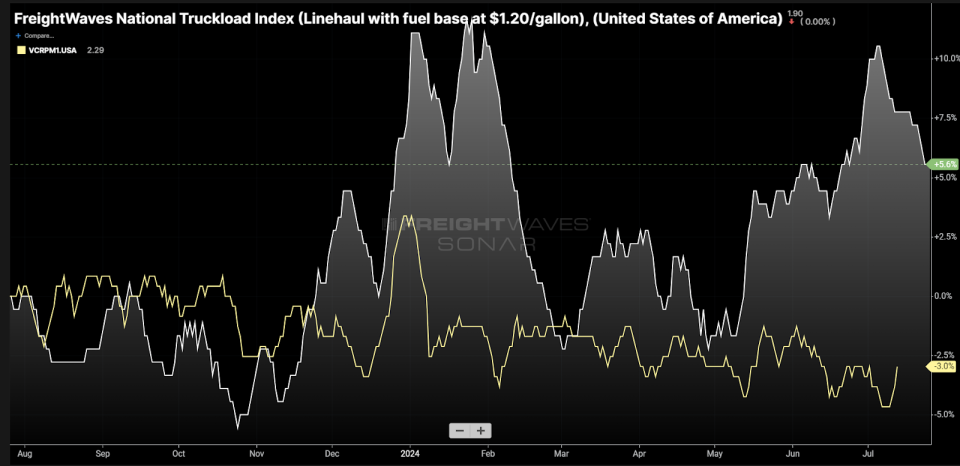

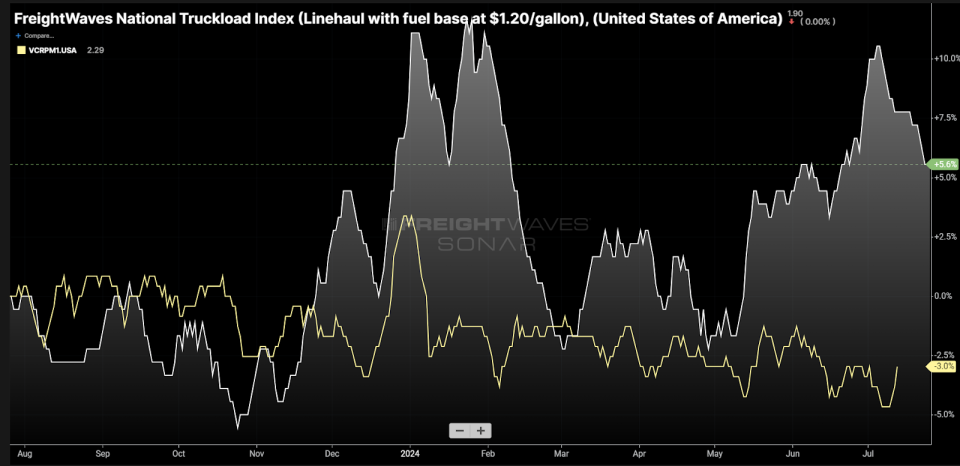

Graph of the Week: National Truckload Index (much less approximated gas price over $1.20/ girl), Van Agreement Base Price per Mile First Record– United States SONAR: NTIL12.USA, VCRPM1.USA

The ordinary long-lasting (agreement) price for completely dry van truckloads (yellow) has actually gone down regarding 3% -5% considering that July 2023, according to FreightWaves billing information. The even more temporary focused-spot price (white) is relocating the contrary instructions, boosting around 5% -6% y/y. The area market is still providing solid price cuts to agreement prices as a whole– the graph is a loved one sight and determining portion modification from the beginning– yet those price cuts are diminishing as we come close to quote period. What does this mean for future agreements?

Having an understanding of the essential distinctions in between the truckload area and agreement markets is required for this workout. Exactly what is the agreement price index in the graph (VCRPM1) determining?

The Van Agreement Base Price Per Mile Index determines the ordinary price of completely dry van lots billings paid by carriers for lots that relocate greater than 250 miles or half a day’s drive from beginning. These billings greatly favor the straight shipper-to-carrier partnership for prices worked out for an extended period (3 months to 2 years) without an intermediary. This is an essential difference.

Several 3PLs provide taken care of transport solutions where they provide agreement prices to carriers, sourcing from their base of numerous service providers. Due to the fact that these prices are a combinations of numerous service providers in each lane, they have a tendency to track even more along the lines of area prices.

3PLs additionally can normally utilize a much bigger provider base than carriers can in each lane as this is their main company, which additionally maintains taken care of transport prices reduced usually. Transport supervisors have a tendency to choose less service providers, whereas 3PLs are continuously seeking carriers.

VCRPM1 much better tracks the prices instructions of agreements on a specific provider basis due to this.

Agreement prices have actually been reducing in their decrease. Agreement prices were can be found in 8% -10% reduced y/y in January and February. The swiftly decreasing price of decrease is an indication that service providers have actually almost lacked space to go down rates and continue to be in company.

One more crucial note is that billing information delays the settlement, implying brand-new agreements are most likely can be found in with also much less descending stress. Simply put, check out the agreement prices as slow-moving and delaying to the present market problems.

Instantly

The National Truckload Index (omitting approximated gas prices over $1.20 a gallon) determines the ordinary price that is worked out for completely dry van lots on a transactional or impromptu basis without long-lasting ramifications for service providers recognizing that price for any kind of lots relocating beyond the prompt future, normally much less than a couple of days.

The area market stands for 15% -30% of the truckload market quantity. Its prices are unpredictable and commonly mirror an overestimation of the present market problems. They are extremely seasonal yet can be a much faster indication of a transforming products market.

Taking a look at the previous five-year partnership in between these 2 indices on an outright range can aid with comprehending their partnership. Place prices have a tendency to run listed below agreement prices throughout nonholiday durations. This is because of the reality that they are manipulated towards backhaul and agented lots.

Backhaul products obtains service providers out of a location where there is little products need about the offered supply of service providers to one where there are a lot more load-carrying chances. Providers provide to lug products listed below their operating expense in these lanes to obtain the opportunity to make it up in an additional a lot more desirable location.

3PLs do not rely upon having their very own properties or vehicles to lug consumers’ products. The majority of their time is invested working out with carriers and service providers and they have an obese participation right away market. Their impact suggests that area prices relocate initially and quick as their presence is big.

The around 5% y/y area price boost is not big sufficient to state the marketplace has actually struck a factor of severe susceptability. The reducing decrease of agreement prices is possibly the a lot more remarkable number. Both are signifying some kind of price rising cost of living going back to the truckload market is near.

Regarding the Graph of the Week

The FreightWaves Graph of the Week is a graph choice from SONAR that gives a fascinating information indicate explain the state of the products markets. A graph is selected from countless possible graphes on SONAR to aid individuals picture the products market in genuine time. Every week a Market Professional will certainly upload a graph, in addition to discourse, reside on the front web page. Afterwards, the Graph of the Week will certainly be archived on FreightWaves.com for future recommendation.

finder accumulations information from thousands of resources, offering the information in graphes and maps and offering discourse on what products market specialists would like to know regarding the sector in genuine time.

The FreightWaves information scientific research and item groups are launching brand-new datasets every week and improving the customer experience.

To ask for a finder demonstration, click here

The blog post Truckload contracts still falling despite increasing spot pressure showed up initially on FreightWaves.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.