On-chain information reveals the Bitcoin mining profits has neared its annual standard, an indicator that capitulation might be ending for miners.

Bitcoin Miner Income Is Currently Near Its 365-Day SMA

In a brand-new post on X, expert James Van Straten has actually gone over concerning exactly how the circumstance of the BTC miners is appearing like today. There are various means to evaluate the problem of the miners, with a preferred one being the hashrate, which is an action of the complete computer power linked to the Bitcoin network.

Below, however, the expert has actually used the day-to-day total amount profits of these chain validators. There are 2 components to miner profits: block aid and deal charges.

The very first of these describes the BTC compensates that miners get as payment for addressing blocks on the network, while the last one is the settlement individuals pack with private purchases. Historically, the block aid has actually offseted a far more considerable component of the miner profits than the deal charges.

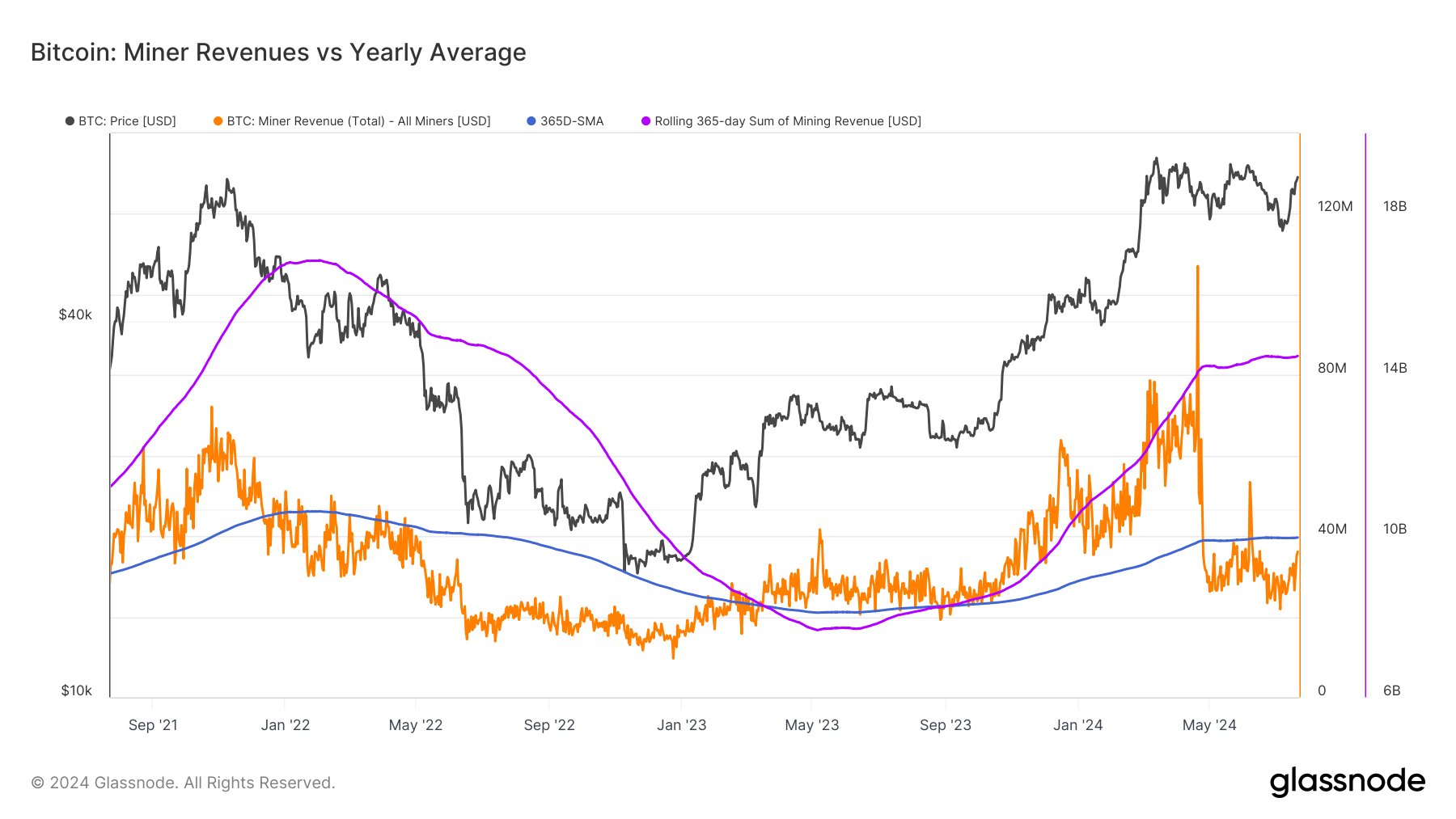

The listed below graph demonstrates how the mixed Bitcoin miner profits has actually transformed over the last couple of years.

The worth of the statistics shows up to have actually signed up a sharp decrease in current months|Resource: @jvs_btc on X

As shown in the above chart, the Bitcoin miner profits had actually begun climbing up along with the rate rally that started back in October of in 2015 and had actually accomplished a brand-new all-time high (ATH) by April of this year.

This boost had actually taken place because of 2 factors. Initially, the block aid, which is offered in BTC, is normally dealt with in both worth and periodicity, so the only variable pertaining to it is the possession’s USD rate. Thus, it makes good sense that the profits would certainly increase when the rate rallies.

At the very same time, the network likewise came to be active, because of the enhanced advancing market website traffic. The deal charge depends on the blockchain problems, because there is just minimal area readily available in blocks. This area normally ends up being extra pricey as competitors for transfers boosts.

The spike to the ATH profits, specifically, was sustained by the arrival of Runes, which is a brand-new modern technology on the chain that enables individuals to mint fungible symbols. Purchases connected to Runes resemble any kind of various other on the network, so they likewise influence network business economics.

From the graph, it shows up that the miner profits had actually signed up a sharp dive right hereafter ATH, with its worth sinking listed below the 365-day easy relocating standard (SMA).

The factor behind this was the 4th Halving. While block benefits remain dealt with in worth for the majority of the moment, there is an exemption in the kind of Cutting in half occasions. These routine occasions, which take place every 4 years, completely slash off these benefits in fifty percent, therefore dramatically shocking miner profits.

Because this decline, the Bitcoin mining profits has actually remained under the 365-day SMA, which has actually placed lots of miners under stress and compelled a few of them right into capitulating.

With the current healing, however, the miner profits has actually climbed to $35 million, which isn’t much from the $40 million annual standard. “This is one more means to reveal the miner capitulation is practically over,” clarifies Van Straten.

If the metric can handle to redeem the 365-day SMA, after that Bitcoin might remain to trend greater, according to the expert.

BTC Rate

Bitcoin has actually delayed in its healing as its rate is still trading around the $66,200 degree.

Resembles the rate of the possession has actually plunged to laterally activity over the last couple of days|Resource: BTCUSD on TradingView

Included picture from Dall-E, Glassnode.com, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.