This is The Takeaway from today’s Early morning Short, which you can subscribe to obtain in your inbox every early morning in addition to:

Tesla (TSLA) and Alphabet (GOOGL) started Large Technology revenues on Tuesday with combined outcomes. Each dropped in pre-market trading on Wednesday.

But Also For all the hand-wringing concerning the focus of outsized gains in the hands of a stunning couple of, supply bulls have 2 factors to support as revenues period increases.

Initially, markets simply finished a fierce turning that moved jackpots from the 7 biggest United States supplies– Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Meta (META), Nvidia (NVDA), Tesla, and Alphabet– to small-cap supplies and rate of interest rate-sensitive names.

Industries like property, homebuilders, and local financial institutions are amongst those currently blazing a trail.

The intensity of the action– which increased with the most up to date weak rising cost of living numbers– should not be marked down.

Liz Ann Sonders, primary financial investment planner at Charles Schwab, wrote that June was the Russell 2000’s worst month versus the Nasdaq in over a year. Yet, she keeps in mind that July is currently tracking the ideal because 2016.

On The Other Hand, in the land of titans, the Wonderful 7 shed $ 1.25 trillion in market cap worth over 7 sessions just recently– equally as the small-cap supplies began insisting toughness.

The trillion-plus decrease in evaluation by the Mag 7 stood for an 8% loss in rate– yet the total market (the S&P 500) was off just 2% over the very same time. Timing is every little thing.

The various other tailwind preferring bulls is a video game of revenues catch-up.

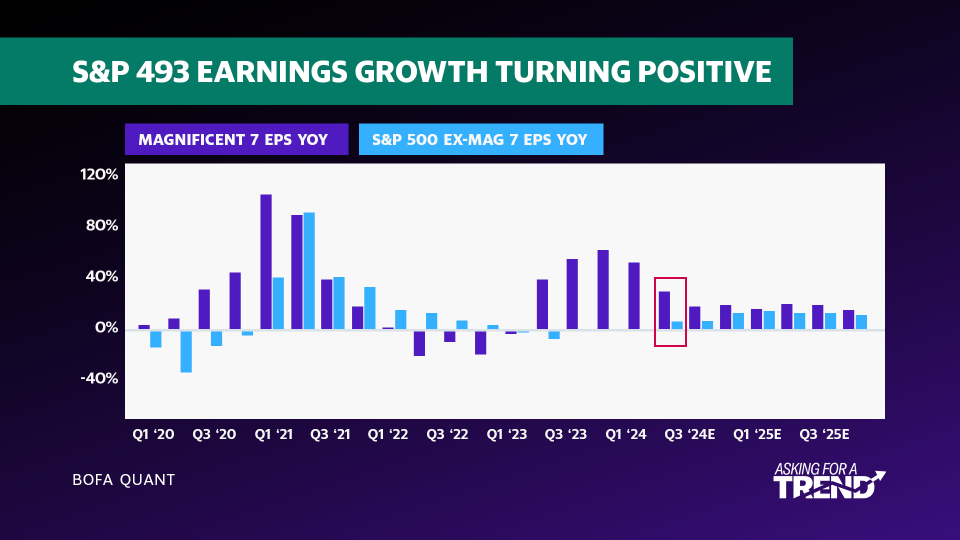

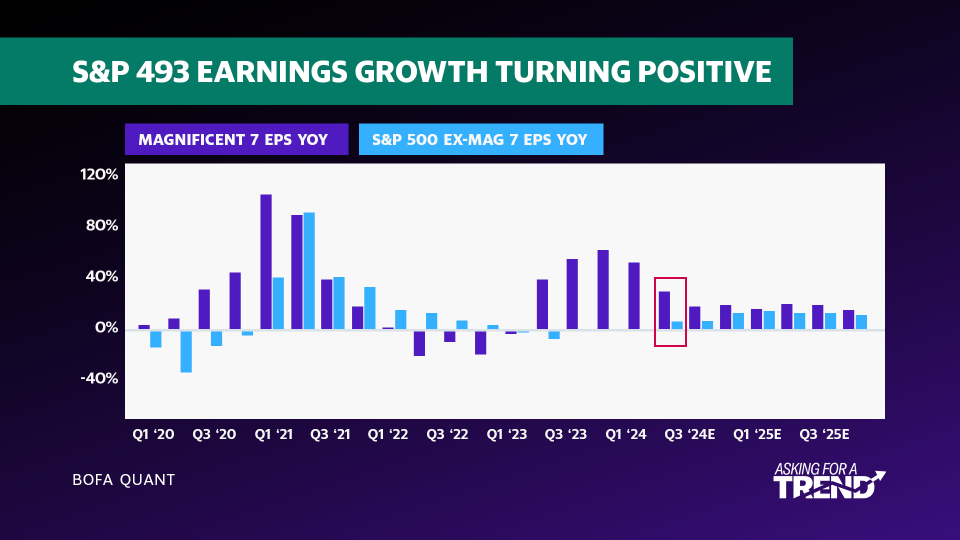

The S&P 493 (the S&P 500 minus the Mag 7) is lastly climbing up out of an earnings recession, as noted by the BofA United States Equity & & Quant Technique group.

Revenues per share (EPS) for the S&P 493 have actually been “level to down for the previous 5 quarters,” composed BofA, also as EPS development for all 500 names transformed favorable 3 quarters earlier.

This newly found toughness for the remainder of the market comes equally as revenues development is “anticipated to slow down for the Wonderful 7 for the 2nd straight quarter and once again in the [third quarter].”

It shows up that also revenues development is turning on a greater timespan.

The really reality that total market volatility stays controlled in spite of these structural changes happening under the marketplace’s hood is a testimony to the durability of the booming market itself.

And BofA anticipates the rally to proceed via breadth development.

” Provided the high connection in between Technology’s outperformance in supplies vs. revenues,” the financial institution composed, “we anticipate the tightening development differential to be the driver for the marketplace to expand out.”

Visit This Site for the most up to date securities market information and comprehensive evaluation, consisting of occasions that relocate supplies

Check out the most up to date monetary and company information from Yahoo Financing

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.