Today assures to be a spots in the Bitcoin and market, identified by numerous high-stakes occasions that might improve the marketplace characteristics for BTC, Ethereum, and various other crypto possessions.

# 1 Bitcoin 2024 Meeting

The Bitcoin 2024 meeting, arranged for July 25-27 in Nashville, is attracting remarkable focus this year as a result of its top-level schedule of audio speakers, most significantly Donald Trump. Presently the frontrunner in the United States governmental race, Trump is slated to offer a keynote on the meeting’s last day (Saturday).

The Bitcoin area is swarming with supposition that Trump could introduce strategies to develop a United States Bitcoin calculated book if chosen in November. Recently, this report was sustained by Dennis Doorperson, creator of the Satoshi Act Fund, that asserted that Trump will certainly “introduce an U.S.A. bitcoin calculated book in Nashville” based upon confidential resources.

In Addition, Elon Musk included a “laser-eyes” meme to his X account image over the weekend break, an icon widely utilized by BTC fanatics to indicate favorable market overviews. This act has actually caused extensive supposition concerning his feasible presence and assistance for Bitcoin, more stiring passion in the meeting.

# 2 United States Area Ethereum ETF Release

On Friday, the Chicago Board Options Exchange (Cboe) validated that trading for numerous area Ethereum ETFs will certainly start on July 23 (Tuesday). This adheres to the United States Stocks and Exchange Payment’s (SEC) authorization of the needed governing filings previously in May.

The ETFs introducing consist of 21Shares Core Ethereum ETF (CETH), Integrity Ethereum Fund (FETH), Franklin Ethereum ETF (EZET), Invesco Galaxy Ethereum ETF (QETH), and VanEck Ethereum ETF (ETHV). “We delight in to introduce that [5] Exchange Traded Item[s] (‘ ETP’) will certainly be detailed on Cboe and will certainly start trading as a brand-new problem on July 23, 2024, pending governing performance,” the note mentioned.

# 3 Surge Vs. SEC: Negotiation Or Judgment?

According to conjectures with the XRP area, the United States Stocks and Exchange Commision (SEC) has actually rescheduled recently’s terminated closed-door conference with Surge Labs to July 25, 2024. This conference might be essential as it might possibly result in a negotiation in the continuous Surge vs. SEC suit. The rescheduling has actually triggered supposition in the marketplace, creating a rise in the XRP rate.

Significantly, the Surge chief executive officer Garlinghouse lately likewise stated that the suit might finish quickly. As reported by Bitcoinist, Garlinghouse revealed in a Lot of money meeting positive outlook for a quickly ahead resolution of the suit. “There are a pair points that I’ll call cliffhangers that the court ought to rule on imminently, you recognize a month possibly much less, or possibly 2 months. I can not recognize that, yet I’m anticipating a complete resolution.”

Furthermore, pro-XRP legal representative Fred Rispoli likewise forecasted that a solutions and charge judgment will certainly be launched by the end of July.

# 4 United States Rising Cost Of Living Information

The launch people rising cost of living information, particularly the core PCE consumer price index, on July 26 (Friday), is seriously vital for the monetary markets, consisting of Bitcoin and crypto. Kevin Gordon from Charles Schwab kept in mind that economic experts anticipate the information to reveal an extension of modest rising cost of living prices, possibly affecting the Federal Book’s financial plan.

” Huge week for financial information … Bloomberg agreement of economic experts anticipates June core PCE consumer price index ahead in at +0.1% m/m momentarily straight month. That would certainly bring the 3-month annualized price to the slowest rate this year, and listed below the Fed’s 2% target,” Gordon stated using X.

Likewise, Financial Institution of America anticipates that upcoming financial information will certainly mirror a durable financial background with regulated rising cost of living degrees. “Individual revenue and intake most likely rose by a strong 0.4% mother in June, and we anticipate heading and core PCE to enhance by 0.1% mother and 0.2% mother, specifically. Basically, the information ought to reveal healthy and balanced task, which rising cost of living is relocating the ideal instructions.”

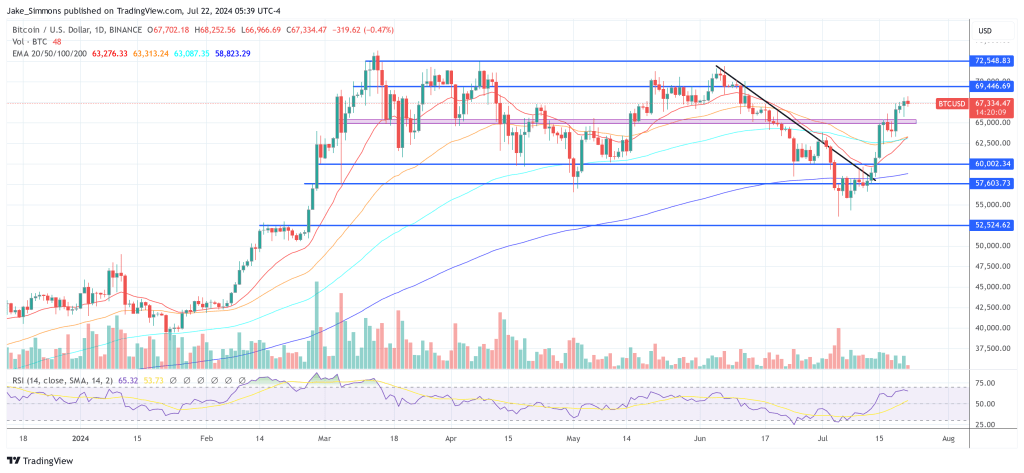

At press time, BTC traded at $67,334.

Included photo from Shutterstock, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.