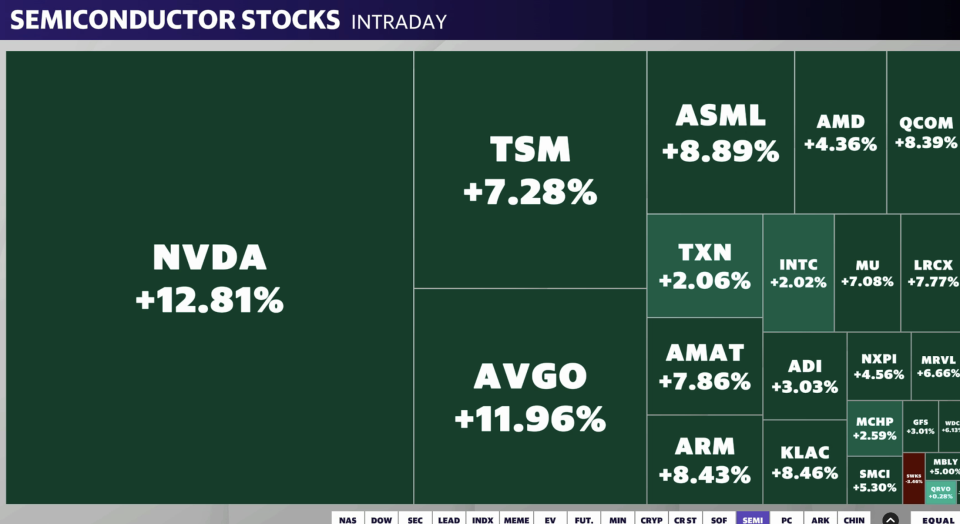

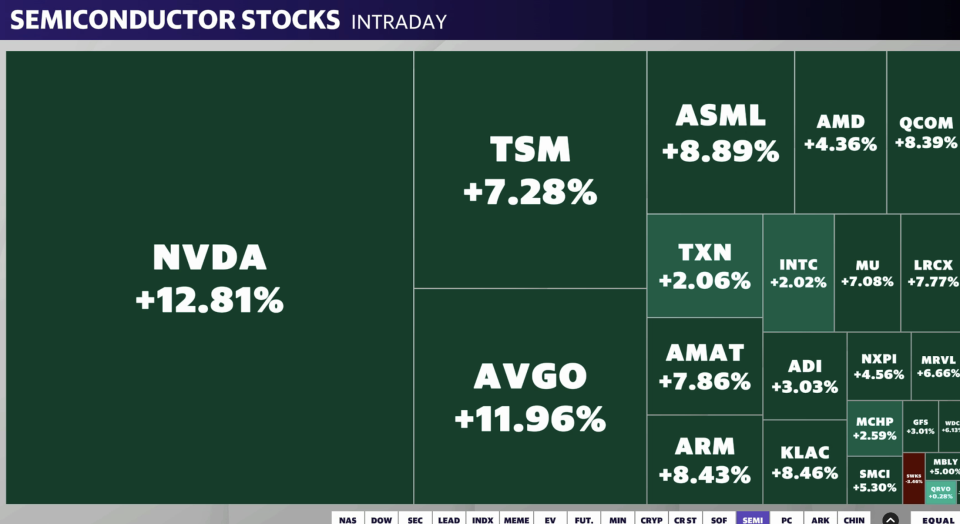

Nvidia (NVDA) supply rallied greater than 12% on Wednesday complying with better-than-expected advice from peer AMD (AMD) and a favorable phone call from experts at Morgan Stanley after a greater than 20% decrease in the supply.

AMD’s quarterly outcomes out late Tuesday stopped some problems that the AI profession might have run its program as capitalists revolved out of Huge Technology over the previous month. The firm defeated assumptions on the leading and profits and uploaded a better-than-expected expectation for the 3rd quarter.

In addition, technology large Microsoft (MSFT) disclosed greater costs on information facility framework in its newest quarterly outcomes. AI chip distributors like AMD and Nvidia stand to gain from Huge Technology’s enhanced financial investments.

” The anxiety of several of this energy not lasting, or perhaps are afraid that the earnings trajectory would not exist over the following year approximately– I assume that is beginning to reduce,” CFRA elderly equity expert Angelo Zino informed Yahoo Financing on Wednesday.

Chip peers consisting of Broadcom (AVGO), Micron (MU), Taiwan Semiconductor (TSM), ASML (ASML), and Super Micro (SMCI) likewise rallied on Wednesday.

Nvidia was likewise increased on Wednesday by a note of Morgan Stanley experts led by Joseph Moore, that relocated the supply to a ‘Leading Choose’ after a current pullback from document highs gotten to in June.

The company created the approximately 25% in Nvidia supply “sell-off provides a great entrance factor as we remain to listen to solid information factors short-term and long-term, with overblown affordable problems.”

Morgan Stanley mentioned 5 primary vehicle drivers of the current decrease in Nvidia– budget, competitors, export controls, supply chain anxieties, and appraisal concerns– yet stated, “With those problems, the revenues atmosphere is most likely to continue to be solid, for Nvidia and for the entire AI complicated.”

The company kept its Obese ranking and $144 rate target on the supply.

Nvidia supply is still up greater than 135% this year, surpassing the Nasdaq’s a lot more moderate 17% gain. The firm is readied to release its following quarterly record on Wednesday, Aug. 28.

Ines Ferre is an elderly organization press reporter for Yahoo Financing. Follow her on X at @ines_ferre.

Click On This Link for the current innovation information that will certainly influence the securities market

Review the current economic and organization information from Yahoo Financing

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.