The HousingWire Pulse Study for Q3 2024 gives an in-depth picture of existing housing market views and difficulties dealt with by realty representatives, brokers, and home mortgage experts. The study discloses an usually careful positive outlook amongst these markets, regardless of different assumptions relating to market fads over the following 3 months.

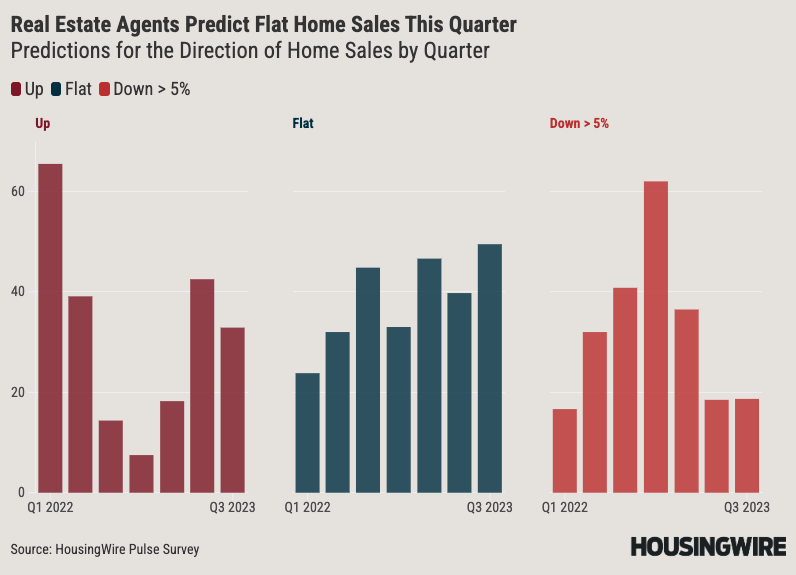

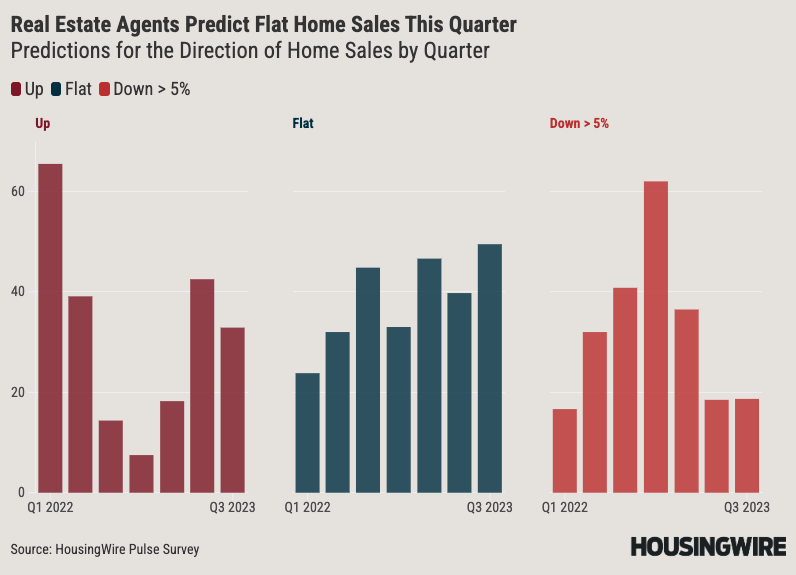

Property representatives have blended expectation

Brokers display a combined yet enthusiastic expectation, with almost 29% preparing for a surge in home sales and 18% anticipating a decrease, much less passionate concerning home sales than in Q2 2023. The bulk (55%) think home costs will certainly stay level, while concerning 34% predict a rise.

In regards to mortgage rates, 63% forecast they will certainly remain level, mirroring a wider assumption of security.

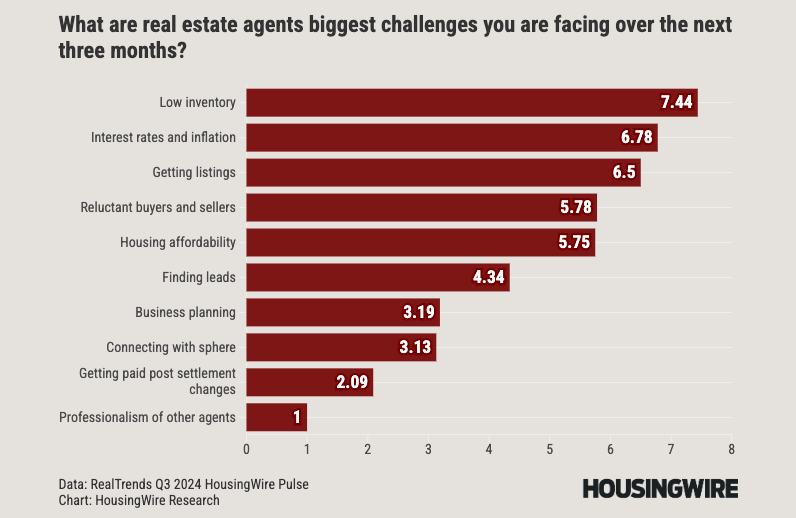

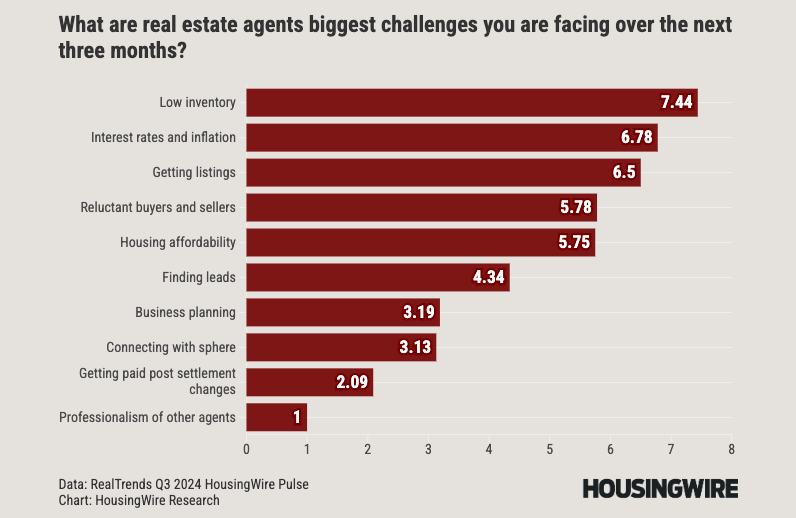

Nevertheless, agents are coming to grips with considerable difficulties, consisting of reduced stock, high rate of interest and rising cost of living, obtaining listings and an action even more handling unwilling purchasers and vendors. Intriguing sufficient, regardless of brand-new plan and method modifications relating to compensation entering into impact in August, realty representative participant rated “making money article negotiation modifications” as the least of their difficulties.

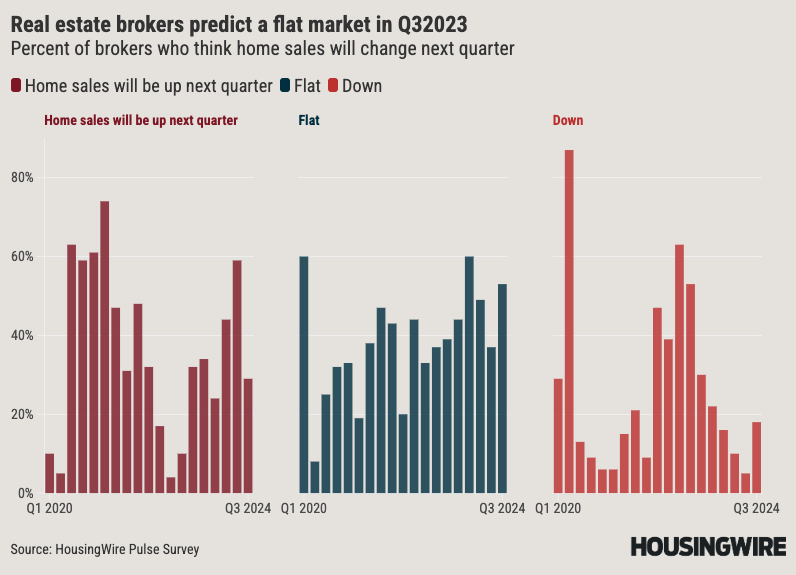

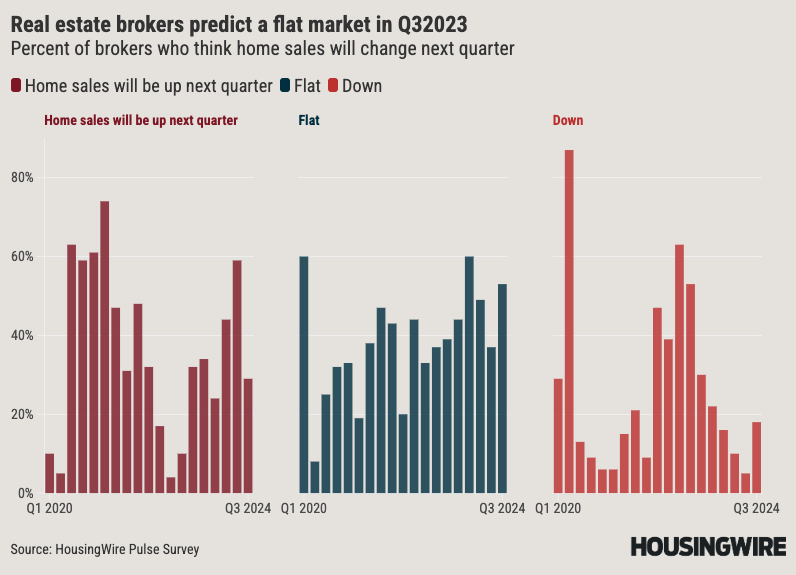

Property brokers anticipate home costs to remain level

Brokers share comparable market assumptions, with a mix of views concerning sales and cost fads. Many brokers additionally anticipate home costs to remain level and rate of interest to stay the same.

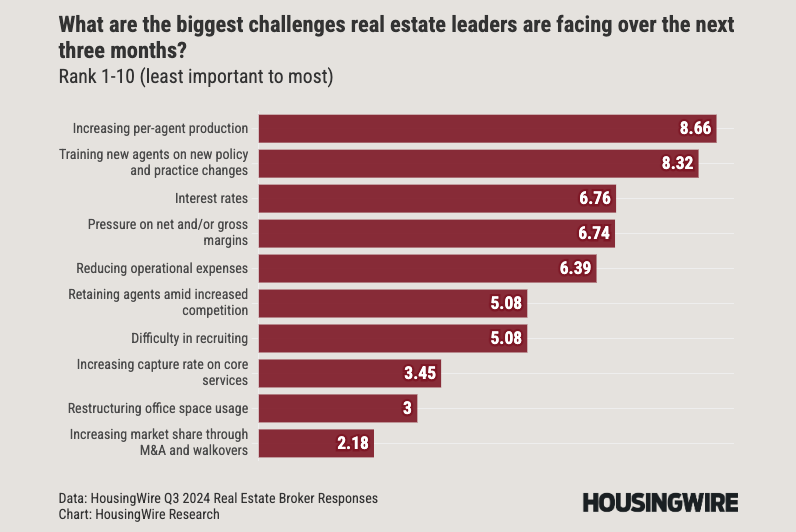

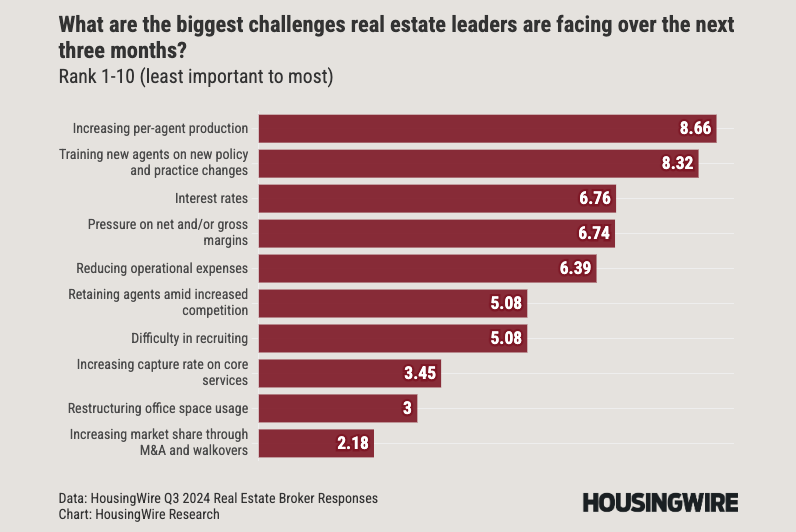

The main difficulties for brokers line up with those of representatives, focused around functional performance, tactical management, and adjusting to brand-new market characteristics. Brokers are concentrating greatly on representative training and assistance, intending to increase efficiency andretain top talent The methods consist of giving raised training sessions, marketing assistance, and innovation devices to aid representatives browse the marketplace better. Some brokers are embracing a careful employment technique, focusing on high quality over amount to construct a lean, reliable group efficient in providing high efficiency in a difficult market.

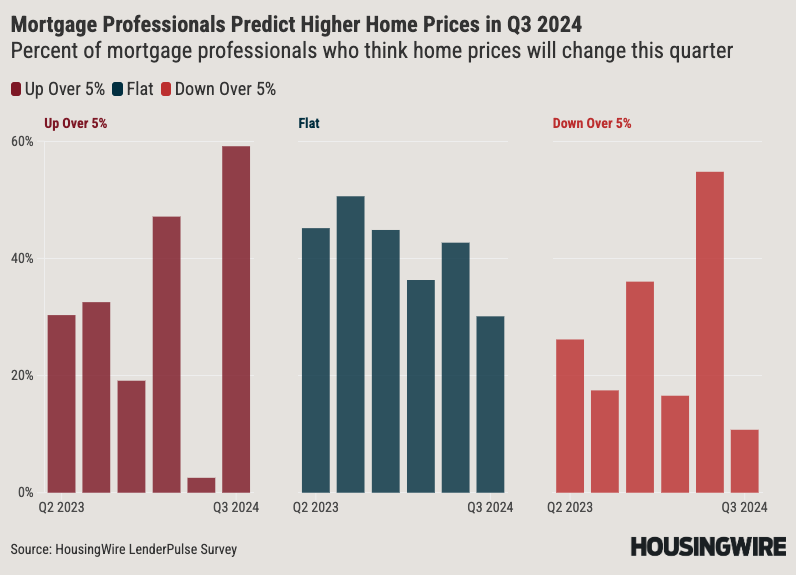

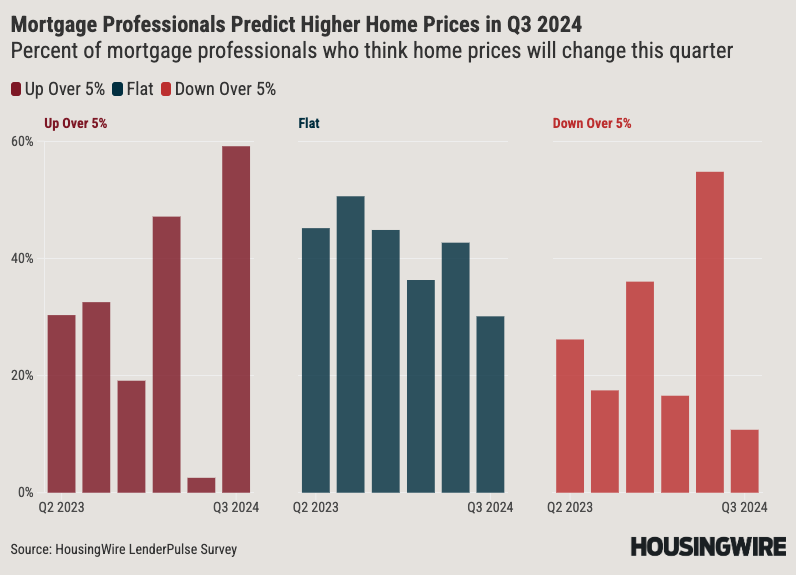

Home loan experts favorable on home costs

Amongst home mortgage experts, the belief is somewhat extra positive when it involves home costs.

Various from realty representatives and brokers, most of mortgage experts (53%) forecast home costs will certainly stay level, with 34% anticipating a rise. Concerning rate of interest, 69% expect security, though there are issues concerning possible variations.

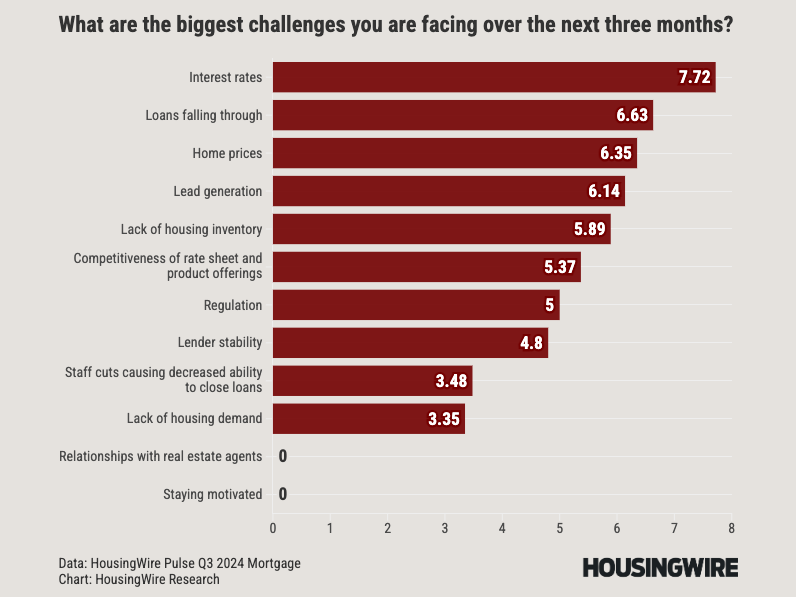

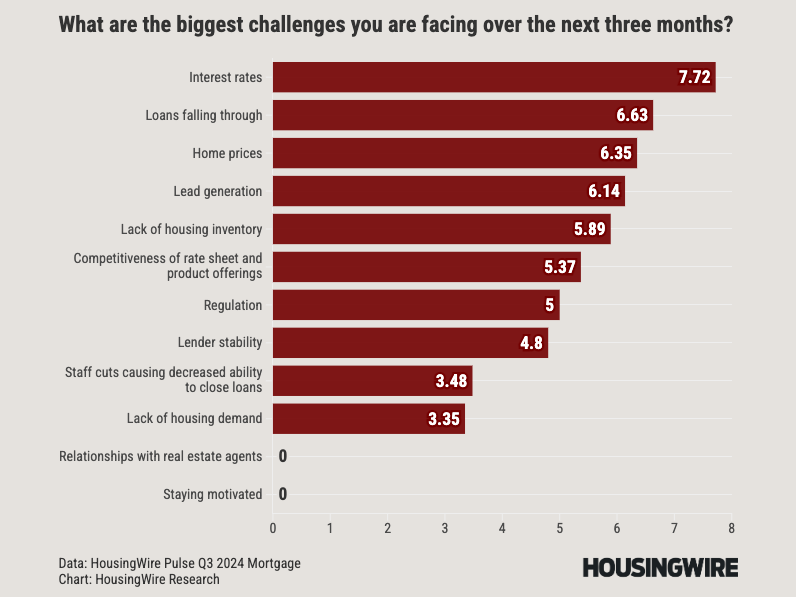

When inquired about their best difficulties, home mortgage experts are specifically worried concerning mortgage rates, lending security, home costs, list building, and keeping affordable price sheets and item offerings.

The functional difficulties consist of handling personnel cuts and decreased capability to shut car loans, which are influencing their capability to run effectively.

While not ranked, relationship-building with realty representatives is vital, particularly taking into account modifications to MLS payment plans. Home loan experts are concentrating on instructional campaigns, aggressive outreach, and keeping solid collaborations to browse these modifications. Approaches such as participating in networking occasions, routine interaction, and leveraging social media sites are being used to enhance partnerships and boost market existence.

Total, the HousingWire Pulse Study for Q3 2024 highlights a market identified by careful positive outlook, with a solid concentrate on security in home costs and rate of interest. The main difficulties throughout the board entail functional performance, training, employment, and adjusting to market modifications.

Market experts are proactively looking for methods to boost efficiency, keep partnerships, and browse an altering housing market and realty sector, using a selection of methods to stay affordable and reliable.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.