Domain pc registry driver Verisign (NASDAQ: VRSN) reported cause line with experts’ assumptions in Q2 CY2024, with income up 4.1% year on year to $387.1 million. It made a GAAP revenue of $2.01 per share, enhancing from its revenue of $1.79 per share in the very same quarter in 2015.

Is currently the moment to acquire VeriSign? Find out in our full research report.

VeriSign (VRSN) Q2 CY2024 Emphasizes:

-

Earnings: $387.1 million vs expert price quotes of $385.8 million (tiny beat)

-

EPS: $2.01 vs expert price quotes of $1.94 (3.6% beat)

-

Gross Margin (GAAP): 87.8%, up from 86.5% in the very same quarter in 2015

-

Cost-free Capital of $404.7 million, up 59.6% from the previous quarter

-

Payments: $429.7 million at quarter end, up 15.6% year on year

-

Market Capitalization: $17.43 billion

” We provided one more strong quarter, both operationally and economically, by concentrating on our goal. Recently we noted 27 years of supplying 100% schedule in the.com/.net domain resolution system,” stated Jim Bidzos, Exec Chairman, Head Of State and President.

While the firm is not a domain name registrar and does not straight offer domain to finish customers, Verisign (NASDAQ: VRSN) runs and preserves the framework to sustain domain such as.com and.net.

Ecommerce Software Application

While shopping has actually been around for over 20 years and taken pleasure in purposeful development, its total infiltration of retail still continues to be reduced. Just around $1 in every $5 invested in retail acquisitions originates from electronic orders, leaving over 80% of the retail market still ripe for on-line interruption. It is these huge swathes of the retail where shopping has actually not yet held that drives the need for different shopping software program options.

Sales Development

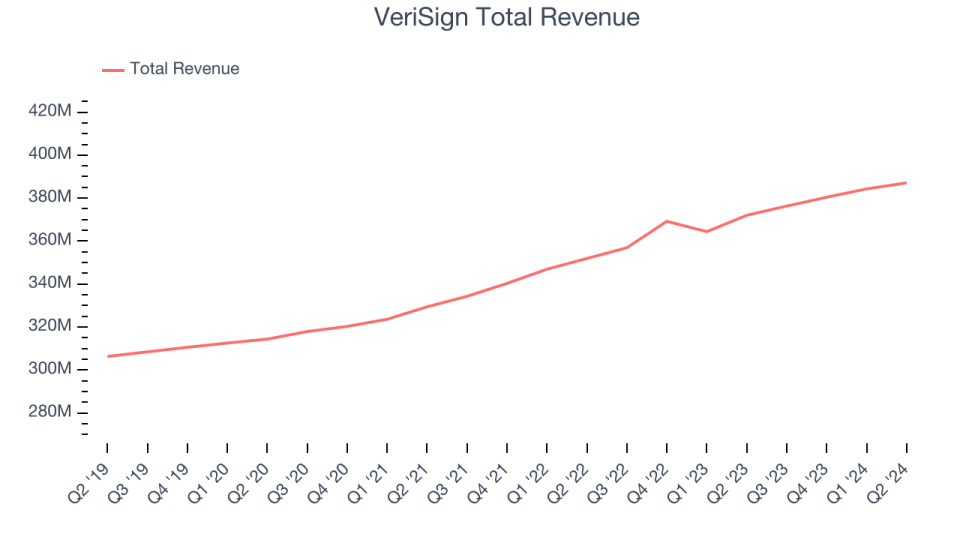

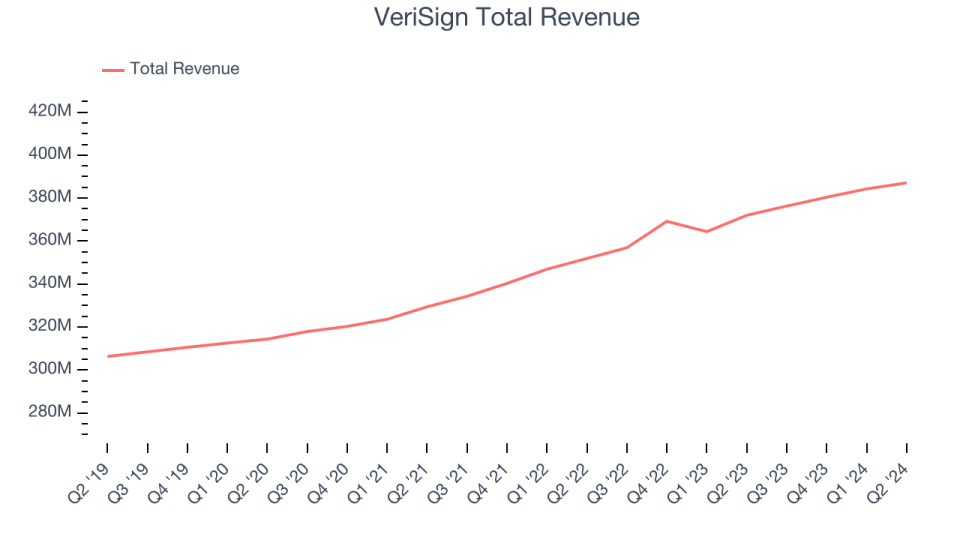

As you can see below, VeriSign’s income development has actually been weak over the last 3 years, expanding from $329.4 million in Q2 2021 to $387.1 million this quarter.

VeriSign’s quarterly income was just up 4.1% year on year, which may let down some investors. In addition, its development did reduce contrasted to last quarter as the firm’s income raised by simply $2.8 million in Q2 contrasted to $3.9 million in Q1 CY2024. While we wish to see income boost by a higher quantity each quarter, a one-off variation is generally not worrying.

Looking in advance, experts covering the firm were anticipating sales to expand 5% over the following year prior to the profits outcomes news.

When a firm has even more cash money than it understands what to do with, redeeming its very own shares can make a great deal of feeling– as long as the cost is right. Fortunately, we have actually discovered one, an inexpensive supply that is spurting complimentary capital AND redeeming shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Money Is King

If you have actually adhered to StockStory for some time, you recognize we highlight complimentary capital. Why, you ask? Our company believe that in the long run, cash money is king, and you can not utilize audit revenues to foot the bill.

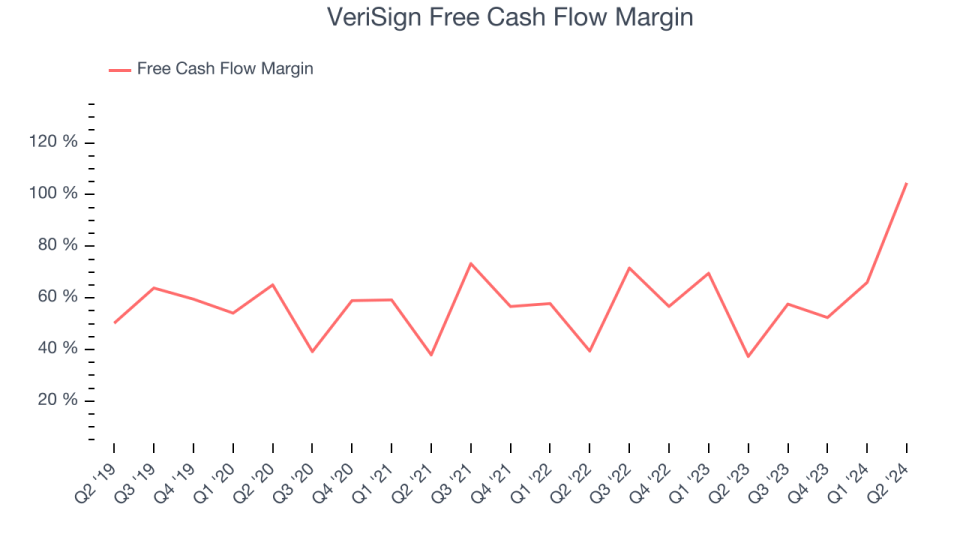

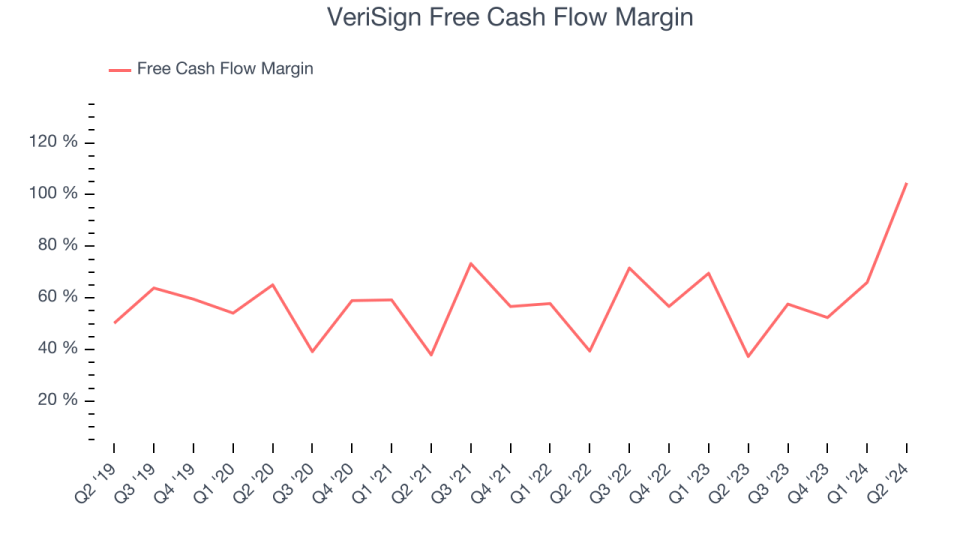

VeriSign has actually revealed fantastic cash money earnings, driven by its rewarding company version that allows it to reinvest, return funding to financiers, and remain in advance of the competitors while preserving a sufficient cash money padding. The firm’s complimentary capital margin was amongst the very best in the software program market, balancing an eye-popping 70.3% over the in 2015.

VeriSign’s complimentary capital appeared at $404.7 million in Q2, equal to a 105% margin. This quarter’s outcome was excellent as its margin was 67.2 portion factors more than in the very same quarter in 2015, however we would not review excessive right into the short-term due to the fact that financial investment requirements can be seasonal, creating momentary swings. Lasting fads outdo variations.

Trick Takeaways from VeriSign’s Q2 Outcomes

It was excellent to see VeriSign defeat experts’ EPS assumptions this quarter. Zooming out, we assume this was a suitable quarter, revealing the firm is remaining on target. The supply traded up 1.9% to $180 quickly adhering to the outcomes.

So should you buy VeriSign today? When making that choice, it is essential to consider its appraisal, company high qualities, along with what has actually taken place in the most recent quarter. We cover that in our actionable full research report which you can read here, it’s free.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.