Chip huge AMD (AMD) reported its 2nd quarter profits after the bell on Tuesday, defeating experts’ assumptions on the leading and profits and uploading better-than-anticipated advice for the 3rd quarter.

AMD, like competing Nvidia, is riding the AI buzz train, which is powering sales of its information facility graphics refining systems (GPUs) and main handling systems (CPUs). For the quarter, AMD reported modified profits per share (EPS) of $0.69 and earnings of $5.8 billion. Wall surface Road was expecting modified EPS of $0.68 on earnings of $5.7 billion, according to agreement quotes by Bloomberg. AMD reported changed EPS of $0.58 on earnings of $5.4 billion throughout the duration in 2023.

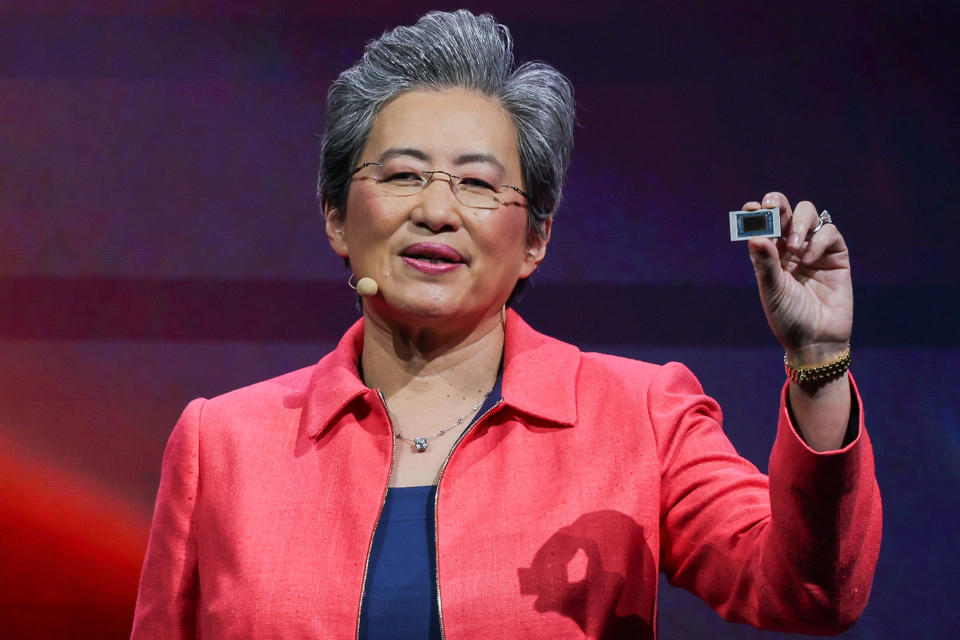

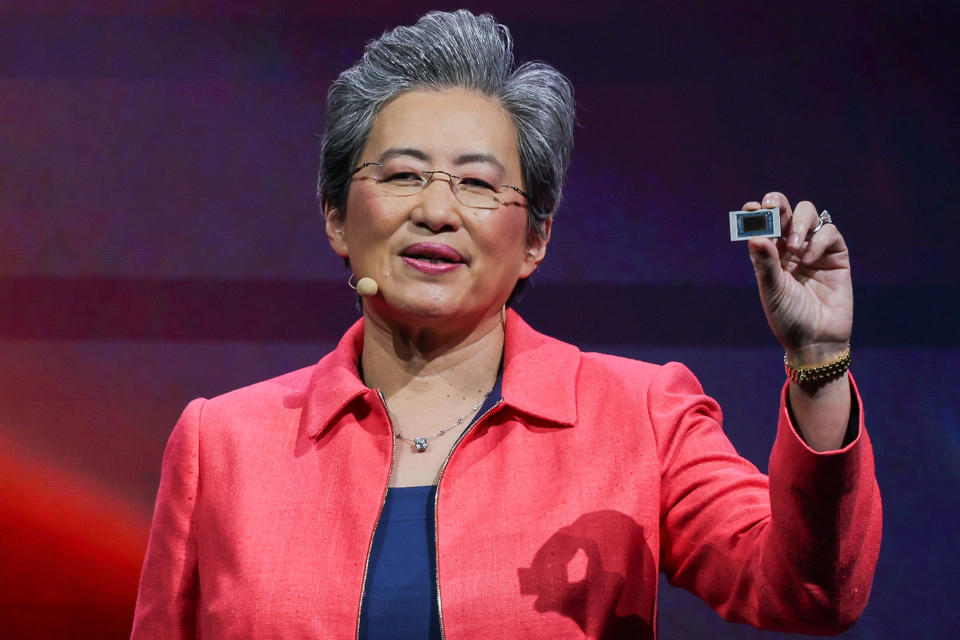

” Our AI company proceeded speeding up and we are well placed to provide solid earnings development in the 2nd fifty percent of the year led by need for Reaction, EPYC and Ryzen cpus,” AMD chief executive officer Lisa Su stated in a declaration.

” The quick breakthroughs in generative AI are driving need for even more calculate in every market, developing substantial development chances as we provide management AI services throughout our company.”

AMD’s Information Facility earnings, that includes sales of AMD’s GPUs and CPUs, peaked at $2.8 billion, defeating assumptions of $2.75 billion. That’s a 115% dive versus the very same quarter in 2015, when AMD reported Information Facility earnings of $1.3 billion.

Shares of AMD climbed as long as 5% adhering to the record, while shares of competing Nvidia (NVDA) leapt 3%. Shares of Intel (INTC) were level.

AMD’s existing leading GPU is its MI300X. Throughout an interview at the Computex occasion in Taiwan in June, AMD stated companions and clients, consisting of Microsoft, Meta, Dell, HPE, and Lenovo, are currently taking on the chip. The firm likewise exposed that its next-generation MI325X will certainly be readily available start in Q4, while the MI350X will certainly strike the marketplace in 2025. AMD stated it will certainly turn out the MI400 in 2026.

It’s not simply AI that matters for AMD, however. Its Customer sector, that includes sales of chips for Computers, is still a vital part of its company. For the quarter, the firm reported earnings of $1.5 billion pounding assumptions of $1.45 billion, and up from $998 million in the very same duration in 2015.

The Customer sector beat comes as the computer market proceeds its turn-around adhering to a considerable stagnation after the eruptive development seen at the start of the pandemic.

However that was 4 years earlier, and customers are starting to look for substitutes for the Computers they purchased the begin of the pandemic. That, according to IDC, has actually led to globally computer deliveries enhancing 3% year over year in the 2nd quarter, noting the 2nd quarter of development after 8 successive quarters of decreases.

Video gaming earnings peaked at $648 billion in Q2, down 59% year over year yet defeating quotes of $646 billion.

Like the computer market, the video gaming market has actually likewise been emulating a stagnation contrasted to the high-flying sale days of the very early pandemic period. Still, there’s wish for the video gaming market entering into completion of 2024 and begin of 2025 as Nintendo prepares to introduce its following console and Take-Two preps its extremely expected “Grand Burglary Car VI” later on following year.

AMD is the initial of the large 3 chip firms to report its profits this quarter. Intel will certainly do the same on Aug. 1, while Nvidia will certainly report its profits on Aug. 28.

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

For the most recent profits records and evaluation, profits murmurs and assumptions, and firm profits information, go here

Review the most recent monetary and company information from Yahoo Financing

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.