Starbucks (SBUX) capitalists beware in advance of its Tuesday revenues record.

Its shares are down almost 28% contrasted to a year earlier, when the coffee titan suggested of a durable customer with a 10% sales development. Currently, various assumptions get on faucet.

Q3 income is anticipated to expand 0.37% to $9.20 billion, per Bloomberg agreement price quotes. Changed revenues per share are anticipated to be $0.92, contrasted to $1.00 a year earlier.

Same-store sales are anticipated to decrease for the 2nd quarter straight, down 2.71%, while total foot website traffic is anticipated to go down 4.27%.

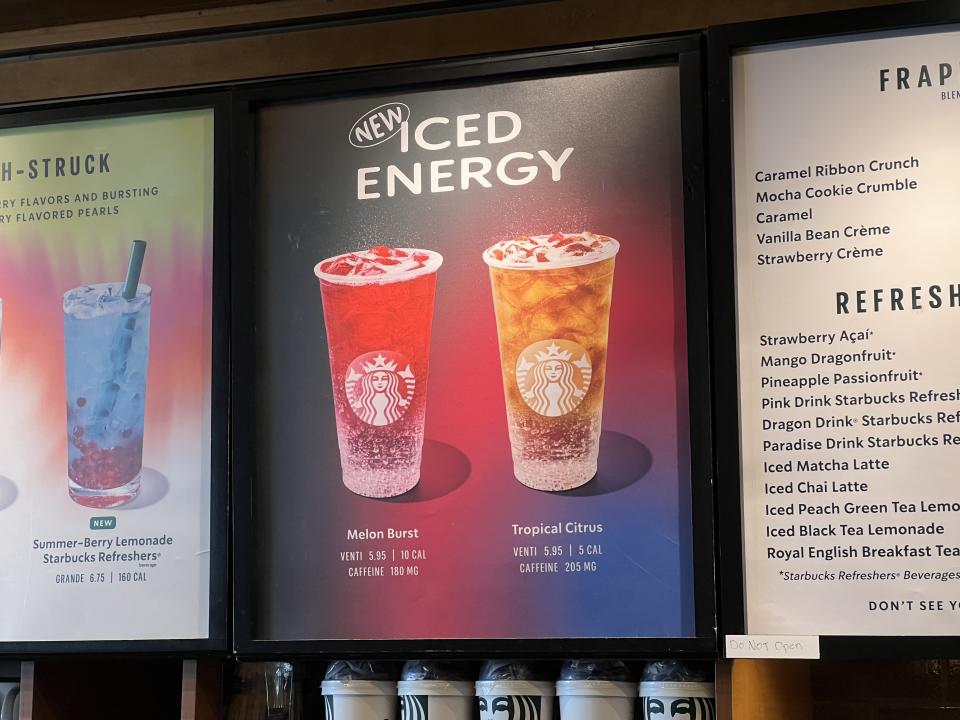

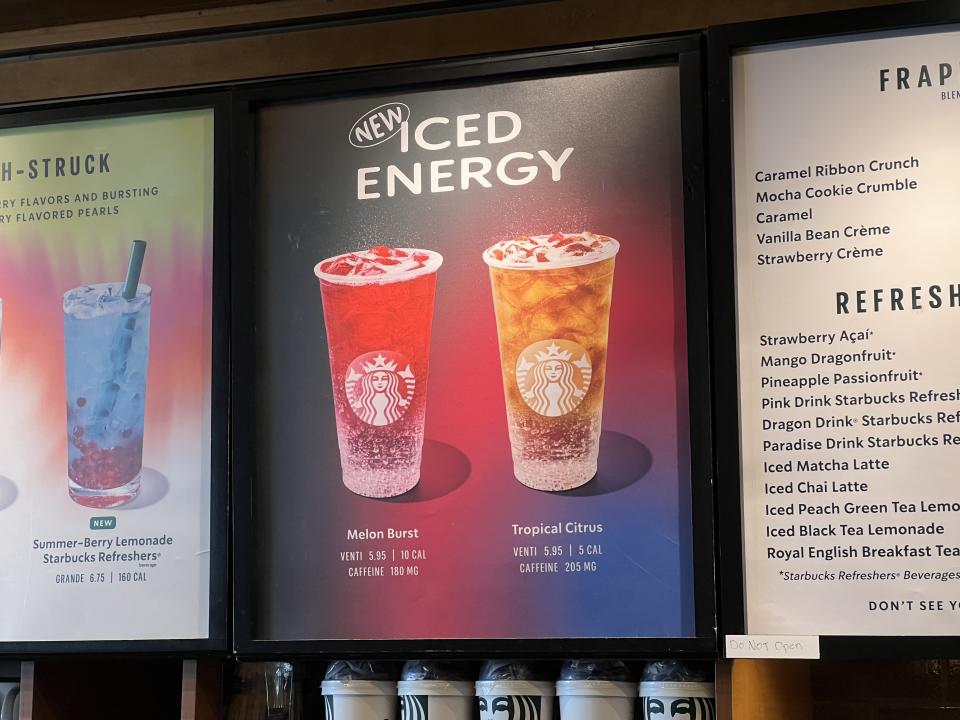

The dimension of the typical check is approximated to be up 1.98% as food selection rates boost. This might likewise be increased by brand-new things introduced throughout the quarter like standing out boba-like pearls and cold power beverages. It introduced a limited-time “pairing food selection,” which enables clients to obtain a little cold or warm coffee with a butter croissant or morning meal sandwich for $5 or $6.

This might not have actually transformed the trend sufficient.

” Our company believe United States same-store sales continued to be weak in Q3 regardless of a purposeful rise in advertising task and numerous item launches in the quarter,” Deutsche Financial institution expert Lauren Silberman created in a note to customers. She has a Hold score on the supply.

She included “view on Starbucks remains to lean unfavorable … [it] has actually been much less topical than various other huge caps and about the previous couple of quarters.”

” Intermittent macro concerns” might be to responsible, per a note from Baird expert David Tarantino. He anticipates gentleness most of financial 2024 sales as customers draw back on optional costs, “consisting of mid-day event at Starbucks.” He has a Hold score on shares.

This revenues record comes as stress is placing from activist financier Elliott Financial investment Monitoring, which took an unrevealed risk in the firm, according to a report from WSJ.

” Capitalists have actually examined Elliott’s experience and performance history in the customer industry, our company believe that an exterior push might increase making vibrant choices and might provide intriguing risk-reward possibilities for lasting capitalists happy to approve that a turn-around might require time,” Bernstein expert Danilo Gargiulo created in a note to customers.

Right here are 10 things Gargiulo thinks the Elliot group would certainly focus on.

Improving causes its second-largest market, China, is likewise much required.

Last quarter, China saw the largest decrease of all Starbucks sections, with same-store sales down 11%, foot website traffic down 8%, and the typical ticket dimension down 4%. This quarter, Wall surface Road anticipates approximately the very same, with sales down 10.58%.

” Efficiency was influenced by a decrease in periodic clients, transforming vacation patterns, a high advertising atmosphere, and a normalization of client actions adhering to in 2014’s market resuming,” chief executive officer Laxman Narasimhan stated on his last revenues phone call.

In a note to customers, Financial institution of America expert Sara Senatore stated Starbucks’ efficiency in China is linked to industrywide battles.

” Extreme competitors is the all-natural state of dining establishment markets and also the greatest brand names are not shielded,” she stated. “The instructions of SBUX’s China same-store sales development is highly associated with those of various other worldwide brand names. And all are associated with macro variables (GDP).”

McDonald’s (MCD) indicated decreasing sales development in China in its Q2 results as customer view continues to be weak in an affordable atmosphere.

Gargiulo thinks franchising might be the means to enter the marketplace with an “similarly engaging option to take advantage of buildout of among the largest coffee market without the resources allowance” and much less direct exposure to “varying macro-economic problems.”

The firm still intends to have 9,000 places in China by 2025.

Incomes sneak peek

Below’s what Starbucks is anticipated to report, based upon Bloomberg agreement information, contrasted to Q3 2023:

Earnings: $9.20 billion contrasted to $9.17 billion

Changed revenues per share: $ 0.92 contrasted to $1.00

Same-store sales: -2.71% contrasted +10%

Foot website traffic: -4.27% contrasted to 5.00%

Ticket Development: 1.98% contrasted to 4%

Complying With Q2, Starbucks modified its 2024 expectation for the 3rd time this .

It anticipates 2024 worldwide income development of low-single numbers, below the previous series of 7% to 10%, which itself was below a previous assistance of 10% to 12%.

International and United States same-store sales are anticipated to see a reduced single-digit decrease or remain level, below the previous series of 4% to 6% development. China’s same-store sales are anticipated to see a single-digit decrease, below the formerly anticipated low-single-digit development.

—

Brooke DiPalma is an elderly press reporter for Yahoo Money. Follow her on Twitter at @BrookeDiPalma or email her at bdipalma@yahoofinance.com.

Click On This Link for every one of the most recent retail supply information and occasions to much better notify your investing approach

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.