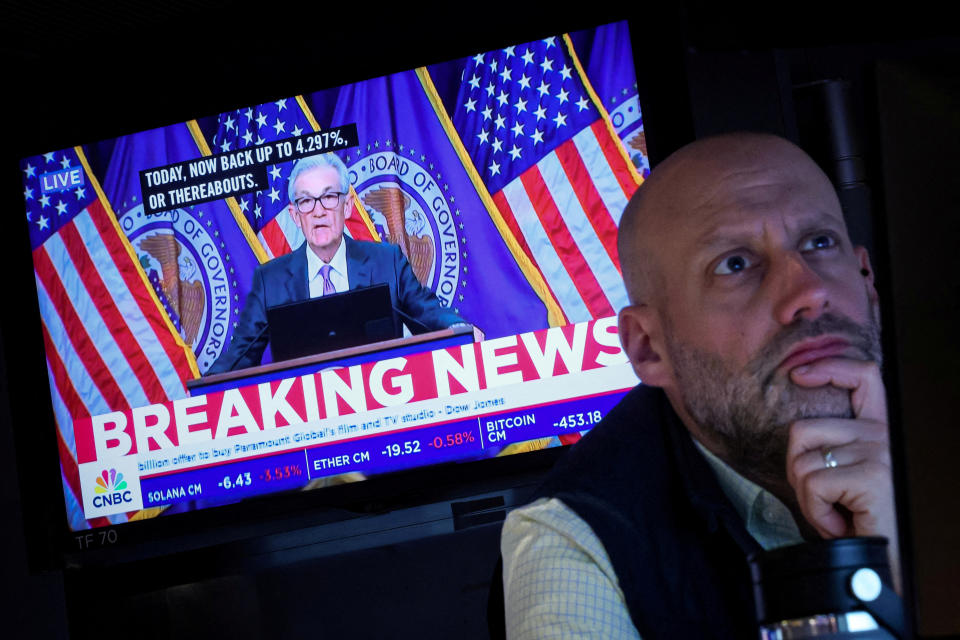

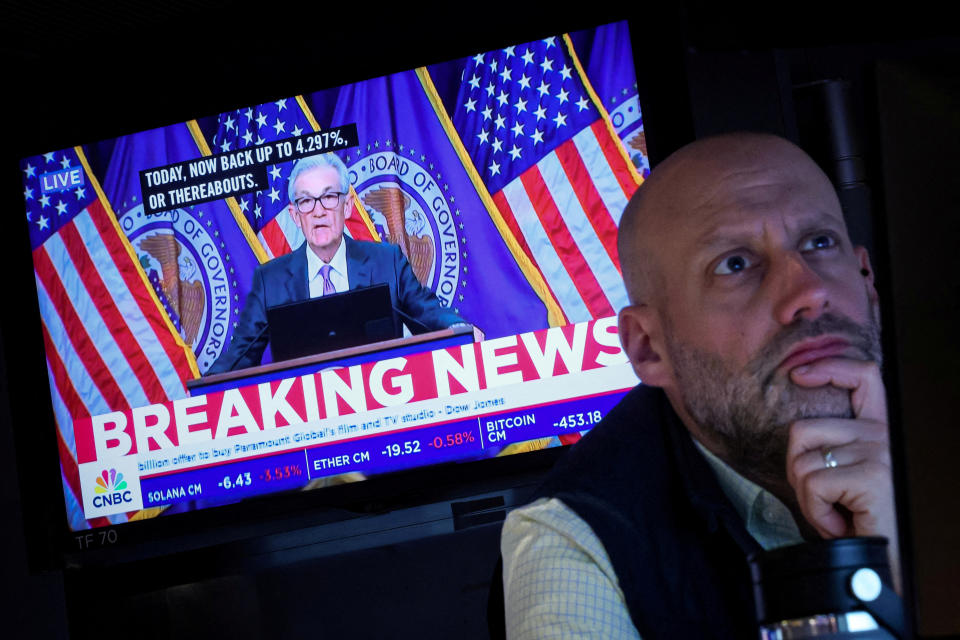

The Federal Book is extensively anticipated to hold rate of interest constant at the final thought of its plan conference Wednesday while unlocking to a September cut if rising cost of living remains to reveal progression.

Capitalists will certainly be expecting hints regarding the course ahead in a post-meeting declaration from Fed authorities and a 2:30 pm ET interview with Fed Chair Jay Powell.

The Fed can make some adjustments to its plan declaration proclaiming even more progression towards the reserve bank’s 2% rising cost of living objective. it can additionally recognize a current air conditioning in the work market.

Powell can additionally make a decision at his interview to supply a more powerful signal regarding financial plan, maybe also strengthening market assumptions of a most likely cut at the Fed’s following conference on September 17-18.

” We believe Chair Powell will certainly supply that the most recent rising cost of living analyses contribute to the Fed’s self-confidence that rising cost of living will certainly head in the direction of the 2% rising cost of living target,” stated Morgan Stanley primary financial expert Ellen Zetner.

At the very same time, “we believe he will certainly once again keep in mind that the labor market remains in far better equilibrium,” she included.

Some essential Fed authorities have actually been stressing in the weeks leading up to Wednesday’s conference that they are obtaining closer to having self-confidence rising cost of living is sustainably going down to their 2% objective.

They have actually additionally made it clear they are paying even more focus to climbing joblessness, an additional indicator that cuts might be nearing.

The majority of Fed spectators claim the reserve bank still requires simply a little bit even more time to make sure, while additionally preparing the marketplaces for the considerable activity to find.

The current peace of mind that a cut can be nearing came Friday when a brand-new analysis of the Fed’s favored rising cost of living scale– the core Individual Usage Expenses (PCE) index– revealed its most affordable yearly gain in greater than 3 years.

The 2.6% yearly rise in the month of June coincided degree as Might and below 2.8% in April. On a three-month annualized price, core PCE hung back to 2.3% from 2.9%.

An additional rising cost of living step, the Customer Rate Index (CPI), has actually additionally revealed progression.

On a “core” basis– which omits unstable food and power costs the Fed can not regulate– CPI climbed 3.3% year over year in the month of June. That was below 3.4% in Might and 3.6% in April.

Some Fed spectators do suggest the Fed has the basis to sustain a cut at its conference today, also as they note they do not anticipate it to occur.

” I do not see a factor within the financial information that they must not reduce this conference,” stated Wilmington Depend on primary financial expert Luke Tilley. “Actually, I believe it’s difficult to see a factor that they must maintain prices where they are.”

That stated, there’s “no chance” the Fed would certainly do that, Tilley included, since it risks of “scaring the marketplaces.”

He forecasts one cut in September and an additional in December, adhered to by an overall of 6 quarter-point cuts in 2025.

The last typical quote from the 19 Fed authorities that have a voice towards prices was for one price reduced this year, a forecast made in very early June.

However that was most likely affected by hotter-than-expected rising cost of living information in the very first quarter. Since rising cost of living is cooling down once again, authorities might be extra open up to 2 cuts prior to 2024 mores than.

The Fed will certainly introduce its plan choice Wednesday at 2 pm ET, adhered to by Chair Powell’s interview at 2:30 pm ET.

Go here for comprehensive evaluation of the most recent stock exchange information and occasions relocating supply costs

Review the most recent economic and organization information from Yahoo Money

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.