On-chain information reveals that lasting Bitcoin owners have actually reversed their pattern just recently, as their supply has actually taken in $8 billion well worth of symbols.

Bitcoin HODLers Have Actually Returned To Web Build-up

As clarified by CryptoQuant writer Axel Adler Jr in a post on X, the lasting owners have actually been enhancing their supply just recently. The “lasting owners” (LTHs) below describe the Bitcoin financiers that have actually kept their coins for greater than 155 days.

These owners compose among both primary departments of the BTC market based upon holding time, with the various other associate being referred to as the “temporary owners” (STHs).

Statistically, the longer a financier keeps their coins, the much less most likely they end up being to offer, so the LTHs, that have a tendency to hold for extended periods, stand for the persistent side of the marketplace.

Usually, this team does not quickly offer, also throughout rallies or collisions, unlike the STHs. Still, this year’s rally was also great a profit-taking possibility for also the ruby hands to lose out on.

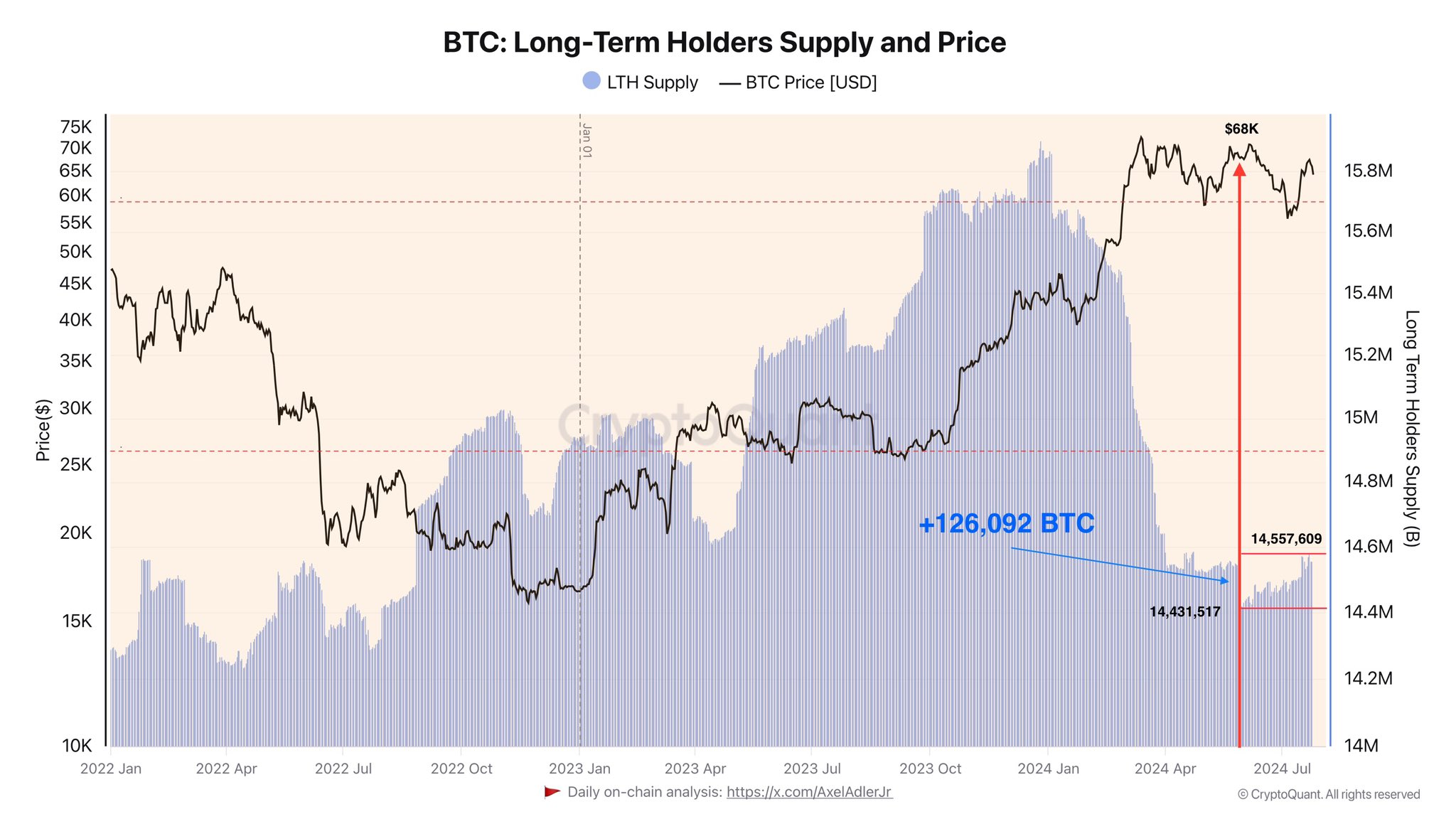

As the listed below graph shared by the expert reveals, the Bitcoin LTHs dramatically minimized their incorporated supply throughout the rally to the brand-new cost all-time high (ATH).

Appears like the worth of the statistics has actually gotten on the surge in current weeks|Resource: @AxelAdlerJr on X

The Bitcoin HODLers had actually reduced their selloff not long after the cost had actually gone down, however they joined one last set of sharp marketing when BTC observed a rebound to $68,000.

The LTH supply went down to 14,431,517 BTC following this marketing spree, however ever since, these owners have actually reversed their actions. The graph reveals that the statistics has actually climbed to 14,557,609 BTC currently, which recommends a boost of 126,092 BTC, worth a tremendous $8.1 billion at the present currency exchange rate.

Something to bear in mind, however, is that whenever the LTH supply signs up a surge, it does not imply that these ruby hands are purchasing in the here and now. Instead, the boost recommends that some acquiring happened 5 months earlier, and those coins have actually developed sufficient to be a component of this team.

The exact same concept does not relate to marketing, certainly, because coins see their age reset back to no as quickly as they are gone on the Bitcoin blockchain, so they are quickly eliminated from the LTH supply.

The current revival of the uptrend in the indication might be an indicator that the ruby hands have actually ended up marketing and are currently back to HODLing. If this is really the situation, after that the pattern can normally be a favorable indicator for cryptocurrency.

BTC Rate

The previous day has actually been bearish for Bitcoin as its cost has actually visited greater than 3%, currently drifting around the $64,600 degree. The graph listed below programs what the property’s current efficiency has actually resembled.

The cost of the coin shows up to have actually been dropping over the last couple of days|Resource: BTCUSD on TradingView

Included photo from Dall-E, CryptoQuant.com, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.