Electronic devices making solutions firm Sanmina (NASDAQ: SANM) disappointed experts’ assumptions in Q2 CY2024, with income down 16.6% year on year to $1.84 billion. Following quarter’s income support of $1.95 billion likewise underwhelmed, being available in 3.9% listed below experts’ quotes. It made a GAAP earnings of $0.91 per share, below its earnings of $1.28 per share in the exact same quarter in 2014.

Is currently the moment to get Sanmina? Find out in our full research report.

Sanmina (SANM) Q2 CY2024 Emphasizes:

-

Earnings: $1.84 billion vs expert quotes of $1.86 billion (1.1% miss out on)

-

EPS: $0.91 vs expert assumptions of $0.95 (4.2% miss out on)

-

Earnings Assistance for Q3 CY2024 is $1.95 billion at the omphalos, listed below expert quotes of $2.03 billion

-

EPS (non-GAAP) Assistance for Q3 CY2024 is $1.35 at the omphalos, listed below expert quotes of $1.45

-

Gross Margin (GAAP): 8.3%, according to the exact same quarter in 2014

-

Complimentary Capital of $44.46 million, comparable to the previous quarter

-

Market Capitalization: $4.12 billion

” We supplied 3rd quarter causes line with our expectation. We are beginning to see stablizing and need boost entering into our 4th quarter, and we anticipate to see development in financial 2025,” specified Jure Sola, Chairman and Ceo.

Established In 1980, Sanmina (NASDAQ: SANM) is an electronic devices production solutions firm providing end-to-end options for different sectors.

Electric Solutions

Like several tools and element suppliers, electric systems firms are buoyed by nonreligious patterns such as connection and commercial automation. Much more certain pockets of solid need consist of Net of Points (IoT) connection and the 5G telecommunications upgrade cycle, which can profit firms whose cords and channels fit those demands. However like the more comprehensive industrials industry, these firms are likewise at the impulse of financial cycles. Rate of interest, as an example, can considerably affect tasks that drive need for these items.

Sales Development

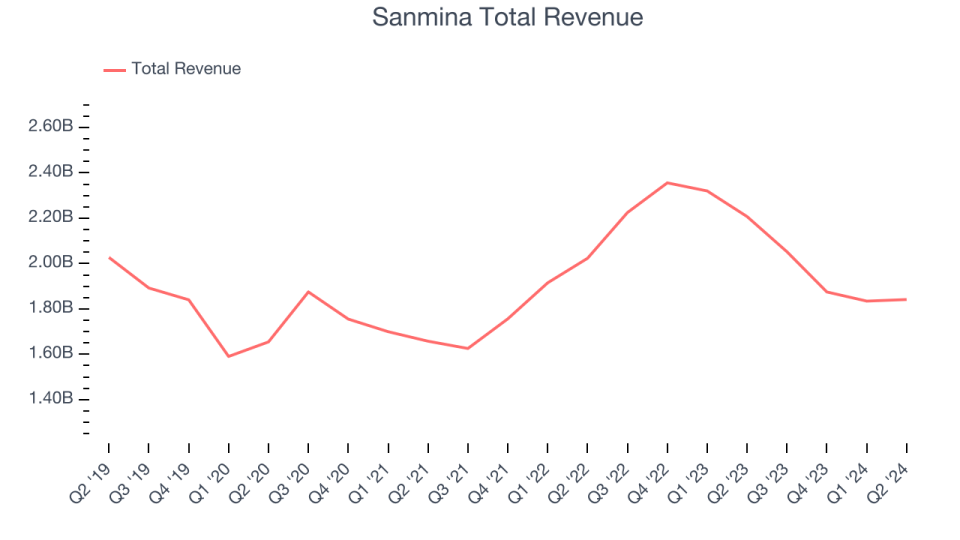

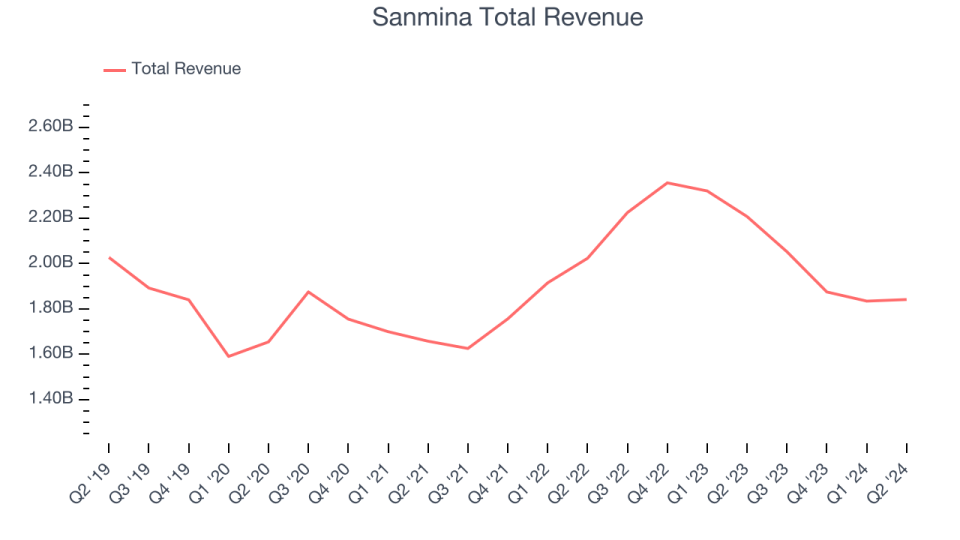

A firm’s lasting efficiency can offer signals concerning its organization high quality. Also a negative organization can radiate for a couple of quarters, however a top-tier one often tends to expand for several years. Sanmina’s need was weak over the last 5 years as its sales dropped by 2.4% each year, a harsh beginning factor for our evaluation.

Long-lasting development is one of the most vital, however within industrials, a half-decade historic sight might miss out on brand-new sector patterns or need cycles. Sanmina’s annualized income development of 1.9% over the last 2 years is over its five-year fad, however we were still dissatisfied by the outcomes.

This quarter, Sanmina missed out on Wall surface Road’s quotes and reported an instead unexciting 16.6% year-on-year income decrease, producing $1.84 billion of income. The firm is leading for a 5% year-on-year income decrease following quarter to $1.95 billion, a renovation from the 7.8% year-on-year reduction it taped in the exact same quarter in 2014. Looking in advance, Wall surface Road anticipates sales to expand 10.9% over the following twelve month, a velocity from this quarter.

Below at StockStory, we absolutely comprehend the capacity of thematic investing. Varied victors from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Beast Drink (MNST) might all have actually been recognized as appealing development tales with a megatrend driving the development. So, because spirit, we have actually recognized a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

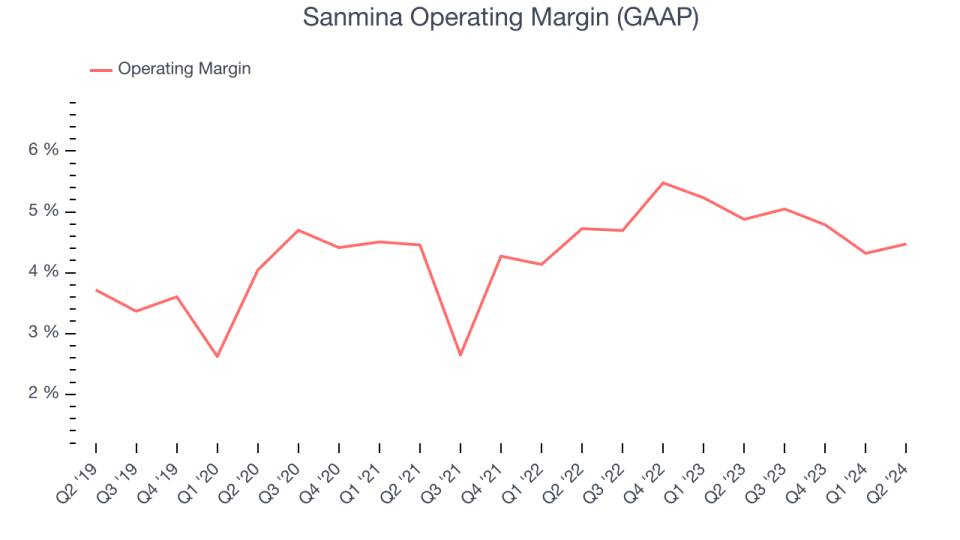

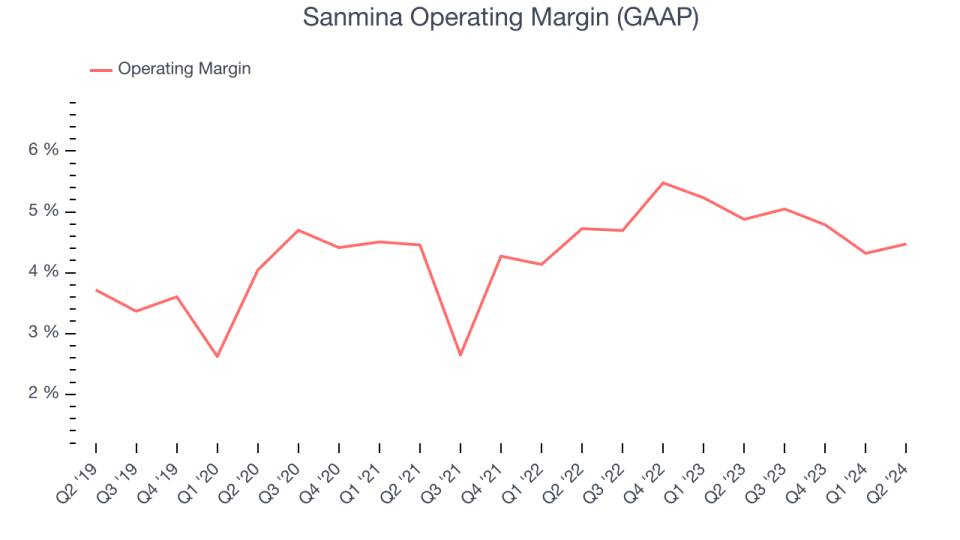

Sanmina paid over the last 5 years however kept back by its huge expenditure base. It showed poor earnings for an industrials organization, generating a typical operating margin of 4.4%. This outcome isn’t as well shocking provided its reduced gross margin as a beginning factor.

On the silver lining, Sanmina’s yearly operating margin increased by 1.2 percent factors over the last 5 years

This quarter, Sanmina created an operating earnings margin of 4.5%, according to the exact same quarter in 2014. This shows the firm’s price framework has actually just recently been steady.

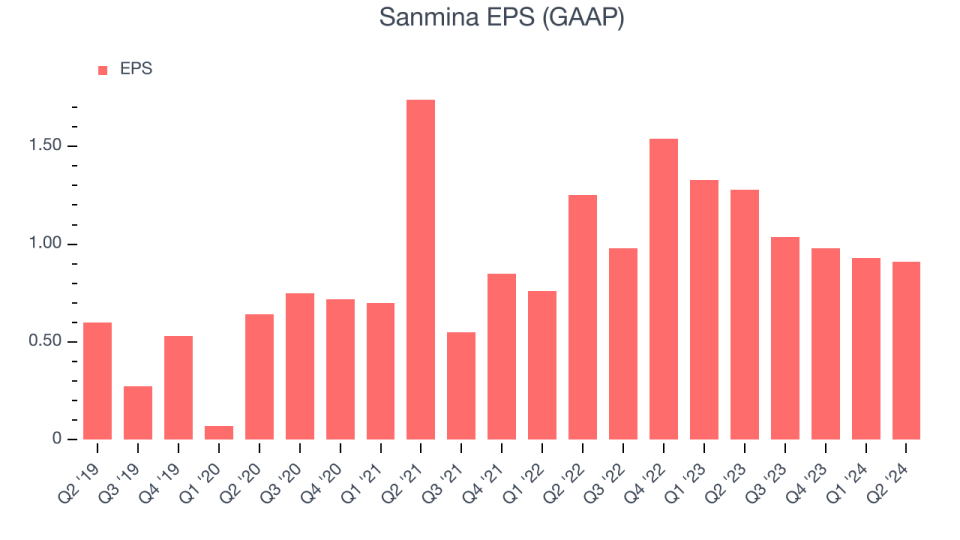

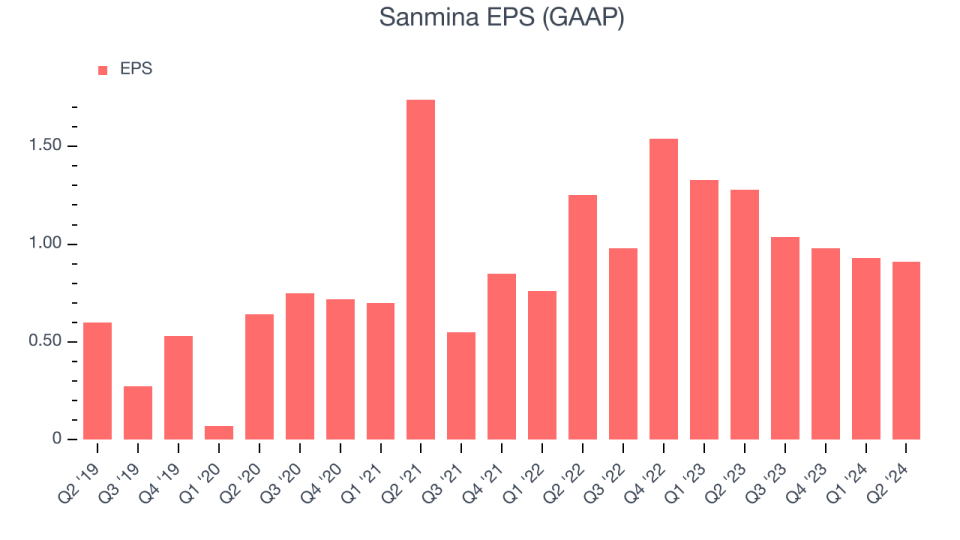

EPS

Examining lasting income patterns informs us concerning a firm’s historic development, however the lasting adjustment in its incomes per share (EPS) indicate the earnings of that development– as an example, a firm might inflate its sales with too much investing on advertising and marketing and promos.

Sanmina’s EPS expanded at a respectable 9.5% worsened yearly development price over the last 5 years, more than its 2.4% annualized income decreases. This informs us administration adjusted its price framework in feedback to a difficult need atmosphere.

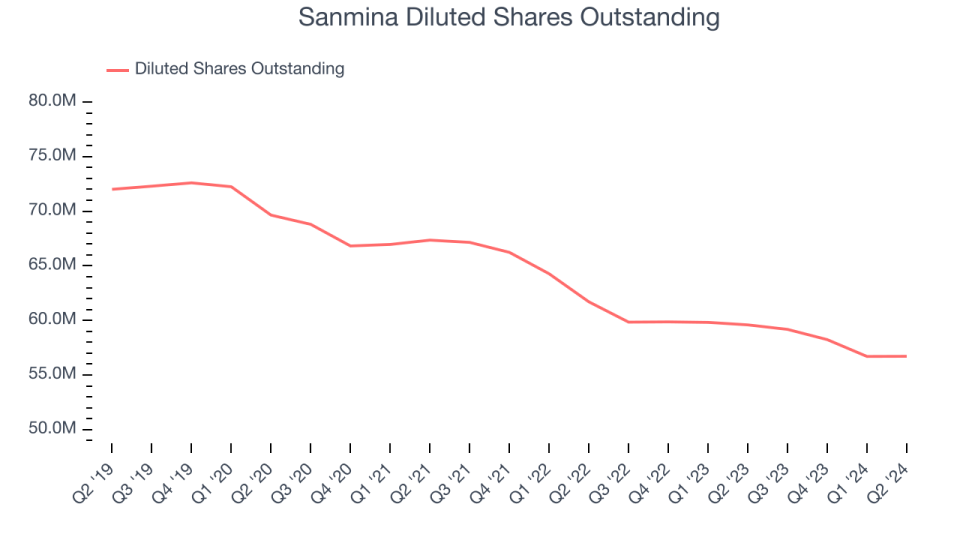

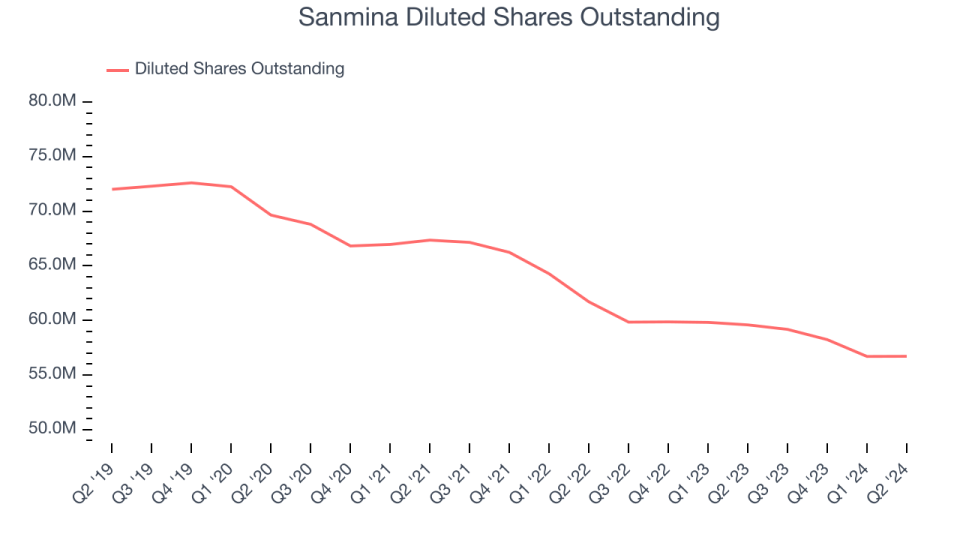

We can take a much deeper consider Sanmina’s incomes to much better comprehend the motorists of its efficiency. As we pointed out previously, Sanmina’s operating margin was level this quarter however broadened by 1.2 percent factors over the last 5 years. In addition to that, its share matter diminished by 21.2%. These declare indications for investors since boosting earnings and share buybacks turbocharge EPS development about income development.

Like with income, we likewise examine EPS over a much more current duration since it can offer understanding right into an arising style or growth for business. For Sanmina, its two-year yearly EPS development of 6.4% was less than its five-year fad. We wish its development can increase in the future.

In Q2, Sanmina reported EPS at $0.91, below $1.28 in the exact same quarter in 2014. This print missed out on experts’ quotes, however we care a lot more concerning lasting EPS development than temporary motions. Over the following twelve month, Wall surface Road anticipates Sanmina to expand its incomes. Experts are predicting its EPS of $3.86 in the in 2014 to climb up by 37.4% to $5.30.

Trick Takeaways from Sanmina’s Q2 Outcomes

We had a hard time to locate several solid positives in these outcomes. Its EPS missed out on and its income support for following quarter disappointed Wall surface Road’s quotes. In general, this was a negative quarter for Sanmina. The supply traded down 5.9% to $71.08 quickly after reporting.

Sanmina may have had a challenging quarter, however does that in fact develop a chance to spend today? When making that choice, it is essential to consider its appraisal, organization high qualities, along with what has actually occurred in the current quarter. We cover that in our actionable full research report which you can read here, it’s free.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.