Following its unanticipated authorization by the USA Stocks and Exchange Compensation (SEC), the area Ethereum ETFs (exchange-traded funds) turned into one of one of the most essential stories in the cryptocurrency room. Nonetheless, the crypto financial investment items appear not to be measuring up to the buzz after an underwhelming trading launching in the previous week.

Grayscale In Charge Of Hefty Area Ethereum ETF Discharges

On Friday, 26th of July, the recently-launched area Ethereum ETFs posted an additional day of substantial discharges, noting the 3rd successive day of withdrawals from these items. The exchange-traded items, which released on Tuesday, July 23, taped a web discharge of approximately $341 in the opening week.

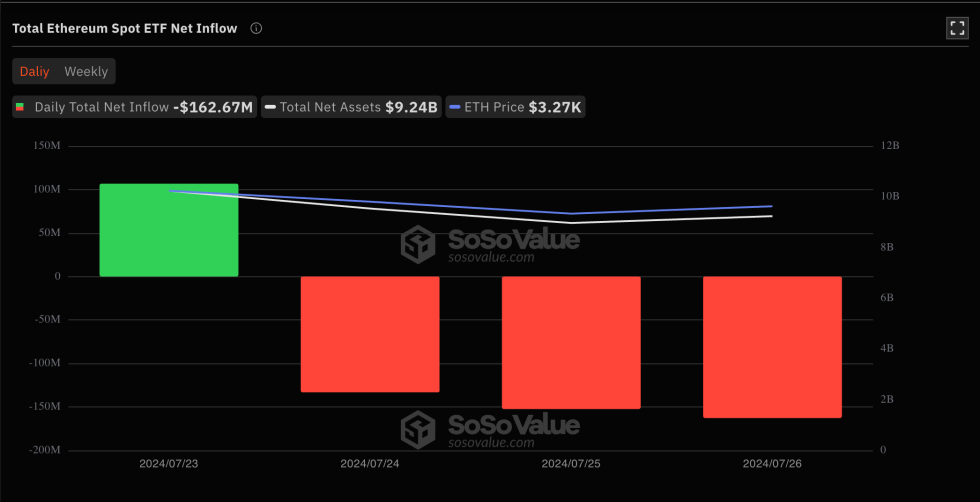

According to information from SoSoValue, the area Ethereum ETF market released on a high note, publishing a web inflow of around $106.8 million on the first day. This first-day efficiency was considered a “strong beginning” by market specialists, specifically in contrast to the launch of the Bitcoin ETFs previously in the year.

Nonetheless, the area Ethereum ETFs adhered to up with a “red day”, with over $133 million spurting of the items on Wednesday, July 24. This was additionally adhered to by $152 million and $162 million internet discharges on Thursday, July 25, and Friday, July 26, specifically.

Resource: SoSoValue

It deserves keeping in mind that Grayscale’s ETH Count on exchange-traded fund ETHE, especially, has actually been accountable for a substantial percent of the resources discharge. On Friday, the fund saw a single-day discharge of over $356 million. Given that the area Ethereum ETFs, the Grayscale item has actually taped a collective internet inflow of $1.51 billion.

Remarkably, the cost of Ethereum has actually greatly battled adhering to the launch of the Ether ETFs. According to information from CoinGecko, the “king of altcoins” has actually decreased in worth by greater than 7% in the previous week. Since this writing, the ETH cost stands at around $3,248, showing a 1.1% dip in the previous day.

New Cash Inflow Much Less Impactful On ETH

According to CryptoQuant’s newest record, the increase of fresh resources, such as ETFs, has a much less substantial effect on Ethereum than on Bitcoin. This monitoring is based upon a statistics called the “recognized capitalization multiplier.”

Current information shows each buck of fresh cash bought Bitcoin has the possible to boost BTC’s market capitalization by $5. At the same time, the result is a lot reduced for Ether, whose market cap would just boost by $1.3 for each and every spent buck.

In 2024, every $1 bought #Bitcoin enhanced its market cap by $5, while for ETH, it was just $1.3.

Brand-new cash circulations have a weak result on $ETH than Bitcoin. pic.twitter.com/CtAmmMVL8g

— CryptoQuant.com (@cryptoquant_com) July 26, 2024

This discovery recommends that ETH’s multiplier result has actually been substantially less than that of Bitcoin up until now in 2024.

The cost of Ethereum deals with substantial resistance at the $3,300 degree on the everyday duration|Resource: ETHUSDT graph on TradingView

Included picture from iStock, graph from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.