Starbucks (SBUX) fizzled for sale once more as it reported its numbers Tuesday after market close.

Q3 earnings dropped 1% to $9.1 billion, less than assumptions of $9.2 billion, per Bloomberg agreement quotes.

Worldwide same-store sales decreased for the 2nd quarter straight, down 3%, while general foot website traffic dropped 5%.

Changed revenues per share was available in at $0.93, contrasted to quotes of $0.92.

In a profits telephone call, chief executive officer Laxman Narasimhan called the existing customer atmosphere “facility,” claiming the business is doing all it can to restore its ground as a costs gamer.

He included that he has “complete self-confidence in the lasting possibility of Starbucks worldwide.”

” We are not pleased with the outcomes, yet our activities are making an effect,” he claimed. Trick signs are “trending in the ideal instructions … and our path for enhancement is long.”

Starbucks is applying a three-part activity prepare for the United States that was presented following its uninspired Q2 outcomes.

It consists of obtaining a lot more consumers throughout the day, introducing brand-new products while “keeping our concentrate on core coffee onward offerings,” and giving even more worth.

While Starbucks missed its revenues numbers, the outcomes were still far better than been afraid, and with a declared assistance, its shares were up virtually 6% in after-hours trading.

The business is dealing with a lot of difficulties in the United States.

Same-store sales decreased 2%, while the ordinary check is up 4%, driven by food selection cost boosts and “marketing deals,” CFO Rachel Ruggeri claimed on the telephone call.

Foot website traffic went down 6%, which the business claimed was mainly because of non-rewards participants.

” We are running in a difficult customer atmosphere,” Narasimhan claimed of the high decrease. “We see quantity boost in your home in our ready-to-drink organization” as customers choose grocery stores over eating in restaurants.

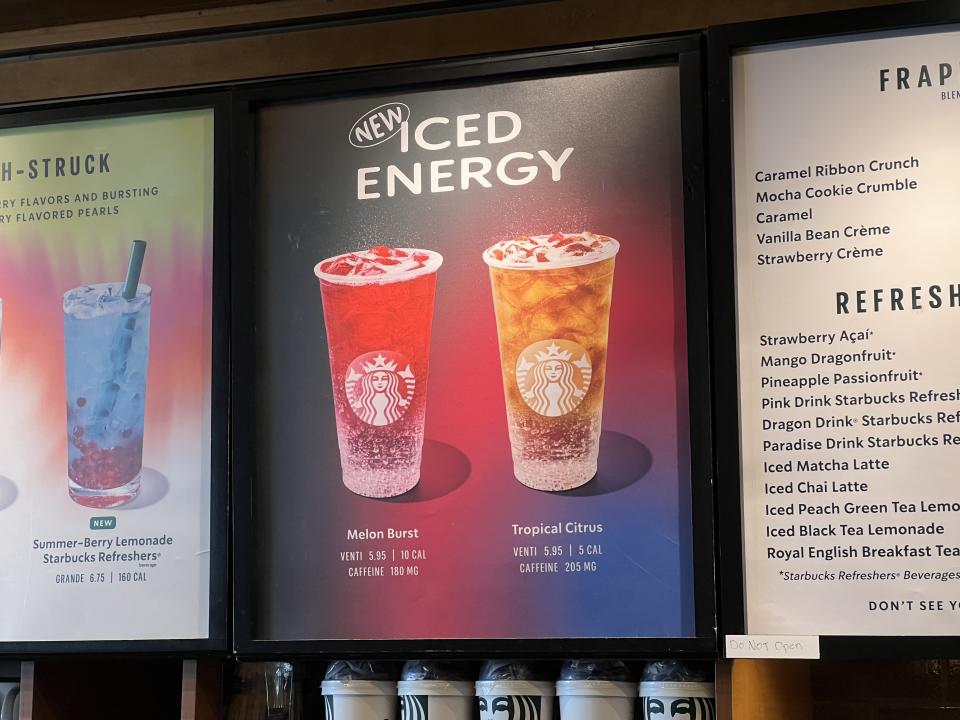

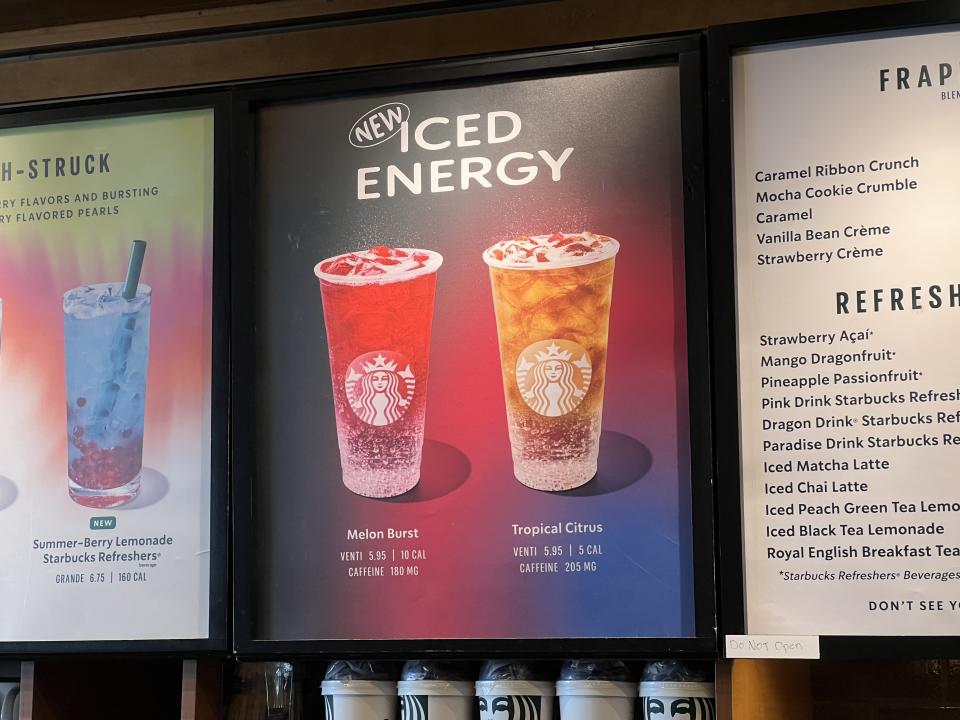

This quarter, the business turned out brand-new products like standing out boba-like pearls and cold power beverages, which caused the highest possible week-one item launch in its background.

Cold beverages currently comprise 76% of overall drink sales in the United States.

It likewise introduced a limited-time “pairing food selection,” which permits consumers to obtain a tiny cold or warm coffee with a butter croissant or morning meal sandwich for $5 or $6.

Execs claimed the promos drove energetic benefit participants in Q2, which were up 3% from Q2 to 33.8 million, yet it has yet to go back to the 34.3 million in Q1.

” Intermittent macro concerns” might be responsible for Starbucks’ battles, per a note from Baird expert David Tarantino before the outcomes. He expected soft qualities most of financial 2024 sales as customers draw back on optional investing, which might impact mid-day acquisitions at Starbucks. He has a Hold score on shares.

Narasimhan claimed need for the pearls led assumptions, and they needed to draw back marketing considering that it lacked supply, including that “mid-days are a possibility for us.”

Its second-largest market, China, saw the most significant decrease of all Starbucks sectors.

Same-store sales dropped 14% contrasted to last quarter when they were down 11%.

Foot website traffic there dropped 7% therefore did the ordinary check dimension. The business connected this decrease to “a lot more careful customer investing and increased competitors in the previous year … and a mass sector cost battle.”

Narasimhan claimed the group remains in the “extremely beginning” of checking out joint endeavors and critical collaborations in innovation, property, and supply chain.

In a note to customers, Financial institution of America expert Sara Senatore claimed Starbucks’ efficiency in China is connected to industrywide battles.

” Extreme competitors is the all-natural state of dining establishment markets and also the best brand names are not shielded,” she claimed. “The instructions of SBUX’s China same-store sales development is highly associated with those of various other international brand names. And all are associated with macro aspects (GDP).”

Bernstein expert Danilo Gargiulo claimed franchising might be the means to visit minimize capital investment and direct exposure to unpredictable macro problems.

The business still intends to have 9,000 places in China by 2025, from its existing 7,306 shops.

This revenues record comes as stress is installing from activist financier Elliott Financial investment Administration, which took an unrevealed risk in the business, according to a report from WSJ.

On the telephone call, Narasimhan validated that “Elliott Administration is an investor in our business, and our discussions to day have actually been useful.”

Some on the Road, like Gargiulo, are asking yourself if this might light a fire under Starbucks.

” Capitalists have actually examined Elliott’s experience and performance history in the customer industry, our company believe that an outside push might increase making vibrant choices and might supply intriguing risk-reward chances for lasting financiers happy to approve that a turn-around might require time,” he composed in a note to customers.

Below are 10 products Gargiulo thinks the Elliot group would certainly focus on.

Profits failure

Below’s what Starbucks reported, contrasted to quotes based upon Bloomberg agreement information:

Income: $9.1 billion versus $9.2 billion

Changed revenues per share: $ 0.93 versus $0.92

Same-store sales: -3% versus -2.71%

Foot website traffic: -5% versus -4.27%

Ticket Development: 2% versus 1.98%

The business declared its 2024 assistance, which it modified adhering to Q2, for the 3rd time this .

It anticipates 2024 international earnings development of low-single numbers, below the previous variety of 7% to 10%, which itself was below a previous assistance of 10% to 12%.

Worldwide and United States same-store sales are anticipated to see a reduced single-digit decrease or remain level, below the previous variety of 4% to 6% development. China’s same-store sales are anticipated to see a single-digit decrease, below the formerly anticipated low-single-digit development.

Starbucks decreased to make chief executive officer Laxman Narasimhan and CFO Rachel Ruggeri readily available for meetings.

—

Brooke DiPalma is an elderly press reporter for Yahoo Financing. Follow her on Twitter at @BrookeDiPalma or email her at bdipalma@yahoofinance.com.

Click On This Link for every one of the current retail supply information and occasions to much better educate your investing technique

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.