In a current flare-up on X, noteworthy voices from both the Ethereum and Solana areas clashed over different objections guided at the Solana blockchain. Flip Research Study, a X take care of straightened with pro-Ethereum perspectives, laid out numerous regarded imperfections in SOL’s style and procedure, questioning concerning the blockchain’s integrity, use, and future possibility in institutional setups.

Flip Research Study cited problems concerning Solana’s network security, indicating “countless interruptions” and a “high price of unsuccessful deals” as crucial weak points. The study entity additionally critiqued the Solana blockchain for being systematized and the traveler for its user-unfriendliness, in addition to making use of Corrosion shows language, which it asserts positions “high obstacles to access on the dev side” contrasted to Ethereum’s Strength.

In Addition, Flip Study discussed what they regard as Solana’s “bad interoperability versus EVM” and hypothesized on the reduced chance of a place SOL ETF arising as a result of regulative and need viewpoints.

All Solana FUD?

Joe McCann, a preferred supporter for Solana, responded with a collection of counterarguments targeted at disproving the cases made by Flip Study. McCann highlighted the context of blockchain integrity, contrasting SOL’s interruptions to those experienced by mainstream innovations.

” Integrity for any kind of network needs stress screening the system with genuine tons. For instance, AWS has actually had more than 20 interruptions considering that 2007. AWS is, naturally, the marketplace share leader in cloud computer,” McCann clarified, recommending that periodic interruptions belong to the development and scaling procedure for any kind of innovative technical system.

Dealing with the problem of purchase failings, McCann cleared up the nature of these cases: “If you intend to carry out a swap on Jupiter Exchange and you establish your slippage to an optimum of 3%, and you most likely to make a swap and the program (clever agreement) identifies your slippage is > > 3%, it will certainly return the purchase. This is not a failing– the on-chain program is doing specifically what the customer regulated.”

McCann robustly safeguarded making use of Corrosion over Strength, mentioning its appeal and value amongst designers. “Corrosion has actually been elected one of the most ‘appreciated’ configuring language in Heap Overflow’s yearly programmer study for 8 years straight. Additionally, Corrosion is not just one of the most appreciated however is extremely ‘preferred’ by designers,” he specified, highlighting the solid area and programmer assistance for Corrosion in contrast to Strength.

On the factor of centralization, McCann offered certain metrics to respond to the case that Solana is excessively systematized: “Ethereum’s Nakamoto coefficient is … 2. 2. Solana’s Nakamoto coefficient is … 20. That’s 10x even more decentralized utilizing this metric. Yet allow’s utilize an additional statistics. Among the crucial centralization dangers is where your nodes/validators are running. Are they in somebody’s apartment or condo or in a large cloud computer information facility, like AWS or GCP? 50% of Ethereum validators get on held networks, like AWS. Solana validators running in held networks are around 10%.”

McCann additionally dealt with the supposition around a place Solana ETF, rejecting uncertainties concerning institutional passion as unwarranted. “This is merely guesswork, and the end result is that of an electronic choice– either it takes place or it does not. With individuals like Raoul Friend and cutting-edge ETF companies like Vaneck leading the fee, the idea that there isn’t adequate institutional passion in SOL is rubbish.”

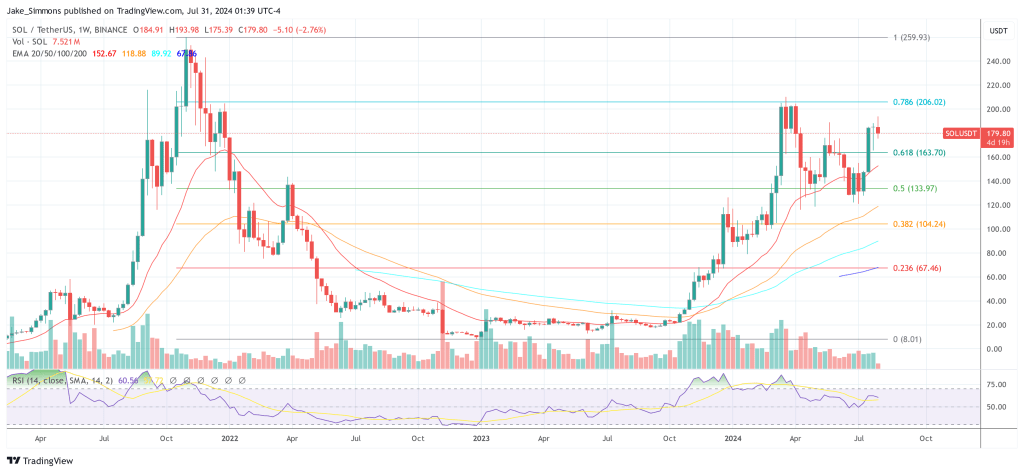

At press time, SOL traded at $179.80.

Included picture from Shutterstock, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.