Shares of Microsoft (MSFT) and AMD (AMD) began the trading day on Wednesday heading in contrary instructions as Wall surface Road absorbed the firms’ Tuesday night incomes. Microsoft dropped some 7% in after-hours trading following its unsteady record, and proceeded trading down greater than 1% Wednesday mid-day. AMD shares, on the various other hand, leapt greater than 3%, raising fellow chip leviathan Nvidia (NVDA) too.

The firms’ outcomes and Wall surface Road’s response brought both sides of the AI profession right into raw alleviation, as investors revealed their frustration in Microsoft’s AI software program sales and liveliness over AMD’s chip sales.

The rival sights demonstrate how distressed capitalists are to see a substantial return on firms’ enormous financial investments in the facilities required to power their AI software program offerings. On the other hand, chip manufacturers like AMD remain to profit of software program manufacturers’ AI facilities buildout, sending out profits and shares greater.

In a capitalist note adhering to Microsoft’s statement, Jefferies expert Brent Thill kept in mind that Microsoft’s Azure profits slowed down in the quarter from 31% in Q3 to 30% in Q4, and is anticipated to proceed reducing in Q1.

And while Microsoft claimed it anticipates to see renovations in Azure development in the 2nd fifty percent of its present , capitalists’ responses to the business’s small miss on Smart Cloud profits, that includes its Azure system and experts’ duplicated concerns regarding when Microsoft will certainly begin generating money from AI sales, reveals Wall surface Road will not wait permanently for the AI profession to repay.

Microsoft’s miss out on and future assurances

Microsoft’s 4th quarter incomes were greatly favorable regardless of its Intelligent Cloud numbers, and also those weren’t horrible. The business reported Intelligent Cloud sector profits of $28.5 billion, simply timid of Wall surface Road’s assumptions of $28.7 billion, however up 19% year-over-year. General profits was available in at $64.7 billion versus an assumption of $64.5 billion.

However Microsoft likewise remains to rake money right into constructing out its AI information facilities. According to CFO Amy Hood, Microsoft’s capital investment consisting of money leases peaked at $19 billion, up from $14 billion in the 3rd quarter.

” This brand-new number needs confidence that Microsoft is getting enough need signals, and in our sight the ‘return on capex’ issues are most likely to linger,” UBS Global Study expert Karl Keirstead created in a capitalist note adhering to Microsoft’s incomes statement.

Still, Microsoft indicated a variety of brilliant places in its AI company, keeping in mind that AI added 8 portion factors of development to Azure profits, up from 7 portion factors in Q3 and 1 portion factor in Q4 in 2014.

The Windows manufacturer likewise kept in mind that it’s still handling supply restraints maintaining even more consumers from accessing to its AI items, which is among the factors for its enormous AI invest. That traffic jam, nevertheless, must begin to clean up at some time in the 2nd fifty percent of 2025, the business claimed.

” Our team believe the outcomes and expectation for Azure AI are specifically solid because of the capability restraints [Microsoft] encountered in [the fiscal fourth quarter] and anticipates to remain to see in 1HF25[first half of 2025] Extra favorably, administration anticipates these problems to be relieved by 2HF25, which must aid drive a reacceleration in total Azure profits development,” Mizuho expert Gregg Moskowitz created in a note to capitalists Wednesday.

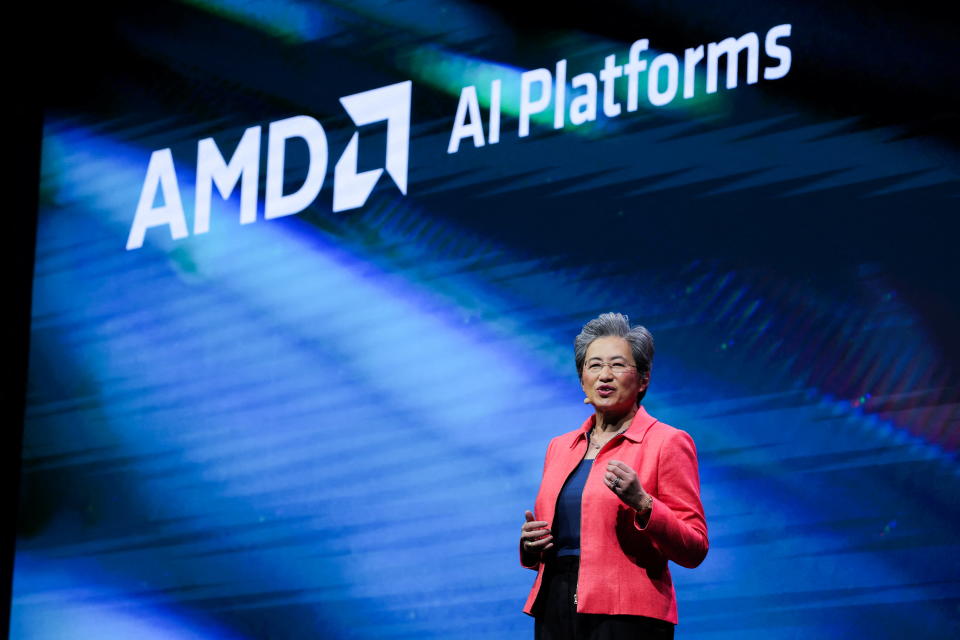

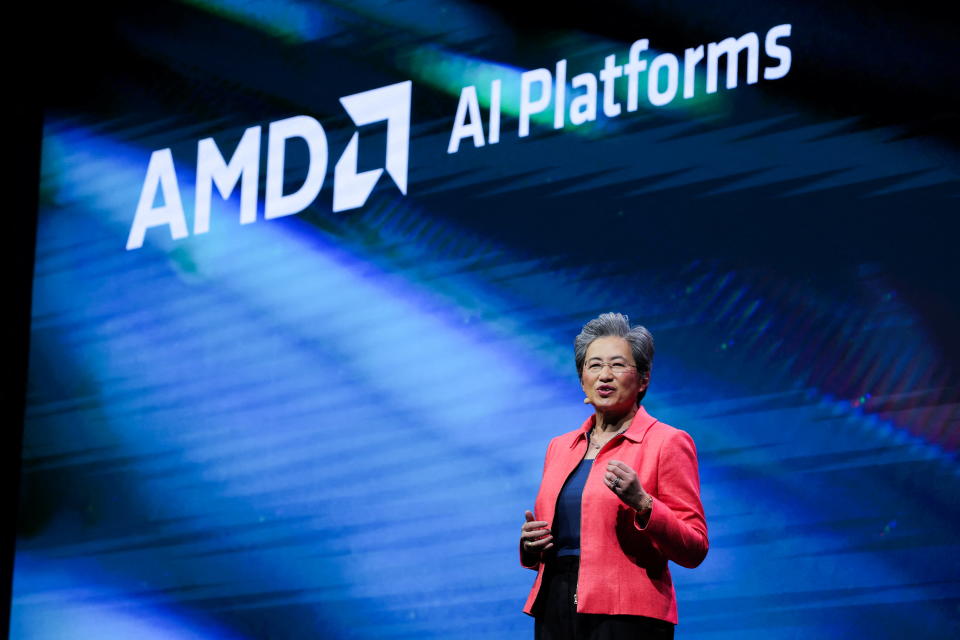

AMD establishes the phase for chip sales increase

While Microsoft shares battled to acquire grip Wednesday, AMD’s supply climbed up greater than 4% in mid-day trading Wednesday, driven by better-than-expected arise from the business’s Information Facility sector. AMD reported Information Facility profits of $2.8 billion, defeating experts’ assumptions of $2.75 billion, and climbing up 115% year-over-year from $1.3 billion in Q2 in 2014.

Microsoft’s capital investment growth likewise plays right into AMD’s development, given that the cloud supplier, and active scalers like it, will undoubtedly require to acquire graphics refining devices (GPUs) PUs and main handling devices (CPUs) from the chip titan and its competitors, consisting of Nvidia.

To that factor, AMD elevated its sales projection for its AI chips for 2024 from $4 billion to greater than $4.5 billion. We’re still a couple of weeks far from Nvidia’s incomes record on Aug. 28, however shares of the AI beloved soared greater than 10% on Wednesday on the stamina of AMD’s outcomes.

Certainly, the AI profession is never resolved, and we’re still in the very early days of not just the facilities develop out, however likewise in comprehending exactly how the software program will certainly affect organizations large and tiny, too.

And up until AI hyperscalers like Microsoft, Google, and Amazon start to see enormous make money from their big financial investments, you can anticipate capitalists to proceed asking one inquiry over and over once again: “When’s the cash can be found in?”

Obtained an idea? Email Daniel Howley at dhowley@yahoofinance.com. Follow him on X at @DanielHowley.

For the current incomes records and evaluation, incomes murmurs and assumptions, and business incomes information, visit this site

Check out the current economic and company information from Yahoo Financing

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.