Ethereum has actually complied with in Bitcoin’s steps, as the Stocks and Exchange Compensation (SEC) has actually accepted the first-ever Ethereum exchange-traded funds (ETFs).

This ETF authorization notes a considerable turning point for Ethereum and the more comprehensive electronic property sector, signifying expanding institutional approval and mainstream assimilation.

Area Ethereum ETFs Will Certainly Start Trading On Tuesday

Companies such as 21Shares, Bitwise Possession Monitoring Inc., BlackRock Inc., Invesco Ltd., Franklin Templeton, Integrity Investments, and VanEck have actually verified that trading of the Area Ethereum ETFs will certainly start on Tuesday. Financiers can currently obtain straight exposure to Ethereum with a managed economic item, possibly driving boosted financial investment and liquidity on the market.

This progression arises from consistent initiatives to protect Ethereum ETF authorizations, a course formerly browsed by Bitcoin ETFs. Given That January, Bitcoin ETFs have actually brought in substantial financial investments from both retail and institutional fields.

Learn More: Ethereum ETF Described: What It Is and Just How It Functions

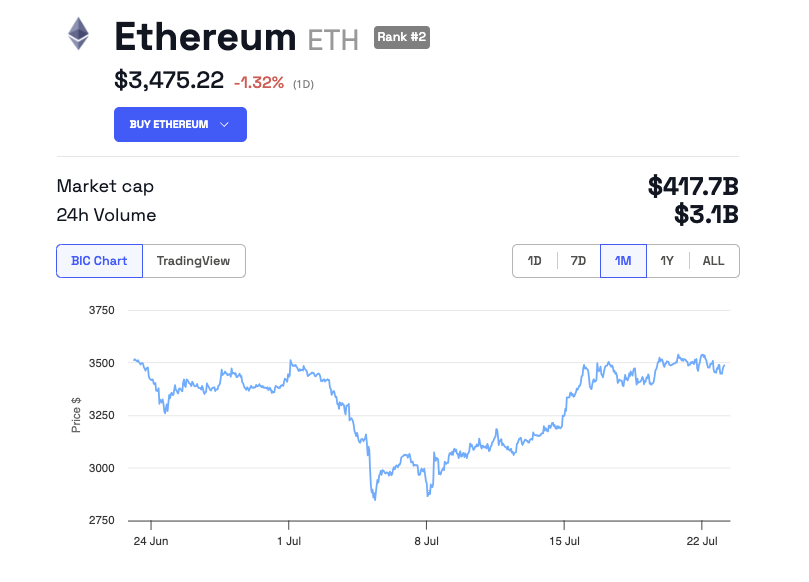

In spite of these developments, Ethereum’s market feedback was remarkably controlled, with a rate decrease of 1.32%. This decrease right away complied with the news, a regular ‘sell-the-news’ impact, where the cost briefly dipped to $3,422 prior to clearing up at concerning $3,475. Offered the value of the SEC’s choice, this warm feedback puzzled numerous financiers and experts.

In a meeting with BeInCrypto, Matteo Greco, Study Expert at Fineqia, reviewed that discharges are gotten out of ETFs originally, including in marketing stress.

” It is very important to keep in mind that Grayscale Ethereum Count On (ETHE), which has actually been trading for many years without redemption alternatives for financiers, might experience web discharges comparable to those seen with Grayscale Bitcoin Count On (GBTC) when BTC Area ETFs released. ETHE will certainly be a different item from the brand-new Grayscale ETH Area ETFs (Ethereum Mini Count On), and first solid discharges from ETHE might balance out web inflows to the brand-new items, complying with the pattern observed with BTC in January,” Greco informed BeInCrypto.

Learn More: Ethereum (ETH) Rate Forecast 2024/2025/2030

In relevant information, Area On Chain reported a considerable deal by an Ethereum whale– 0xf26. This financier transferred 8,762 ETH (valued at about $30.34 million) right into Binance.

Formerly, this whale had actually taken out 8,763 ETH from Binance at a typical cost of $3,882, approximating an expense of $34 million. Marketing currently would certainly cause a projected loss of $3.67 million, a considerable 10.8% reduction, after almost 2 months.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is dedicated to objective, clear coverage. This newspaper article intends to give exact, prompt details. Nonetheless, visitors are recommended to validate realities separately and speak with an expert prior to making any type of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.