Power generation items business Generac (NYSE: GNRC) will certainly be introducing revenues outcomes tomorrow prior to market hours. Below’s what capitalists must recognize.

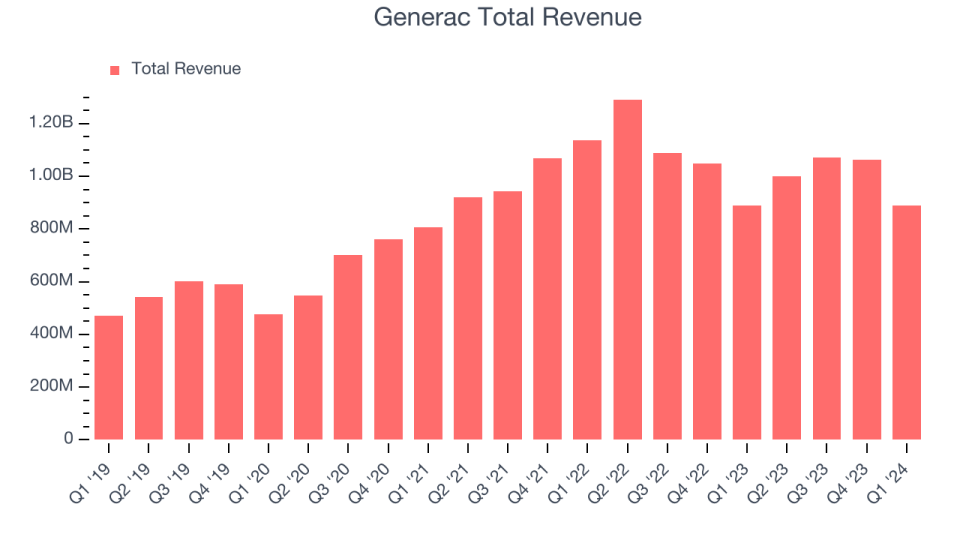

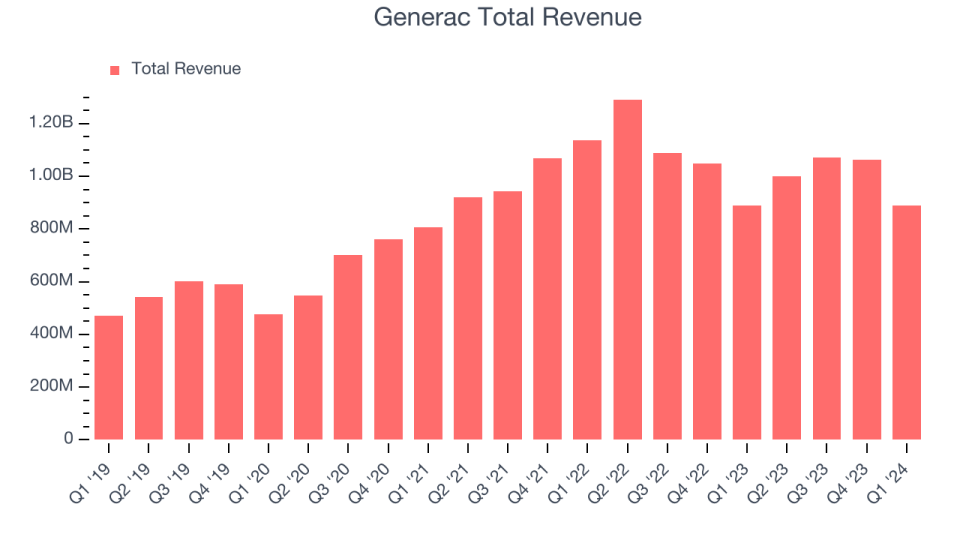

Generac fulfilled experts’ income assumptions last quarter, reporting earnings of $889.3 million, level year on year. It was a weak quarter for the business, with a miss out on of experts’ revenues quotes.

Is Generac a buy or market entering into revenues? Read our full analysis here, it’s free.

This quarter, experts are anticipating Generac’s income to be level year on year at $1 billion, enhancing from the 22.5% decline it taped in the exact same quarter in 2015. Readjusted revenues are anticipated to find in at $1.20 per share.

Most of experts covering the business have actually reconfirmed their quotes over the last one month, recommending they expect business to persevere heading right into revenues. Generac has actually missed out on Wall surface Road’s income approximates 4 times over the last 2 years.

Considering Generac’s peers in the electric devices section, some have actually currently reported their Q2 results, providing us a tip regarding what we can anticipate. Badger Meter provided year-on-year income development of 23.2%, defeating experts’ assumptions by 6.5%, and Whirlpool reported an income decrease of 16.8%, in accordance with agreement quotes. Badger Meter traded up 3.7% adhering to the outcomes while Whirlpool was likewise up 2.9%.

Review our complete evaluation of Badger Meter’s results here and Whirlpool’s results here.

There has actually declared view amongst capitalists in the electric devices section, with share rates up 10.2% typically over the last month. Generac is up 16.4% throughout the exact same time and is heading right into revenues with a typical expert rate target of $147 (contrasted to the existing share rate of $155).

Unless you have actually been living under a rock, it needs to be apparent now that generative AI is mosting likely to have a massive effect on just how big firms work. While Nvidia and AMD are trading near to all-time highs, we like a lesser-known (yet still lucrative) semiconductor supply gaining from the surge of AI. Click here to access our free report on our favorite semiconductor growth story.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.