Food handling and aeronautics tools supplier John Bean (NYSE: JBT) disappointed experts’ assumptions in Q2 CY2024, with income down 5.9% year on year to $402.3 million. On the various other hand, the business’s expectation for the complete year was close to experts’ quotes with income led to $1.73 billion at the axis. It made a non-GAAP revenue of $1.05 per share, boosting from its revenue of $0.97 per share in the exact same quarter in 2015.

Is currently the moment to purchase John Bean? Find out in our full research report.

John Bean (JBT) Q2 CY2024 Emphasizes:

-

Earnings: $402.3 million vs expert quotes of $432.6 million (7% miss out on)

-

EPS (non-GAAP): $1.05 vs expert assumptions of $1.25 (15.7% miss out on)

-

The business dropped its income advice for the complete year from $1.75 billion to $1.73 billion at the axis, a 1% reduction

-

EPS (non-GAAP) Support for the complete year is $5.20 at the axis, about in accordance with what experts were anticipating

-

EBITDA Support for the complete year is $300 million at the axis, listed below expert quotes of $302.2 million

-

Gross Margin (GAAP): 35.6%, up from 34.2% in the exact same quarter in 2015

-

Complimentary Capital of $10.3 million, up from $700,000 in the previous quarter

-

Market Capitalization: $3.10 billion

” As anticipated, JBT’s 2nd quarter orders boosted sequentially driven mostly by a preliminary recuperation in tools need from North American chicken clients and proceeded stamina in storehouse automation,” claimed Brian Deck, Head Of State and Ceo.

Mapping back to its innovation of the mechanical milk container filler in 1884, John Bean (NYSE: JBT) styles, makes, and offers tools made use of for food handling and aeronautics.

General Industrial Equipment

Automation that enhances effectiveness and linked tools that gathers analyzable information have actually been trending, developing brand-new need for basic commercial equipment firms. Those that introduce and produce digitized options can stimulate sales and quicken substitute cycles, yet all basic commercial equipment firms are still at the impulse of financial cycles. Customer costs and rates of interest, as an example, can significantly affect the commercial manufacturing that drives need for these firms’ offerings.

Sales Development

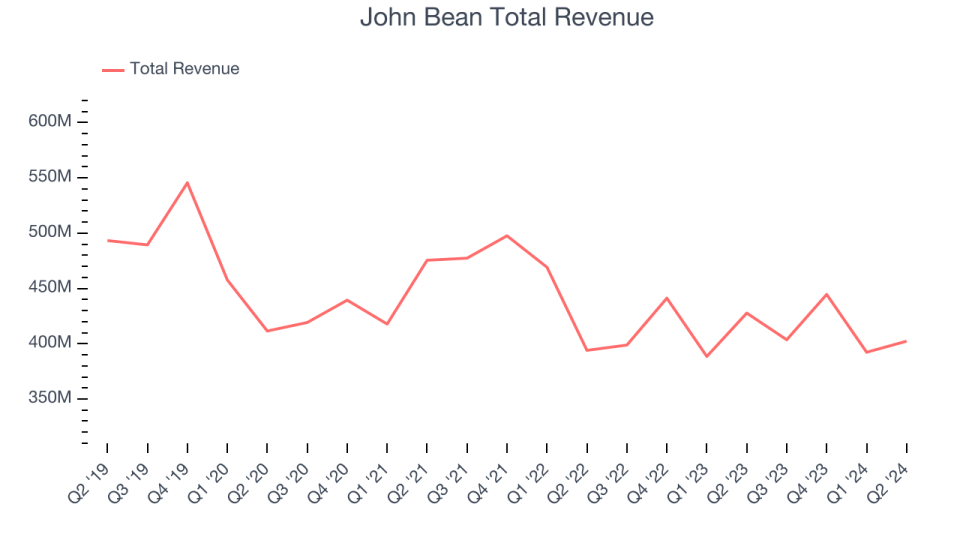

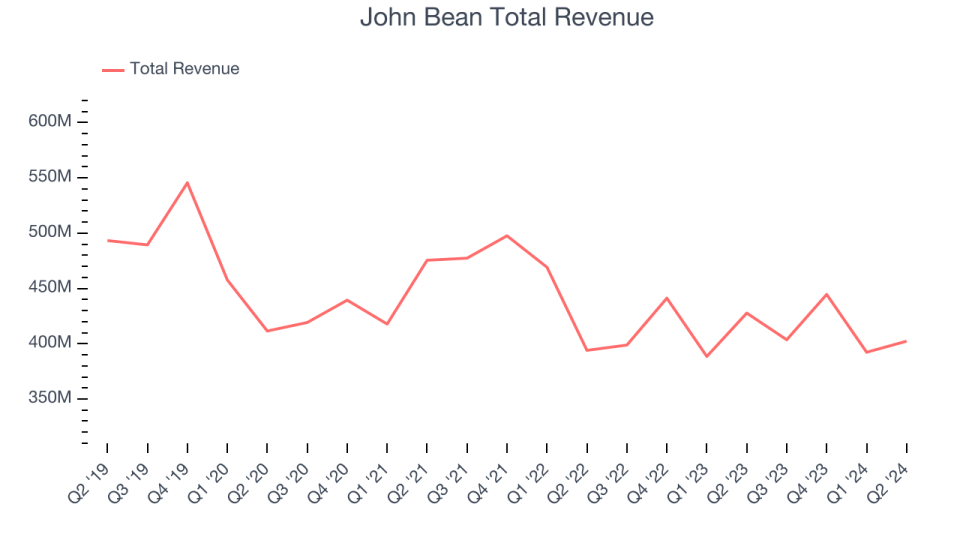

A business’s lasting efficiency can show its organization high quality. Any type of organization can install an excellent quarter or 2, yet several long-lasting ones have a tendency to expand for many years. John Bean battled to create need over the last 5 years as its sales stopped by 3.2% each year, a harsh beginning factor for our evaluation.

We at StockStory put one of the most focus on lasting development, yet within industrials, a half-decade historic sight might miss out on cycles, market patterns, or a business maximizing drivers such as a brand-new agreement win or an effective line of product. John Bean’s current background reveals its need has actually remained subdued as its income has actually decreased by 5.5% each year over the last 2 years.

This quarter, John Bean missed out on Wall surface Road’s quotes and reported an instead unexciting 5.9% year-on-year income decrease, creating $402.3 countless income. Looking in advance, Wall surface Road anticipates sales to expand 8.2% over the following twelve month, a velocity from this quarter.

Today’s young financiers likely have not check out the classic lessons in Gorilla Video game: Selecting Victors In High Innovation since it was created greater than twenty years back when Microsoft and Apple were very first developing their superiority. Yet if we use the exact same concepts, after that venture software program supplies leveraging their very own generative AI capacities might well be the Gorillas of the future. So, because spirit, we are delighted to offer our Unique Free Record on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

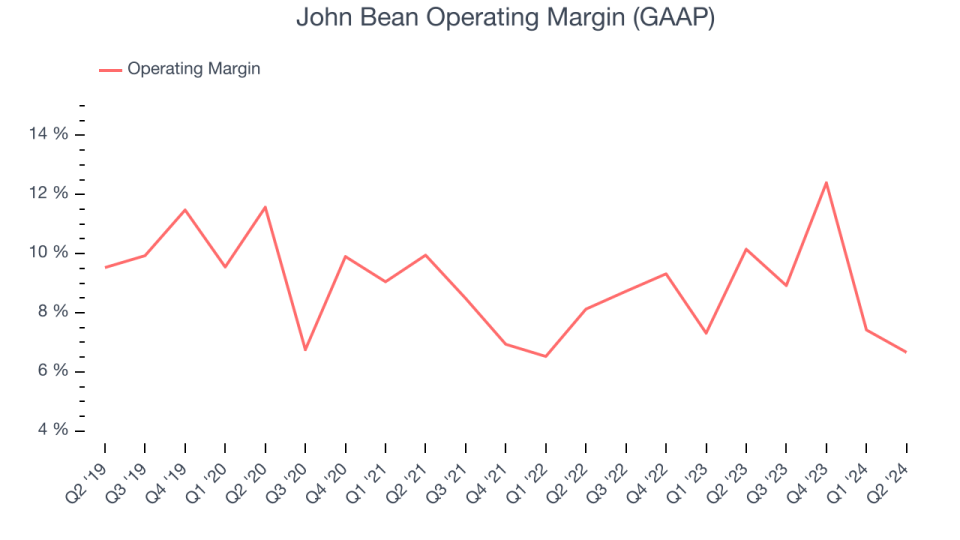

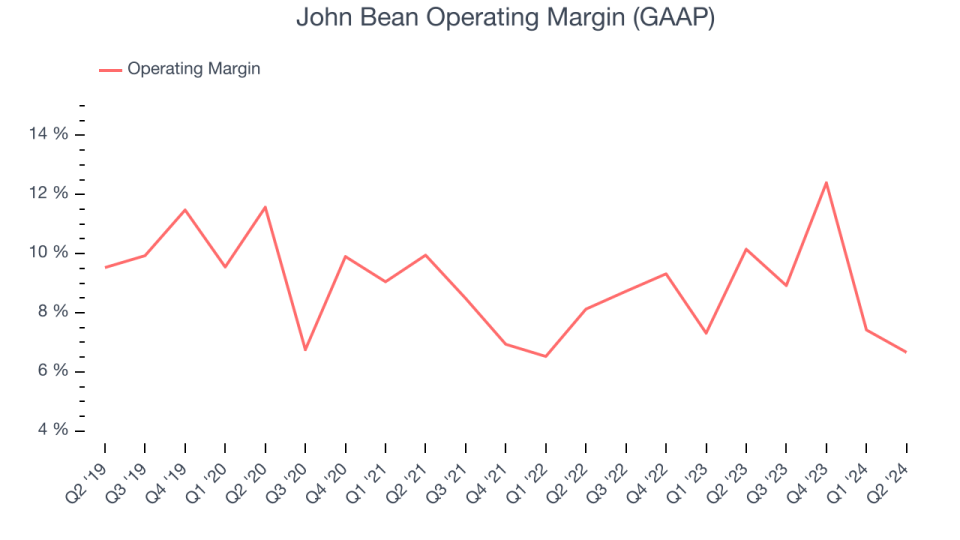

John Bean has actually done a good work handling its expenditures over the last 5 years. The business has actually created a typical operating margin of 9%, more than the more comprehensive industrials market.

Taking a look at the fad in its productivity, John Bean’s yearly operating margin reduced by 1.7 portion factors over the last 5 years. Although its margin is still high, investors will certainly wish to see John Bean end up being a lot more successful in the future.

In Q2, John Bean produced an operating revenue margin of 6.7%, down 3.5 portion factors year on year. Alternatively, the business’s gross margin in fact increased, so we can presume its current inadequacies were driven by boosted operating costs like sales, advertising, R&D, and management expenses.

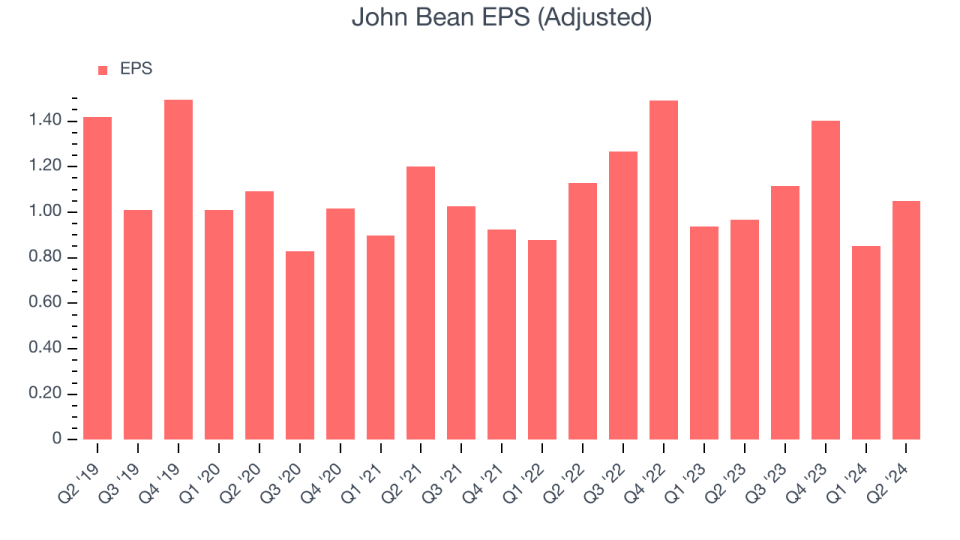

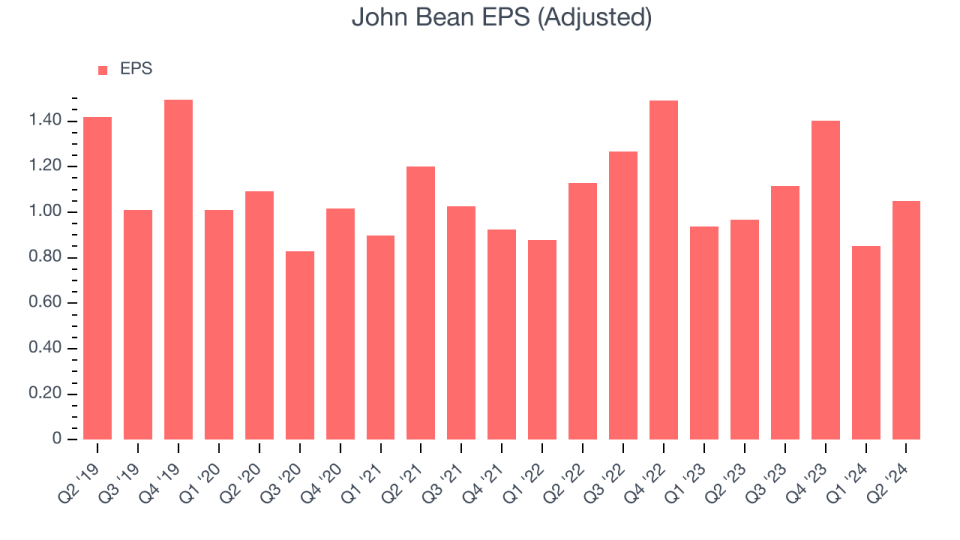

EPS

Examining lasting income patterns informs us concerning a business’s historic development, yet the lasting adjustment in its incomes per share (EPS) indicate the productivity of that development– as an example, a business can inflate its sales via too much costs on advertising and marketing and promos.

Unfortunately for John Bean, its EPS and income decreased by 2.4% and 3.2% each year over the last 5 years. We have a tendency to guide our visitors far from firms with dropping income and EPS, where lessening incomes can suggest altering nonreligious patterns and choices. If the trend transforms suddenly, John Bean’s reduced margin of safety and security can leave its supply cost vulnerable to huge drop-offs.

Like with income, we additionally evaluate EPS over a much shorter duration to see if we are missing out on a modification in business. For John Bean, its two-year yearly EPS development of 5.7% was more than its five-year fad. Increasing incomes development is generally a motivating information factor.

In Q2, John Bean reported EPS at $1.05, up from $0.97 in the exact same quarter in 2015. In spite of expanding year on year, this print missed out on experts’ quotes. Over the following twelve month, Wall surface Road anticipates John Bean to expand its incomes. Experts are forecasting its EPS of $4.42 in the in 2015 to climb up by 24% to $5.48.

Trick Takeaways from John Bean’s Q2 Outcomes

We battled to locate several solid positives in these outcomes. Its income and EPS however missed out on Wall surface Road’s quotes and it reduced its full-year income advice. Its full-year EPS and EBITDA projection additionally failed. On the whole, this quarter can have been much better. The supply stayed level at $96.65 instantly adhering to the outcomes.

So should you buy John Bean today? When making that choice, it is necessary to consider its assessment, organization top qualities, in addition to what has actually taken place in the current quarter. We cover that in our actionable full research report which you can read here, it’s free.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.