Completion of an incomes period can be a good time to find brand-new supplies and evaluate just how firms are dealing with the existing organization setting. Allow’s have a look at just how Lyft (NASDAQ: LYFT) et cetera of the job economic climate supplies made out in Q1.

The apple iphone transformed the globe, introducing the age of the “always-on” web and “on-demand” solutions – anything somebody might desire is simply a couple of faucets away. Furthermore, the job economic climate emerged in a comparable style, with an expansion of tech-enabled freelance labor markets, which function hand and hand with numerous as needed solutions. People can currently deal with need also. What started with technology allowed systems that accumulated cyclists and chauffeurs has actually broadened over the previous years to consist of food distribution, grocery stores, and currently also a plumbing professional or visuals developer are all simply a couple of faucets away.

The 5 job economic climate supplies we track reported an ok Q1; usually, incomes defeat expert agreement price quotes by 3.3%. while following quarter’s earnings advice remained in line with agreement. Supplies, particularly development supplies where capital better in the future are more vital to the tale, had a great end of 2023. However the start of 2024 has actually seen much more unstable supply efficiency because of combined rising cost of living information, and job economic climate supplies have actually had a harsh stretch, with share rates down 12.6% usually given that the previous revenues outcomes.

Ideal Q1: Lyft (NASDAQ: LYFT)

Started by Logan Eco-friendly and John Zimmer as a long-distance intercity car pool business Zimride, Lyft (NASDAQ: LYFT) runs a ridesharing network in the United States and Canada.

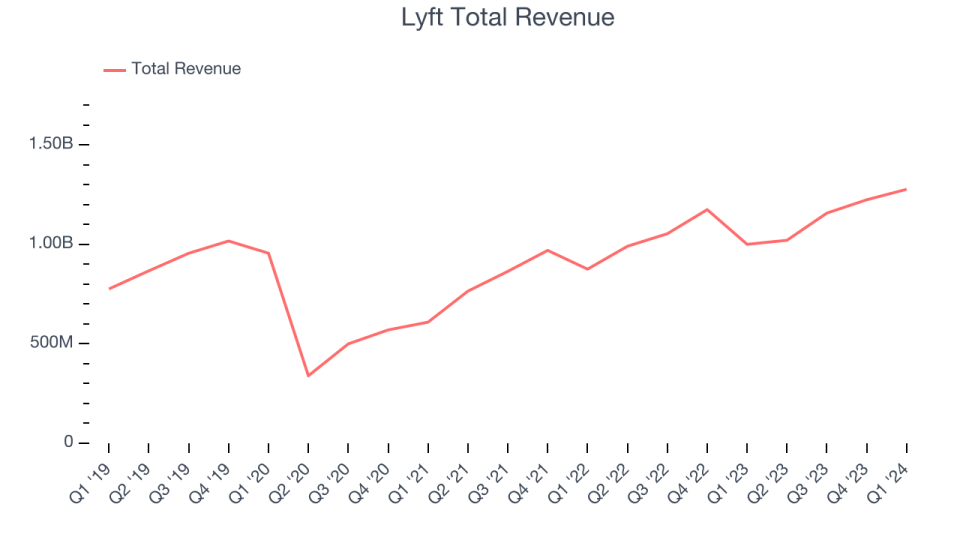

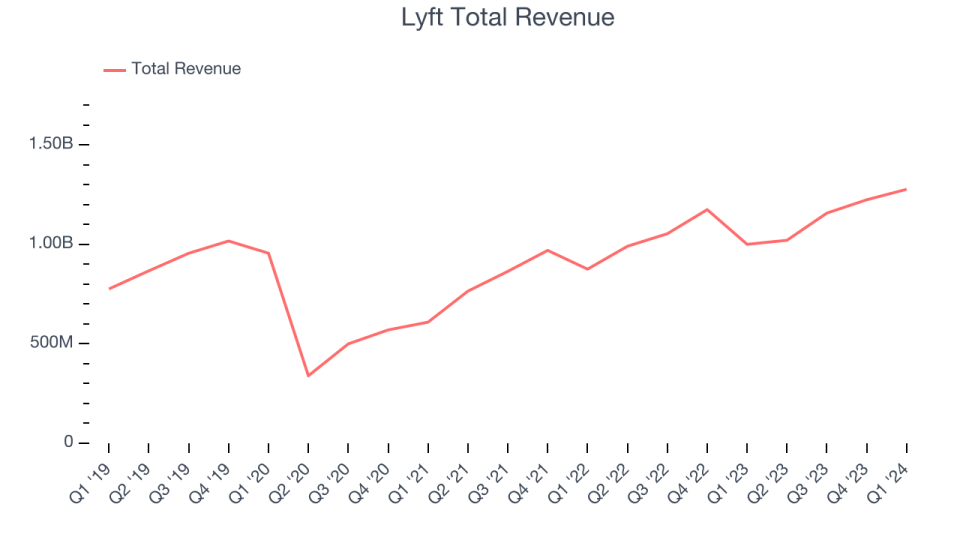

Lyft reported incomes of $1.28 billion, up 27.7% year on year, surpassing experts’ assumptions by 10.2%. On the whole, it was a remarkable quarter for the business with solid top-line development and strong development in its individuals.

” Lyft is off to a solid begin in 2024. We are implementing well and bringing much-needed technology to the marketplace. That’s why chauffeurs and cyclists are selecting Lyft regularly,” stated chief executive officer David Risher.

Lyft racked up the largest expert approximates beat and fastest earnings development of the entire team. The business reported 21.9 million individuals, up 12% year on year. The supply is down 25.8% given that reporting and presently trades at $12.32.

Is currently the moment to get Lyft? Access our full analysis of the earnings results here, it’s free.

DoorDash (NYSE: DASHBOARD)

Started by Stanford pupils with the intent to construct “the neighborhood, on-demand FedEx”, DoorDash (NYSE: DASHBOARD) runs an on-demand food distribution system.

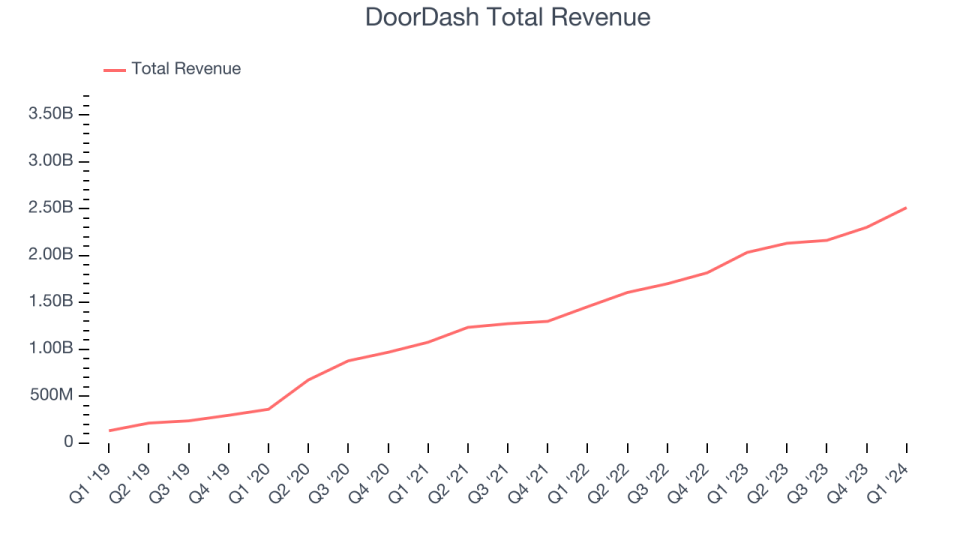

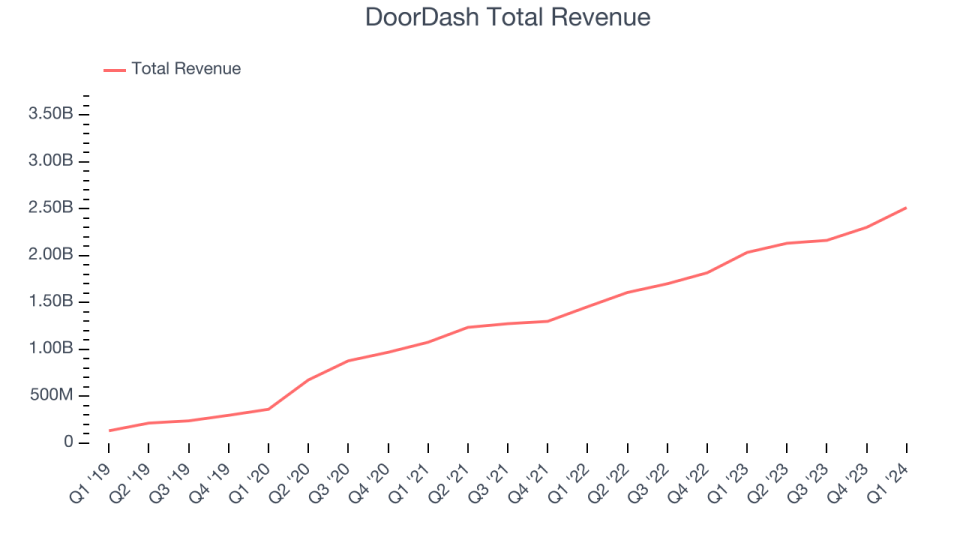

DoorDash reported incomes of $2.51 billion, up 23.5% year on year, exceeding experts’ assumptions by 2.5%. It was a solid quarter for the business with strong earnings development.

Although it had a fantastic quarter contrasted its peers, the marketplace appears dissatisfied with the outcomes as the supply is down 20.2% given that coverage. It presently trades at $101.61.

Is currently the moment to get DoorDash? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Angi (NASDAQ: ANGI)

Developed by IAC’s mergings of Angie’s Checklist and HomeAdvisor, ANGI (NASDAQ: ANGI) runs the biggest on-line industry for home solutions in the United States.

Angi reported incomes of $305.4 million, down 14.1% year on year, surpassing experts’ assumptions by 2.5%. It was a weak quarter for the business with a decrease in its demands and sluggish earnings development.

Angi had the slowest earnings development in the team. The business reported 4.13 million solution demands, down 31.3% year on year. As anticipated, the supply is down 20.2% given that the outcomes and presently trades at $2.09.

Read our full analysis of Angi’s results here.

Uber (NYSE: UBER)

Substantiated of a winter season evening believed: “Suppose you could ask for a trip from your phone?” Uber (NYSE: UBER) runs a worldwide network of as needed solutions, many plainly ride hailing and food distribution, and products.

Uber reported incomes of $10.13 billion, up 14.8% year on year, according to experts’ assumptions. Taking a go back, it was an alright quarter for the business with solid development in its individuals yet sluggish earnings development.

Uber had the weakest efficiency versus expert price quotes amongst its peers. The business reported 149 million individuals, up 14.6% year on year. The supply is down 6.1% given that reporting and presently trades at $66.15.

Read our full, actionable report on Uber here, it’s free.

Fiverr (NYSE: FVRR)

Based in Tel Aviv, Fiverr (NYSE: FVRR) runs a set cost worldwide freelance industry for electronic solutions.

Fiverr reported incomes of $93.52 million, up 6.3% year on year, exceeding experts’ assumptions by 1.1%. Much more extensively, it was a weak quarter for the business with a decrease in its customers and sluggish earnings development.

The business reported 4 million energetic customers, down 7% year on year. The supply is up 9.4% given that reporting and presently trades at $22.24.

Read our full, actionable report on Fiverr here, it’s free.

Sign Up With Paid Supply Capitalist Research Study

Aid us make StockStory much more valuable to capitalists like on your own. Join our paid customer study session and obtain a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.