The United States Stocks and Exchange Compensation (SEC) has amended its grievance in the legal action versus Binance, supplying greatly favorable information for Solana (SOL) and Cardano (ADA). This change entails a vital change pertaining to the category of 10 cryptocurrencies, consisting of Solana and Cardano, which were originally identified as safety and securities in the SEC’s thorough lawsuit versus Binance and its previous chief executive officer, Changpeng Zhao.

Cardano, Solana Are Not Stocks

The initial grievance, lodged on June 5, 2023, by the SEC, targeted Binance together with its United States associate, BAM Trading Providers Inc. The firm’s costs fixated accusations that these entities ran without the essential enrollments for working as nationwide safety and securities exchanges, broker-dealers, and clearing up firms. This absence of enrollment supposedly enabled Binance to run an uncontrolled trading system, therefore revealing United States capitalists to considerable dangers and supposedly misdirecting them pertaining to the safety and regulative oversight of their financial investments.

Today, on July 30, the United States firm submitted a change to its grievance worrying “Crypto Possession Stocks.” This change prevents the instant demand for the court to rule on the adequacy of the accusations associated with these symbols.

The record clarifies, “The SEC notified Offenders that it means to look for entrust to modify its Grievance, especially worrying the ‘3rd party Crypto Possession Stocks’ as specified in the SEC’s Omnibus Resistance to Offenders’ Movement to Reject, Dkt. No. 172, therefore getting rid of the need for the court to analyze the adequacy of the accusations pertaining to those symbols at this time.”

Significantly, the SEC originally marked 10 cryptocurrencies consisting of Binance Coin (BNB), Binance USD (BUSD), Solana (SOL), Cardano (ADA), Polygon (MATIC), Universe (ATOM), The Sandbox (SAND), Decentraland (MANA), Axie Infinity (AXS), and COTI (COTI) as safety and securities.

Regardless of the possibly favorable ramifications of the SEC’s choice to modify its category of particular symbols, there has actually been no considerable market response so far. At the time of coverage, the Solana cost has actually lowered by -5.5% and Cardano by -4.5% over the previous 24 hr. In a similar way, the various other cryptocurrencies pointed out in the SEC’s preliminary grievance have actually disappointed any kind of significant market activities, straightening with the more comprehensive market view, which has actually been affected by current adverse information concerning Bitcoin, specifically worrying the United States federal government’s possible sale of approximately 29,800 BTC.

DeFi ^ 2 (@DefiSquared), the top-ranked crypto investor on Bybit, commented through X: “Market discolored this relocation for some factor, however it really feels like quite considerable information for the coins no more being identified as safety and securities? Short-term ramifications consist of a most likely impending Robinhood re-listing, and longer-term, better possibilities of brand-new ETF authorizations.”

The Cboe has actually officially asked for the SEC’s authorization to permit property supervisors VanEck and 21Shares to introduce a place Solana-based exchange-traded fund (ETF) in very early July. This demand was expressed with a set of 19b-4 filings sent to the Stocks and Exchanges Compensation, recommending these items for listing, subject to regulative authorization.

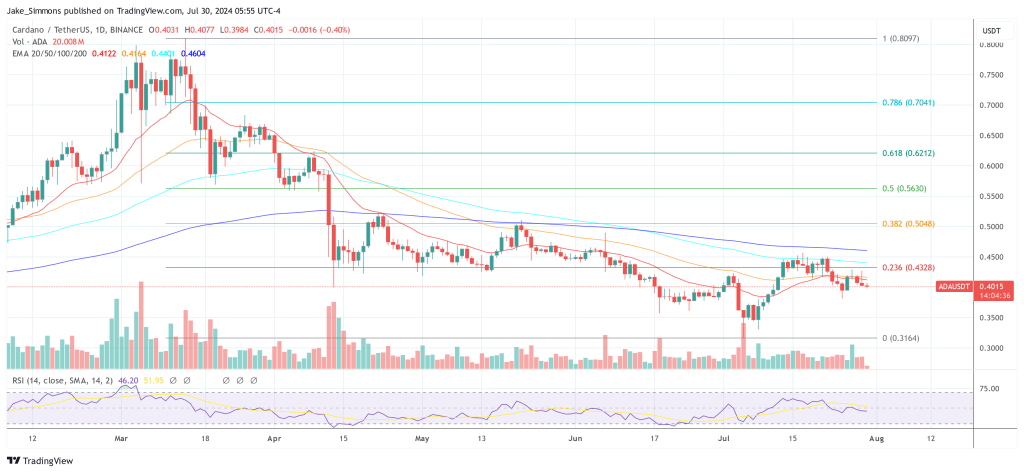

At press time, Cardano traded at $0.4015.

Included photo developed with DALL.E, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.