On-chain information reveals the Binance exchange has actually obtained huge web Bitcoin inflows throughout the previous day, showing that BTC’s decrease might expand additionally.

Bitcoin Binance Netflow Has Actually Simply Required To Favorable Worths

In a brand-new post on X, CryptoQuant neighborhood supervisor Maartunn went over the current pattern in the Bitcoin exchange netflow for the cryptocurrency exchange Binance.

The “exchange netflow” right here describes an on-chain metric that determines the web quantity of Bitcoin getting in or leaving out of the pocketbooks connected to any kind of provided exchange. The indication’s worth is computed by deducting the discharges from the inflows.

When the metric’s worth declares, the inflows bewilder the discharges, and a web variety of symbols go into the system. As one of the primary factors financiers down payment to exchanges is for offering functions, this pattern can be bearish for BTC.

On the various other hand, the unfavorable indication recommends the exchange is observing web withdrawals presently, which might be a favorable indicator for cryptocurrency in the long-term, as it suggests financiers are possibly taking coins off right into self-custody for HODLing.

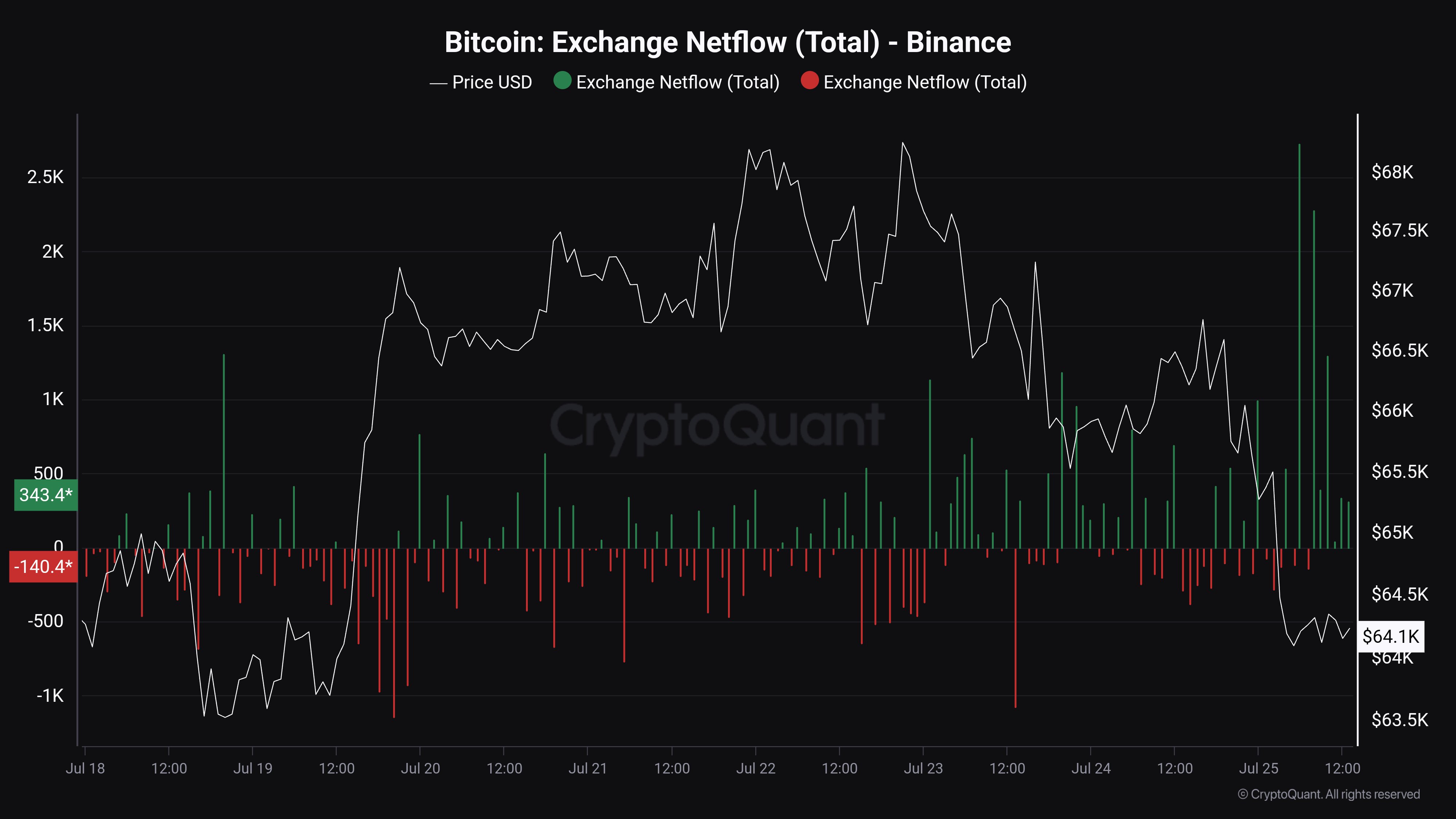

Currently, right here is a graph that reveals the pattern in the Bitcoin exchange netflow especially for Binance over the previous week:

The worth of the statistics shows up to have actually declared in current days|Resource: @JA_Maartun on X

As shown in the above chart, the Bitcoin Binance exchange netflow has actually held favorable worths throughout the current plunge in the cryptocurrency’s rate, recommending that the system has actually been getting web down payments.

Surprisingly, the statistics has actually signed up favorable worths also after the rate decrease has actually quit, and its spikes have actually just been bigger. This might imply that the whale entities just intend to market a lot more, which might be trouble for the property.

Thus far, Bitcoin has actually made some recuperation because these web inflows to the leading cryptocurrency exchange by trading quantity have actually shown up, suggesting that the whales might not have actually shot on their marketing yet.

It continues to be to be seen if these down payments have a bearish impact on the property, hence extending the drawdown, or if they have actually made the inflows for functions aside from offering.

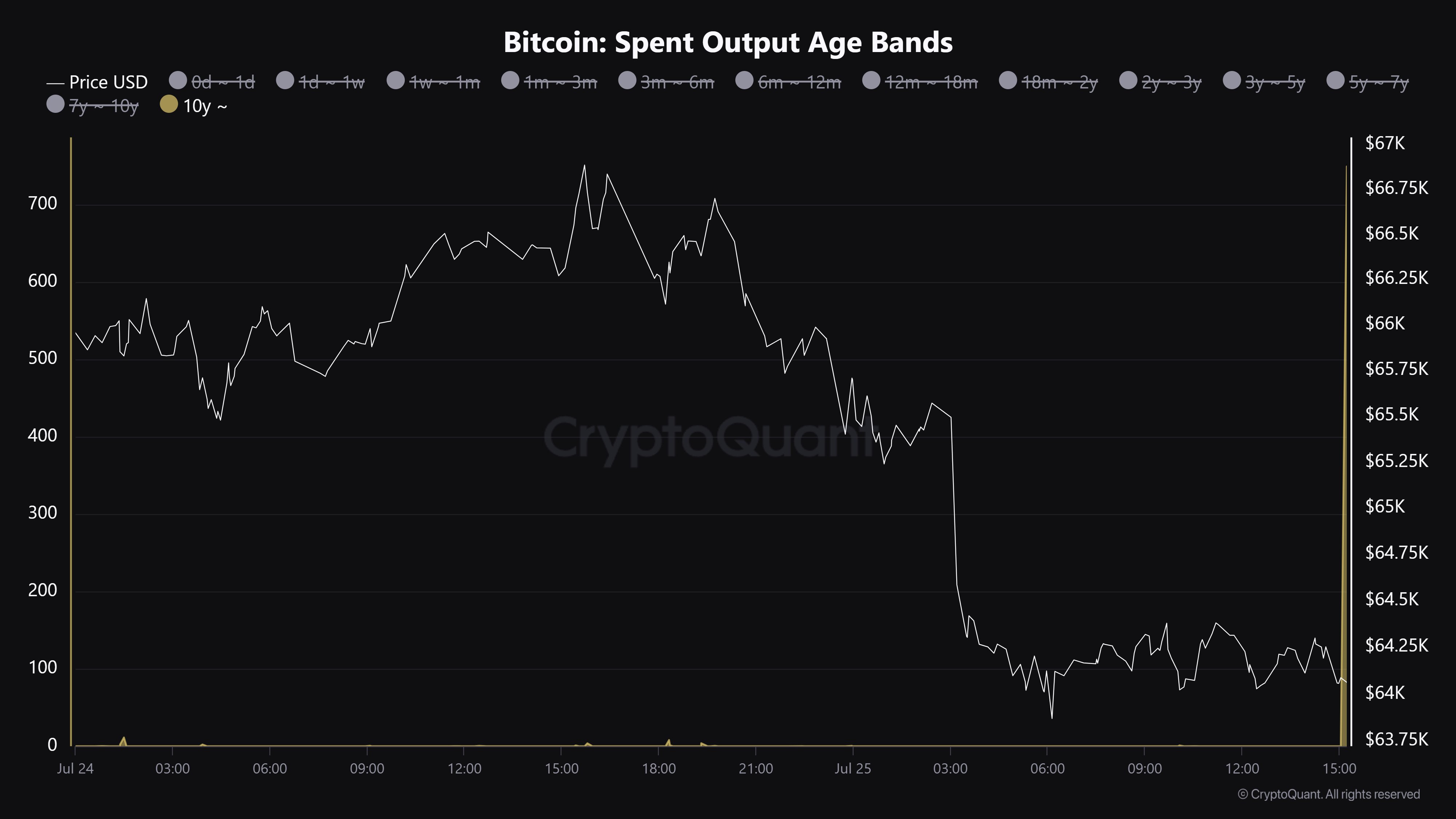

In various other information, an old Bitcoin whale shows up to have actually relocated lots of symbols in the previous day, as Maartunn explained in one more X post.

The information for the deals of coins that are greater than 10 years old|Resource: @JA_Maartun on X

This Bitcoin whale has actually moved 700 BTC (around $45.4 million at the present currency exchange rate), which has actually been inactive for over 10 years.

BTC Rate

Bitcoin dove to $63,400 throughout its newest decrease, however the property has because rebounded to $64,800.

Resembles the rate of the property has actually been dropping just recently|Resource: BTCUSD on TradingView

Included photo from Dall-E, CryptoQuant.com, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.