Ethereum area exchange-traded funds (ETFs) that debuted in the United States recently have actually taken the cryptocurrency market at big by tornado with substantial inflows right into these items.

According to a current report by CoinShares, the arrival of these area ETFs has actually brought in $2.2 billion, noting a turning point for Ethereum and its capitalists.

Rise in Ethereum ETFs, What regarding Bitcoin?

Coinshares disclosed that with the launch of Ethereum ETFs, a huge resources rise has actually not just been seen yet likewise a 542% rise in Ethereum exchange-traded items (ETPs).

Although the need rise shows the expanding passion from capitalists looking for direct exposure to Ethereum with managed monetary items, James Butterfill, head of study at Coinshares, highlighted that the number continues to be “rather debatable.” Butterfill discussed:

This number is rather debatable as Grayscale seeded its brand-new Mini Depend on ETF (the week prior) with resources from its incumbent closed-end trust fund (~ US$ 1bn), which might assist clarify the stable stream of discharges in the last few years.

No matter, presenting these ETFs stands for a considerable landmark, as it lines up with more comprehensive market fads where capitalists progressively look for varied and safe and secure financial investment networks within the crypto room.

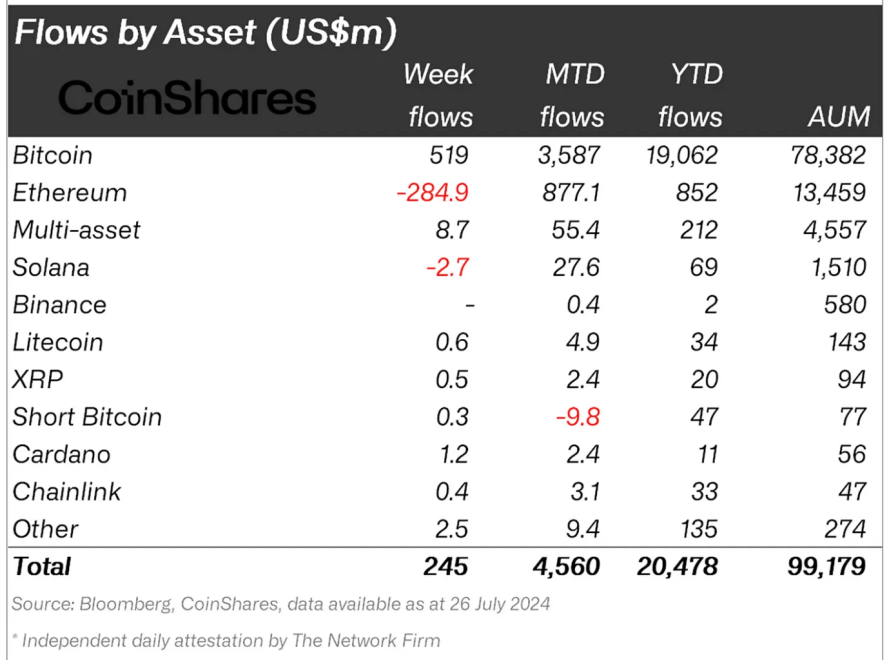

Nonetheless, it’s not all favorable information, as the total electronic possession market has actually experienced blended ton of money. As an example, the Ethereum trust fund from Grayscale saw $285 million in web discharges regardless of the total market buoyancy.

The more comprehensive crypto market has likewise really felt the influence of these growths. According to Coinshares, Bitcoin has actually remained to draw in considerable resources along with Ethereum’s inflows, with $3.6 billion streaming in over the previous month.

This brings its year-to-date inflows to a historical high of $19 billion, underpinned by supposition around the United States political elections and prospective adjustments in Federal Book plans. James Butterfill especially kept in mind:

Our company believe the United States electioneering remarks around Bitcoin as a prospective calculated book possession, and the boosted possibilities for a September 2024 FED price cut are the most likely factor for restored financier self-confidence.

Moreover, the CoinShares record explores the results of these circulations, highlighting a “record-breaking overall inflow of $20.5 billion” throughout all electronic possessions for 2024. Trading quantities have actually risen to their highest degree considering that Might, increased additionally by the Ethereum area ETFs’ launch in the United States.

BTC And ETH Market Efficiency

Adhering to the taped inflows right into Bitcoin and Ethereum area ETF items, their rate efficiency has actually had a hard time to maintain the speed.

Ethereum, for example, regardless of releasing its area ETF item recently, the possession showed a “market the information” rate activity, with ETH going down as reduced as $3,098 days complying with the information.

Although the possession is currently trading over $3,300, it has yet to match the positive outlook in its area ETF items. Bitcoin, on the various other hand, regardless of likewise seeing a decrease to as reduced as $64,000 days complying with the ETH area ETF launch, the possession fasted to recoup.

Presently, Bitcoin trades at $68,850, a small retracement from its earlier rate of $69,907 seen earlier today. Significantly, one remarkable aspect credited to Bitcoin’s existing favorable rate efficiency is the current favorable declaration by previous head of state Donald Trump at the 2024 Bitcoin Seminar.

These declarations consist of shooting Gary Gensler if chosen head of state and producing a United States Federal government calculated nationwide Bitcoin book.

Included photo developed with DALL-E, Graph from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.