to hold rate of interest constant however signal a cut remains in the pipe when it finishes its July plan conference later Wednesday.

Learn More: 32 graphes that inform the tale of markets and the economic situation now

The marketplace is extremely persuaded a Fed pivot is being available in September– the discussion currently is whether prices will certainly drop by 0.25% or 0.5%, according to theCME FedWatch tool Chair Jerome Powell’s post-meeting remarks will certainly be very closely complied with for tips that current rising cost of living and labor information can sustain a much deeper cut.

On the other hand, even more profits are readied to roll in, Meta’s (META) results due later on will certainly be inspected for indications that the Facebook moms and dad’s AI investing is settling– the large inquiry for megacaps this period.

In products, oil leapt after the murder of Hamas’ politician in an airstrike fed geopolitical stress. Brent crude (BZ= F) futures, the international standard, increased simply under 3% to cover $80 a barrel. United States benchmark West Intermediate unrefined futures (CL= F) reached $77 a barrel, a 3% gain.

Live 9 updates

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.