The Area Ethereum ETFs have not specifically left to the best begin, with these funds experiencing combined circulations in their initial 3 days of trading. Crypto research study company 10x Research study has actually offered some solutions regarding why institutional investors aren’t so passionate concerning these funds.

Wall Surface Road Does Not Completely Understand What ETH Has To Do With

10x Research study recommended in a recent report that institutional capitalists have not comfortably got the Area Ethereum ETFs since they do not totally recognize what it has to do with. The record, created by Markus Thielen, kept in mind that these Wall surface Road capitalists “normally do not position bank on points they do not recognize.”

Surprisingly, Bloomberg expert Eric Balchunas explained this problem right away after the Area Ethereum ETFs were accepted in Might. At that time, he noted that of the obstacles these fund providers would certainly deal with was distilling ETH’s usage instance in an “easy-to-understand” means, equally as Bitcoin is quickly described as “electronic gold.”

10x Research study once again highlighted this problem, mentioning the truth that the Area Ethereum ETF providers have up until now had a difficult time discussing ETH to these conventional capitalists. The research study company particularly described BlackRock’s summary of ETH as “a bank on blockchain modern technology,” yet these capitalists still do not look connected.

Furthermore, 10x Research study kept in mind that the Area Ethereum ETF providers have not actually made an initiative to develop understanding of their particular funds, with these funds doing not have significant advertising and marketing projects. This absence of an easy-to-understand story for Ethereum and the initiatives from Area Ethereum ETF providers create component of the factors the research study company stays bearish on ETH.

Thielen mentioned, “Ethereum may be the weakest web link, where principles (brand-new individuals, profits, and so on) have actually been stationary or reduced.” The research study company additionally mentioned ETH’s lessening usage instance in this market cycle as an additional factor to be bearish on ETH. 10x Research study says that Solana, particularly with its exceptional meme coin ecological community, has actually taken ETH’s sparkle in this cycle, which is why SOL has actually been surpassing ETH.

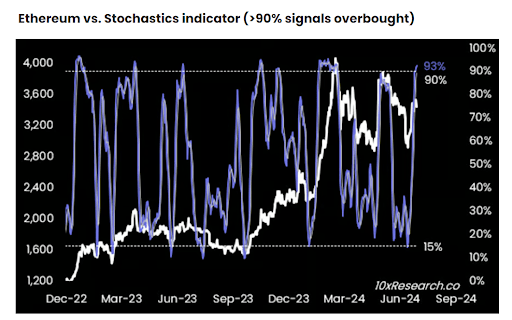

At The Same Time, from a technological point of view, 10x Research study highlighted the stochastics sign, recommending that ETH is presently overbought. They alerted that the crypto token will likely experience considerable decreases in the short-term and mentioned that “it may make good sense to push the ETH short a bit much longer.”

Discharges Pester The Area Ethereum ETFs

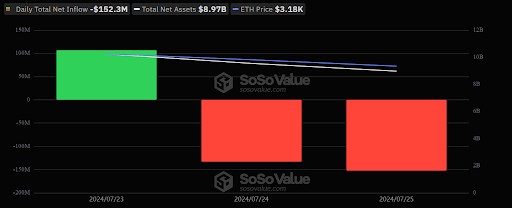

According to data from Soso worth, the Area Ethereum ETFs observed a web discharge of $152.3 million on July 25 (day 3 of trading), with Grayscale’s Ethereum Count on (ETHE) exclusively in charge of this growth with a private internet discharge of $346.22 million. The various other Area Ethereum ETFs videotaped internet inflows, yet the quantity that moved right into these funds had not been sufficient to connect the hemorrhage

Given that they started trading on July 23, these Area Ethereum ETFs have actually observed an advancing overall internet discharge of $178.68 million, with $1.16 billion currently spurting from Grayscale’s ETHE in the initial 3 days of trading. These Area Ethereum ETFs delighted in a terrific getaway on the initial day of trading, with a web inflow of $106.78 million on July 23.

Nevertheless, they at some point caught the discharges from Grayscale’s ETHE, experiencing an advancing web discharge of $133.16 million on day 2 of trading and a web discharge of $152.3 on July 25. The discharges from ETHE are currently placing considerable marketing stress on ETH, possibly resulting in rate decreases for the crypto token in the short-term till the various other Area Ethereum ETFs start to witness a raised need that can bolster the Grayscale discharges.

Included photo produced with Dall.E, graph from Tradingview.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.