After problems early today, Bitcoin has actually recoiled dramatically at area prices. At the time of creating, the globe’s most useful coin is up 20% from July 2024 lows.

Taking into consideration the upswing from July 25, there is a high possibility it will certainly puncture $70,000 over the weekend break and also damage over the critical liquidation degree of $72,000.

Expert: Anticipate Bitcoin To Array In Between $75,000 And $95,000

As Bitcoin reclaims ground, much to the enjoyment of bulls, some experts currently think this is the start of the following boost. This sneak peek declares, a minimum of based upon the current rate activity.

Requiring To X, one expert said the area in between $75,000 and $95,000 will certainly be the following “despised” area. At this area, the coin would certainly have damaged over all-time highs at $74,000, last published in March, including approximately 30% to come to a head at $95,000. When this occurs, the expert claimed the Bitcoin market “will certainly not be as charitable to bears as it is currently.”

The accurate timeline stays unclear also as investors anticipate the coin to tear greater. Investors should wait till bulls clear the barricade at $72,000 and all-time highs.

Checking out rate activity in between March and July, it appears that purchasers, though accountable, had a hard time. The modification from around $74,000 to $53,500 in very early July stood for an almost 27% dip, among the inmost when the marketplace rallied.

Bitcoin Market Shakes Off Mt. Gox Worries

Several aspects will certainly drive need from currently on. Among them is the basic durability amongst bulls as the flattened Mt. Gox exchange disperses coins. Up until now, on-chain information shared by one expert discloses that the Mt. Gox BTC book has actually dropped by 66%, dispersing virtually 95,000 BTC.

Surprisingly, regardless of preliminary concerns that the marketplace would certainly go down, prolonging losses of very early July, rates have actually been constant, recouping. The failing of this occasion to compel rates lower or wet investor or financier belief is an enormous increase of self-confidence.

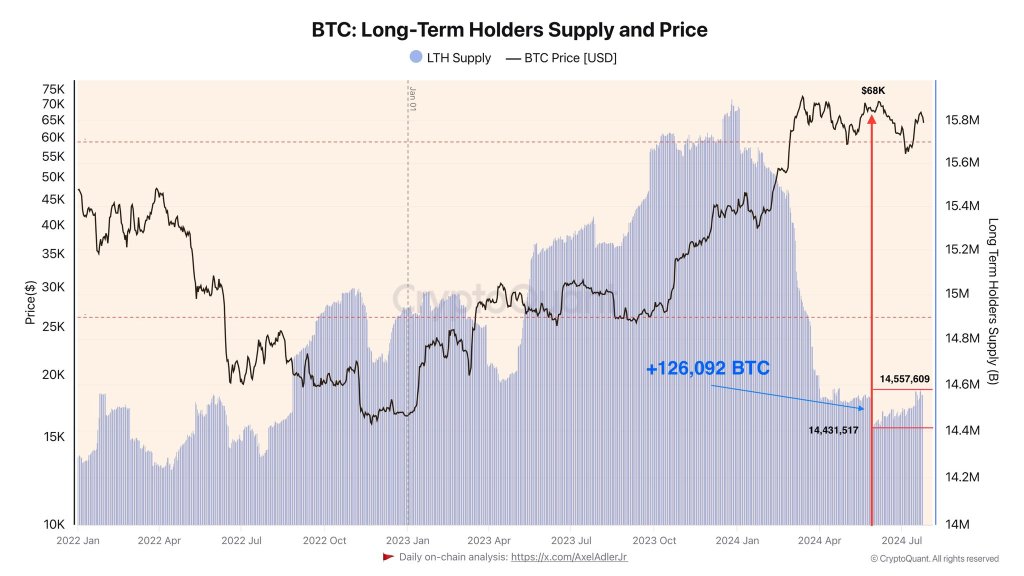

In addition, various other on-chain information shows that lasting owners (LTHs), a lot of whom are establishments or miners that have actually held for over 155 days, have actually been collecting. One expert kept in mind that these entities left when rates climbed over $68,000 and all-time highs.

They can be increasing down after unloading 126,000 BTC well worth over $8 billion at area prices. As necessary, the lack of offering stress from this friend will likely sustain rates, propping up bulls wanting to breach $72,000 in the coming sessions.

Function picture from Canva, graph from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.