On Monday, the United States Stocks and Exchange Payment (SEC) authorized 9 place Ethereum Exchange Traded Finances (ETFs). Coinbase, the leading United States cryptocurrency exchange, reacted with excitement on X. It noted its essential duty as a custodian for the large bulk of these brand-new economic items. According to their declaration, Coinbase is “happy to be a relied on companion and custodian powering 10 of 11 place BTC ETFs and 8 of the 9 recently authorized ETH ETFs.”

Coinbase Is A Single-Point Of Failing

The declaration from Coinbase likewise highlights the transformative possibility of place ETFs, declaring they will certainly “assist militarize additional development and development” and “increase the dimension and breadth of crypto markets.” Nevertheless, this substantial loan consolidation of custodial obligations by Coinbase has actually stimulated a crucial reaction from some market professionals that are worried concerning the effects of such focus.

Gabor Gurbacs, creator of PointsVille and method expert at Tether, expressed his objection using X. He examined the knowledge of the fund companies’ decision-making procedures: “Coinbase holds possessions for 10 out of 11 place Bitcoin ETFs and 8 out of 9 ETH ETFs. While I make certain they have a terrific safety group, I basically examine the expertise and judgment of boards and run the risk of monitoring boards at fund companies that assume this serves danger.”

Gurbacs’s worries come from the possible threats connected with such a high focus of possessions under the monitoring of a solitary entity. He specified, “It’s almost all possessions for nearly all United States ETFs. What happens if something fails? As we found out, that’s definitely an opportunity in the exchange area. I shed the last little self-confidence that also conventional possessions are from another location risk-free with a lot of companies. Boards mishandle.” His remarks show a wider anxiousness concerning the susceptability of the crypto ecological community to solitary factors of failing, a worry that has actually been highlighted by various top-level exchange hacks and technological failings recently.

To additionally clarify his setting, Gurbacs kept in mind that his objection was not a representation of his point of view of Coinbase’s functional capacities. It is instead a review of the systemic threats postured by such focus. He mentioned, “Solitary entity counterparty for the entire area is still an inappropriate danger,” stressing the requirement for diversity in custodial solutions to minimize possible systemic risks.

In reaction to an X individual’s inquiry concerning the individuality of Integrity’s guardianship service, Gurbacs verified, “Yes,” suggesting that Integrity is the just significant gamer that has actually developed its very own custodial solutions for cryptocurrencies.

Resembling Gurbacs’s beliefs, Steven Dickens, Principal Innovation Expert at The Futurum Team, included his point of view on the requirement for regulative analysis: “Agree. Regulatory authorities require to analyze the systemic threats. Not stating anything poor concerning Coinbase however recently must be a sign of things to come concerning the IT focus threats alone.”

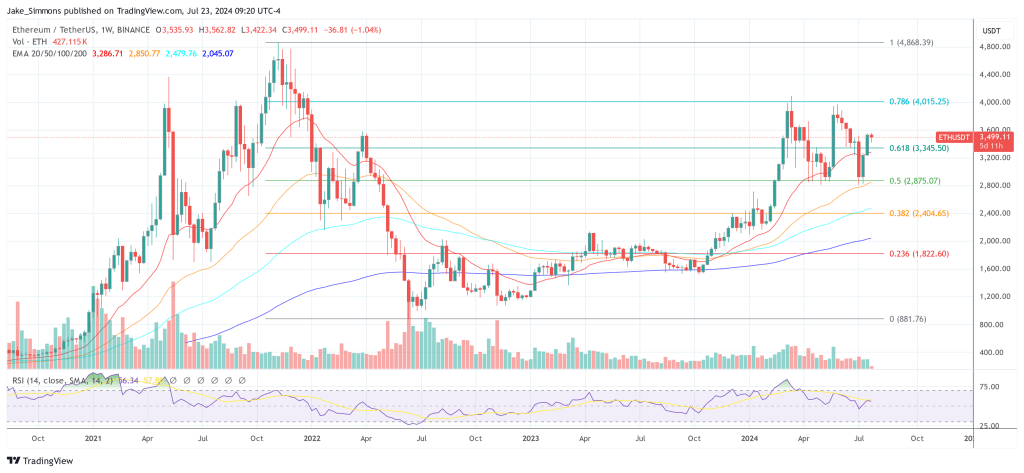

At press time, ETH traded at $3,499.

Included photo developed with DALL · E, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.