Bitcoin is strong when composing, drifting greater and over $60,000. Also as the uptrend showed up toiled and energy subsiding, there are indicators that all is well, a minimum of from the earnings angle.

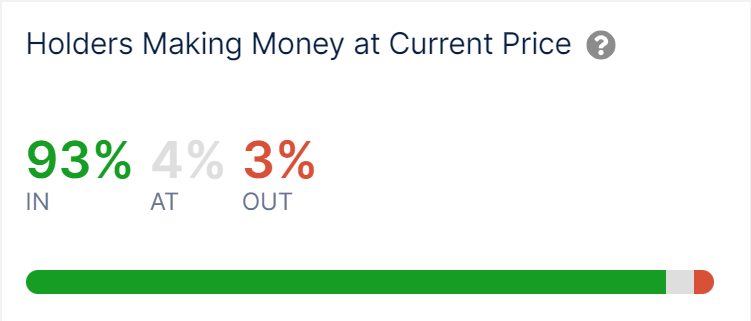

93% Of Bitcoin Addresses Remain In The Cash

Since July 22, Bitcoin is secure and down about 8% from all-time highs of around $74,000. IntoTheBlock data revealed that 93% of all addresses remain in the eco-friendly at area prices.

If anything, it is a significant recuperation and a turn-around, specifically after the significant sell-off of June and very early July 2024, when costs dove to as reduced as $53,500 prior to jumping off.

At the existing evaluation, a minority of BTC owners remain in the red. These entities more than likely purchased around $72,000 or all-time highs, anticipating costs to holler to $100,000.

As it has actually ended up, Bitcoin stopped by as high as 21% from all-time highs to July 2024 lows prior to discovering a respite. The sell-off additionally compelled some owners to leave muddle-headed.

The recuperation to over $67,000 has actually assisted bring back self-confidence amongst BTC owners, specifically temporary owners (STHs). STHs are entities that have actually acquired BTC within the last 155 days. When costs surpassed $63,000, owners within this group started to end up being lucrative, lowering the marketing stress.

Miners Accumulating BTC As Uptrend Confirmed

Surprisingly, as Bitcoin costs border greater, it is additionally arising that miners are not keen on marketing.

Throughout July, IntoTheBlock information revealed that miners had actually been boldy collecting. Leading mining ranches like Mara Digital and Trouble Blockchain built up over 4,500 BTC in the last 3 weeks alone

The favorable belief and assumptions of BTC costs to border greater have actually overflowed, affecting their supply costs. Recently, IntoTheBlock information showed that MARA and trouble supplies climbed by over 30%. Financiers have actually backed these public mining companies, claiming they will certainly proceed broadening in the coming weeks.

At the very same time, it is arising that entities holding a minimum of 1,000 BTC are quickly collecting. By July 19, the quantity of BTC held by this mate stood at a two-year high.

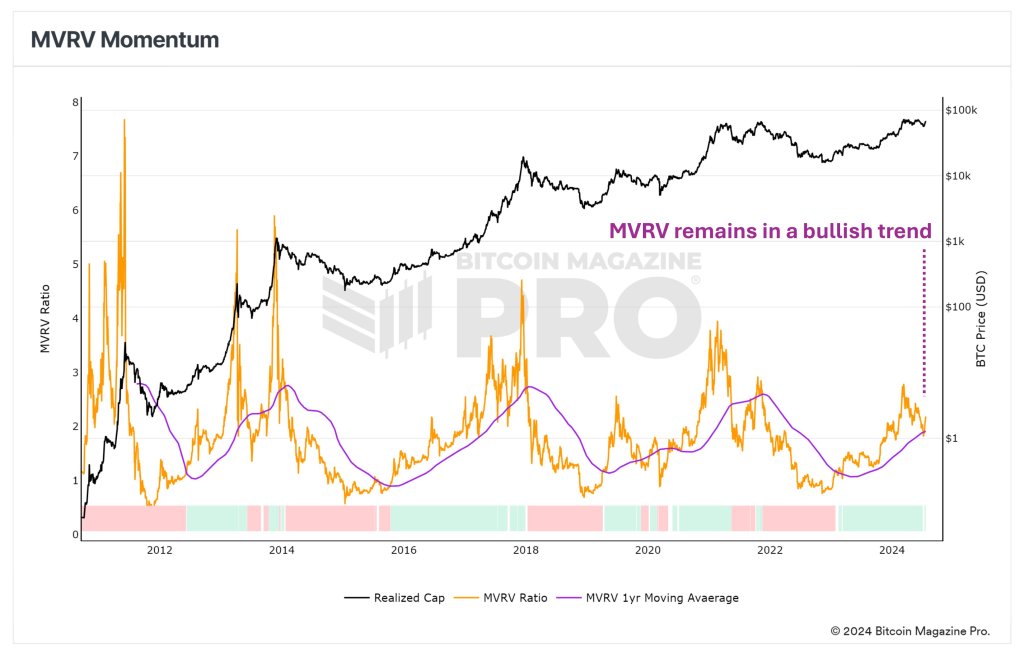

In the middle of this advancement, the Bitcoin Market Price to Recognized Worth (MVRV) proportion, utilized to gauge earnings, is climbing. One expert notes that since July 22, the MVRV was jumping off its 1 year relocating standard, verifying that the BTC uptrend stands.

Attribute photo from Canva, graph from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.