Bitcoin is unsteady at place prices, taking a look at the development in the day-to-day graph. The advantage to place prices suggested the globe’s most important coin fired by about 30%, increasing from the pits of $53,500 to around $70,000 over the weekend break.

Mt. Gox Overhang Gone, An Alleviation For Bitcoin

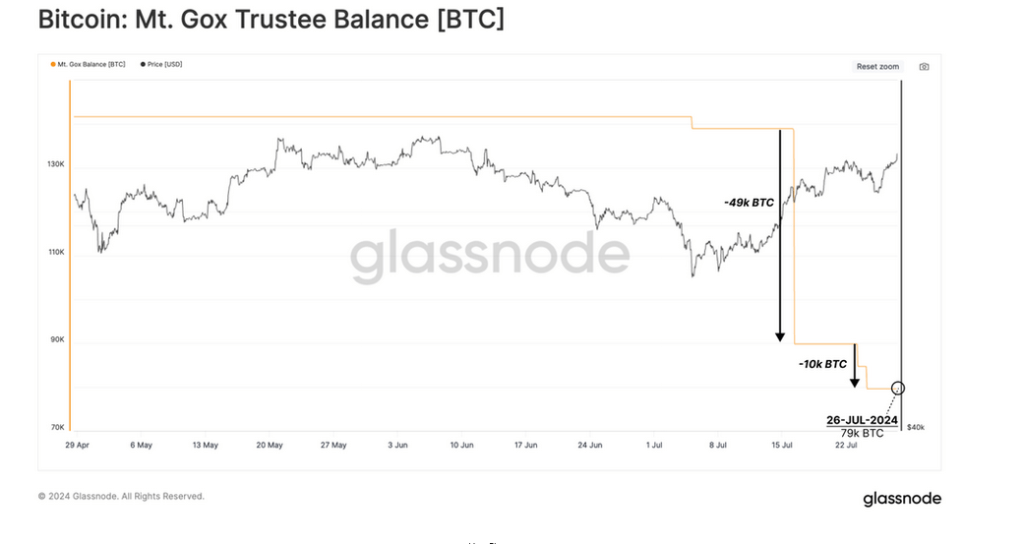

As costs cool down, swiftly discovering being rejected from the important round number and about $2,000 from June 2024 highs, Glassnode experts think Bitcoin is going into a brand-new age. Mentioning the current circulation of BTC by Mt. Gox financial institutions, Glassnode observed that the “overhang” that had actually held the market ransom money for about ten years is relieving.

After preliminary worries that the circulation of billions of BTC by Mt. Gox financial institutions would certainly unleash the marketplace were shown or else, costs climbed. While there was success as the marketplace demonstrated how durable it had actually expanded throughout the years by conveniently taking in those coins, what is necessary to note is the mental landmark this occasion was.

Glassnode observed that a little over 59,000 BTC have actually been dispersed to hack targets through assigned exchanges Sea serpent and Bitstamp. This set was from the 141,686 BTC recuperated from cyberpunks, and Mt. Gox financial institutions intend to disperse the rest in the days ahead.

While some are eased that a section of the Mt. Gox haul has actually been dispersed, it continues to be to be seen exactly how costs will certainly respond in the coming sessions. Thus far, Bitcoin is within a slim variety, stuck largely in between $60,000 and the all-time high of about $74,000. A degree deeper, there are vital resistance degrees to see at $70,000 and $72,000.

If bulls handle to press costs higher, a break over $72,000 would certainly be essential. This line stands for resistance of Might and June, and is the last obstacle prior to the remainder of all-time highs.

The USA Federal Government BTC Scare

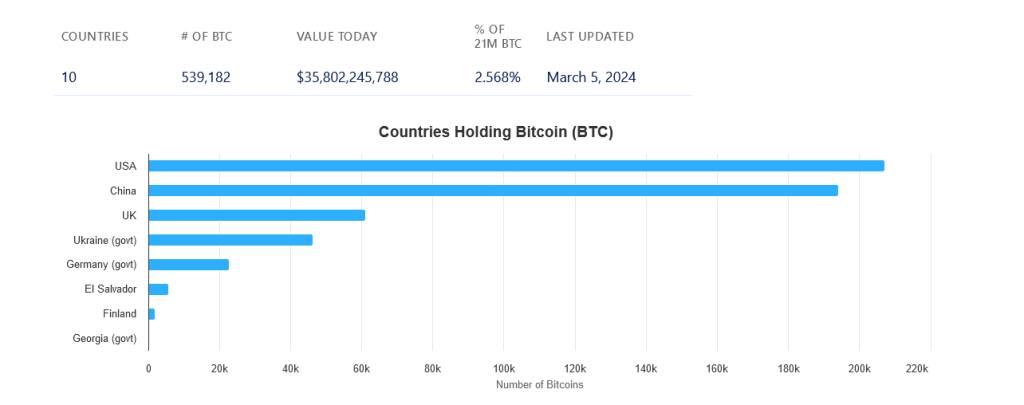

Positive outlook is high, yet costs dropped the other day after the USA moved about $2 billion well worth of BTC, according to Arkham Knowledge information. The on-chain transfer of 30,000 BTC, later on divided right into 2 sets, sent out shockwaves throughout the BTC market, compeling costs lower.

While there were preliminary worries that the federal government intended to liquidate them hours after Donald Trump promised to hold BTC as a critical book, others guess that these coins were being transferred to a custodian. According to one individual on X, the USA Marshals Solution just recently contracted Coinbase Prime to “guard and trade its large-cap electronic possessions profile.”

Bitcoin Treasuries information since July 30 shows that the USA had more than 207,000 BTC. This stockpile was mainly taken from bad guys and various other crooks. China comes second, with 194,000 BTC held.

Function photo from Canva, graph from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.