Starbucks (SBUX) fizzled on income and same-store sales development yet once more.

Q3 income dropped 1% to $9.1 billion, less than assumptions of $9.20 billion, per Bloomberg agreement price quotes.

International same-store sales decreased for the 2nd quarter straight, down 3%, while total foot web traffic dropped 5%.

Changed incomes per share did be available in somewhat greater at $0.93, contrasted to price quotes of $0.92.

In the launch, chief executive officer Laxman Narasimhan claimed its three-part activity strategy “is starting to function and driving functional renovations that we anticipate to enhance economic efficiency,” with an objective to “return business to lasting development.”

That strategy to turn around fads in the United States, which was presented following its Q2 results, consists of obtaining much more clients throughout the day, releasing brand-new products while “keeping our concentrate on core coffee ahead offerings,” and offering even more worth.

The dimension of the typical check was up a little greater, up 2%, because of food selection rate rises.

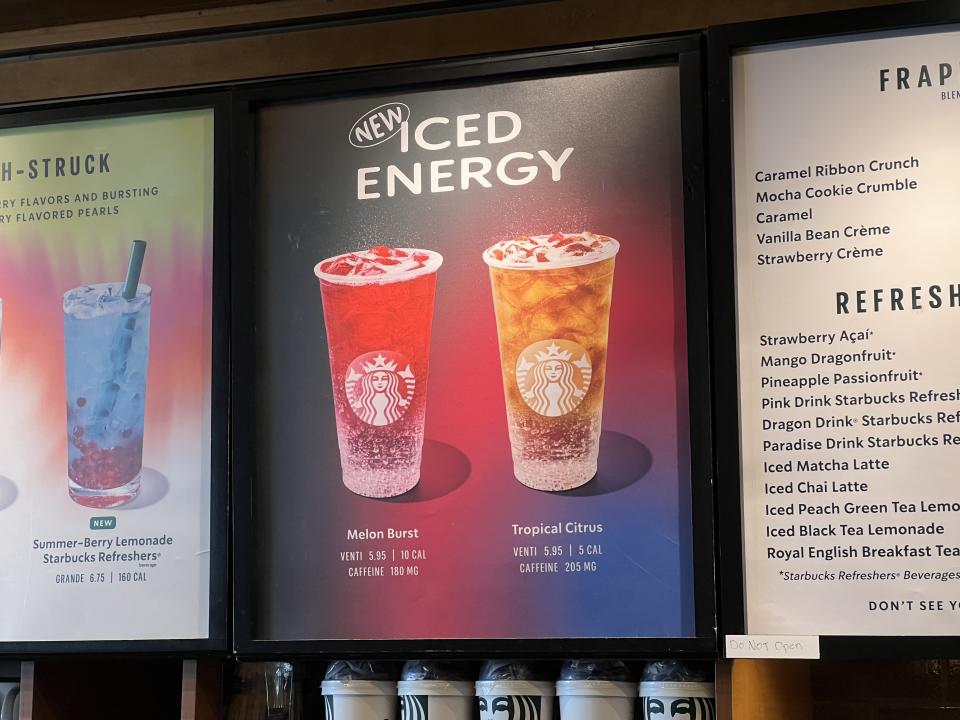

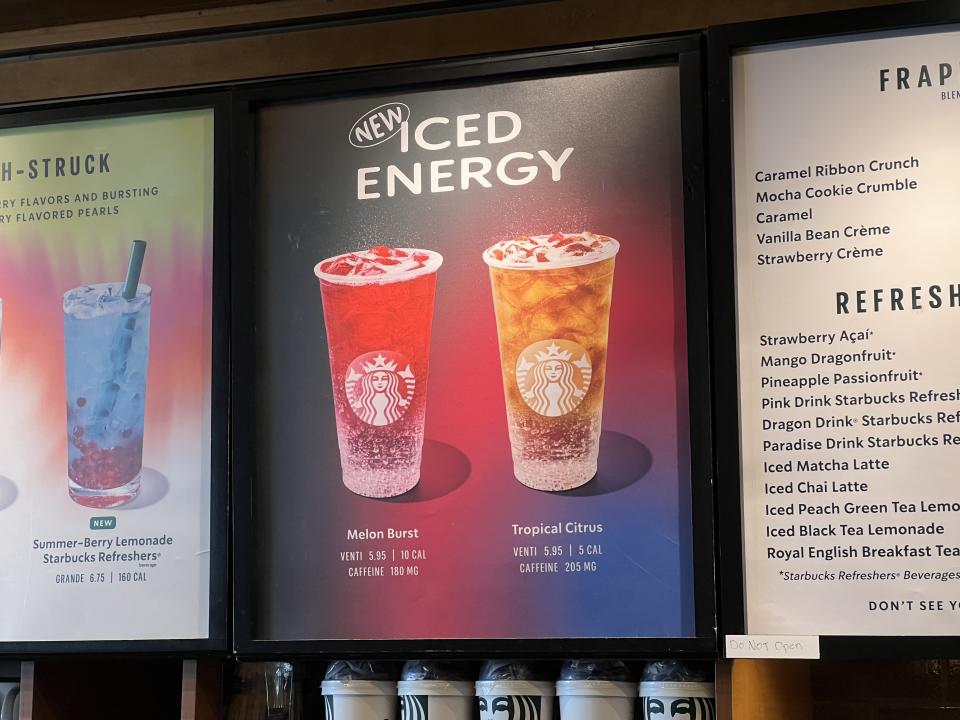

This quarter, it turned out brand-new products like standing out boba-like pearls and cold power beverages. It likewise introduced a limited-time “pairing food selection,” which enables clients to obtain a little cold or warm coffee with a butter croissant or morning meal sandwich for $5 or $6.

However it does not feel like it sufficed to transform the trend. Very same shops sales decreased 2% in the United States.

Before the outcomes, Deutsche Financial institution expert Lauren Silberman, that has a Hold score on the supply, composed in a note to customers that “view on Starbucks remains to lean adverse … [it] has actually been much less topical than various other big caps and about the previous couple of quarters.”

” Intermittent macro problems” might be to at fault, per a note from Baird expert David Tarantino before the outcomes. He expected soft qualities most of monetary 2024 sales as customers draw back on optional investing, “consisting of mid-day event at Starbucks.” He has a Hold score on shares.

This incomes record comes as stress is installing from activist financier Elliott Financial investment Administration, which took a concealed risk in the business, according to a report from WSJ.

” Capitalists have actually examined Elliott’s experience and record in the customer industry, our team believe that an outside push might increase making strong choices and might supply intriguing risk-reward chances for lasting financiers ready to approve that a turn-around might require time,” Bernstein expert Danilo Gargiulo composed in a note to customers.

Right here are 10 products Gargiulo thinks the Elliot group would certainly focus on.

Its second-largest market, China saw the largest decrease of all Starbucks sections.

Same-store sales dropped 14%, contrasted to last quarter when they were down 11%.

Foot web traffic there dropped 7% therefore did the typical check dimension.

In a note to customers, Financial institution of America expert Sara Senatore claimed Starbucks’ efficiency in China is connected to industrywide battles.

” Extreme competitors is the all-natural state of dining establishment markets and also the best brand names are not protected,” she claimed. “The instructions of SBUX’s China same-store sales development is highly associated with those of various other worldwide brand names. And all are associated with macro aspects (GDP).”

McDonald’s (MCD) indicated decreasing sales development in China in its Q2 results as customer view stays weak in an affordable setting.

Gargiulo thinks franchising might be the means to enter the marketplace with an “just as engaging choice to utilize buildout of among the largest coffee market without the funding allowance” and much less direct exposure to “changing macro-economic problems.”

The business still intends to have 9,000 areas in China by 2025.

Incomes sneak peek

Below’s what Starbucks reported, contrasted to price quotes, based upon Bloomberg agreement information:

Income: $9.1 billion versus $9.20 billion

Changed incomes per share: $ 0.93 versus $0.92

Same-store sales: -3% versus -2.71%

Foot web traffic: -5% versus -4.27%

Ticket Development: 2% versus 1.98%

Complying With Q2, Starbucks modified its 2024 overview for the 3rd time this .

It anticipates 2024 worldwide income development of low-single figures, below the previous variety of 7% to 10%, which itself was below a previous support of 10% to 12%.

International and United States same-store sales are anticipated to see a reduced single-digit decrease or remain level, below the previous variety of 4% to 6% development. China’s same-store sales are anticipated to see a single-digit decrease, below the formerly anticipated low-single-digit development.

The business intends to offer an upgrade on the 2024 overview in a phone call with financiers.

Starbucks decreased to make chief executive officer Laxman Narasimhan and CFO Rachel Ruggeri readily available for a meeting.

This tale is damaging and being upgraded.

—

Brooke DiPalma is an elderly press reporter for Yahoo Financing. Follow her on Twitter at @BrookeDiPalma or email her at bdipalma@yahoofinance.com.

Click On This Link for every one of the most up to date retail supply information and occasions to much better notify your investing technique

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.