Analog chips manufacturer ON Semiconductor (NASDAQ: ON) will certainly be reporting outcomes tomorrow prior to the bell. Right here’s what financiers need to understand.

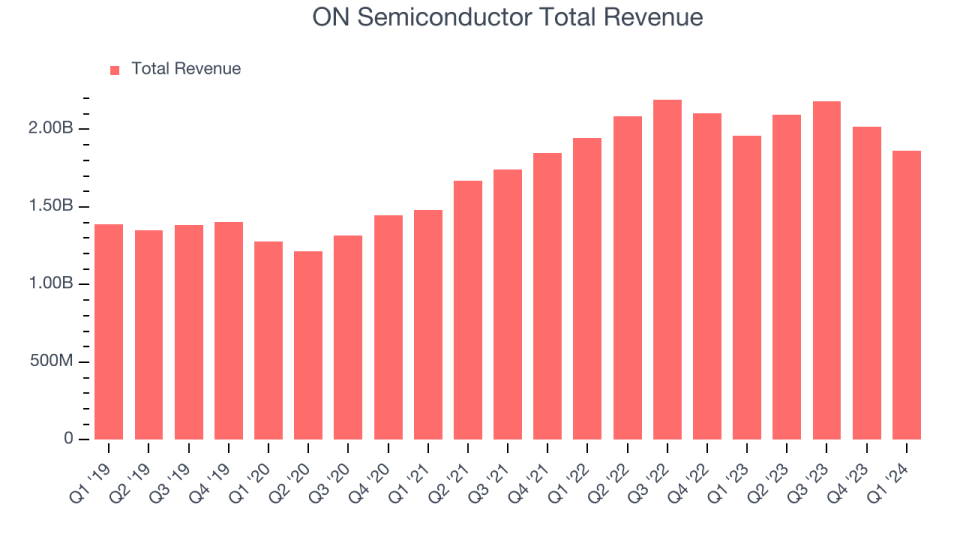

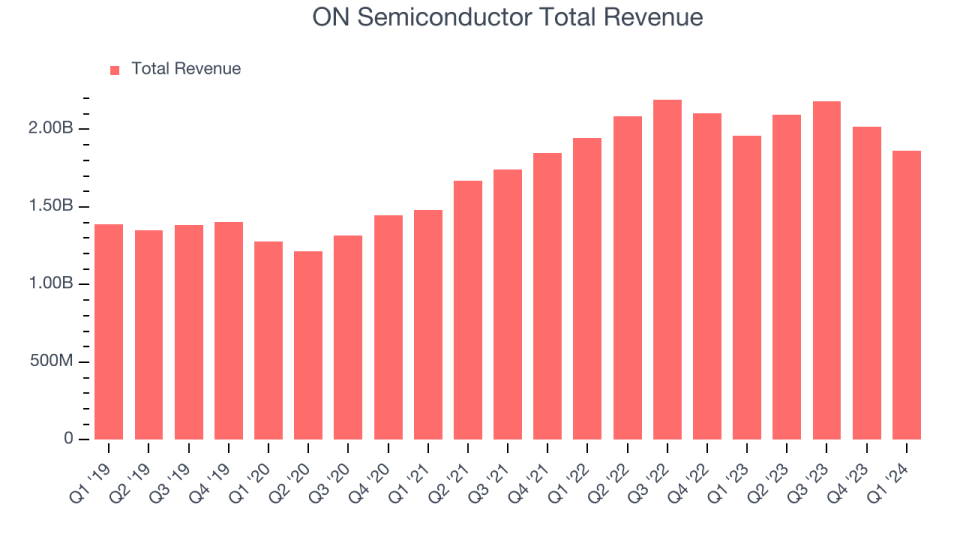

ON Semiconductor satisfied experts’ profits assumptions last quarter, reporting profits of $1.86 billion, down 4.9% year on year. It was a weak quarter for the firm, with underwhelming profits assistance for the following quarter and a rise in its supply degrees.

Gets On Semiconductor a buy or market entering into profits? Read our full analysis here, it’s free.

This quarter, experts are anticipating ON Semiconductor’s profits to decrease 17.4% year on year to $1.73 billion, a slowdown from its level profits in the exact same quarter in 2015. Readjusted profits are anticipated to find in at $0.92 per share.

Most of experts covering the firm have actually reconfirmed their price quotes over the last 1 month, recommending they prepare for business to persevere heading right into profits. ON Semiconductor has a background of surpassing Wall surface Road’s assumptions, defeating profits price quotes every time over the previous 2 years by 2% usually.

Considering ON Semiconductor’s peers in the analog semiconductors sector, some have actually currently reported their Q2 results, providing us a tip regarding what we can anticipate. Impinj supplied year-on-year profits development of 19.2%, defeating experts’ assumptions by 5.2%, and Texas Instruments reported an income decrease of 15.6%, according to agreement price quotes. Impinj traded up 4.6% adhering to the outcomes while Texas Instruments’s supply rate was the same.

Review our complete evaluation of Impinj’s results here and Texas Instruments’s results here.

Supplies– particularly those trading at greater multiples– had a solid end of 2023, however 2024 has actually seen durations of volatility. Blended rising cost of living signals have actually brought about unpredictability around price cuts, and while several of the analog semiconductors supplies have actually gotten on rather much better, they have actually not been saved, with share costs down 3.7% usually over the last month. ON Semiconductor is up 2.6% throughout the exact same time and is heading right into profits with an ordinary expert rate target of $83.1 (contrasted to the present share rate of $71).

Unless you have actually been living under a rock, it must be noticeable now that generative AI is mosting likely to have a significant effect on just how big firms operate. While Nvidia and AMD are trading near to all-time highs, we favor a lesser-known (however still rewarding) semiconductor supply gaining from the surge of AI. Click here to access our free report on our favorite semiconductor growth story.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.