Several Mt. Gox financial institutions have actually lastly been settled their Bitcoin (BTC) after a years of waiting. Report have actually revealed numerous financial institutions have actually been paid off via the US-based crypto exchange Sea serpent. As anticipated, the information of even more BTC possibly swamping the marketplace has actually caused problems regarding its impacts on the rate of Bitcoin. Experts and capitalists alike have actually revealed problems that the increase of Bitcoin right into the marketplace might cause enhanced marketing stress, possibly driving down the rate of the cryptocurrency.

Nevertheless, information records have actually revealed much of the paid off financial institutions are opting to hold their possessions instead of marketing them. This fad mirrors a dominating favorable belief amongst these BTC owners, that show up certain in the lasting possibility of the cryptocurrency.

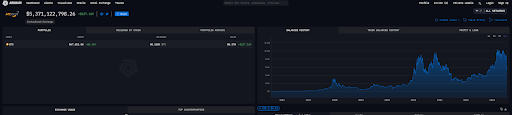

In spite of the favorable way of thinking, on-chain information recommends Mt. Gov still has sufficient BTC to possibly flooding the marketplace. According to Arkham Knowledge, the obsolete exchange still has more than 80,000 BTC, which is valued at about $5.37 billion at the present rate of Bitcoin.

Evaluating Mt. Gox’s Bitcoin Holdings

Bitcoin is not out of the timbers yet from the hands of Mt. Gox. As revealed by Arkham’s control panel, Mt Gox’s BTC holding has actually dropped from 142,000 BTC at the beginning of July to 80,000 BTC at the time of composing. This suggests over 62,000 BTC have actually been dispersed to its financial institutions in the previous 3 weeks.

While some financial institutions have actually picked to hold their Bitcoin, numerous have actually definitely taken the opportunity to squander after a years of waiting. This wave of marketing added to a $170 billion wipeout from the crypto market when Bitcoin dropped listed below $54,000. Several could suggest this was an overreaction from various other market individuals, as numerous hurried to minimize their direct exposure also prior to financial institutions started any kind of selloffs. Remarkably, Bitcoin was under extreme stress from a concurrent selloff of seized Bitcoins by the German State of Saxony.

The first worry and unpredictability have actually considering that cooled, despite the fact that on-chain information reveals that Mt. Gox financial institutions remain to obtain settlements. Especially, Arkham’s information suggests about 0.02 BTC were just recently sent out to 8 Bitstamp down payment addresses, an additional exchange being utilized for these settlements. In A Similar Way, CryptoQuant Chief Executive Officer Ki Youthful Ju exposed that these settlements have actually not caused a spike in area trading quantity prominence on Sea serpent.

Thus far, Mt. Gox has actually handled the settlements efficiently, reducing marketing stress. Bitcoin has also responded positively, showing security and expanding maturation that have actually aided protect against additional decreases. Mt. Gox still holds 80,128 BTC in its purse. We will certainly see just how the marketplace responds as the settlements unravel in the following couple of weeks. At the time of composing, Bitcoin is trading at $67,085, up by 5% in the previous 24-hour.

Included photo produced with Dall.E, graph from Tradingview.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.