A version of this post first appeared on TKer.co

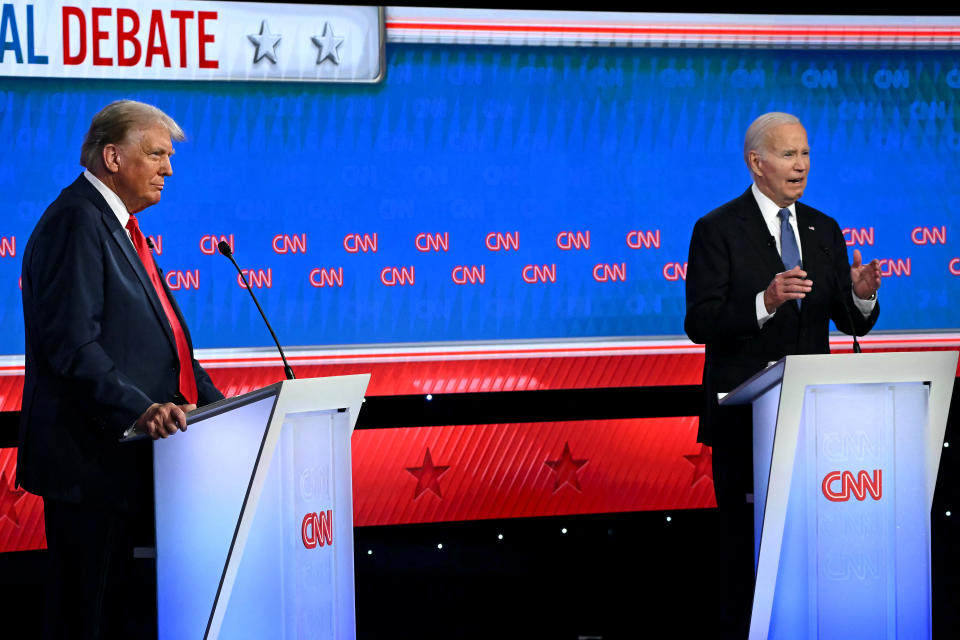

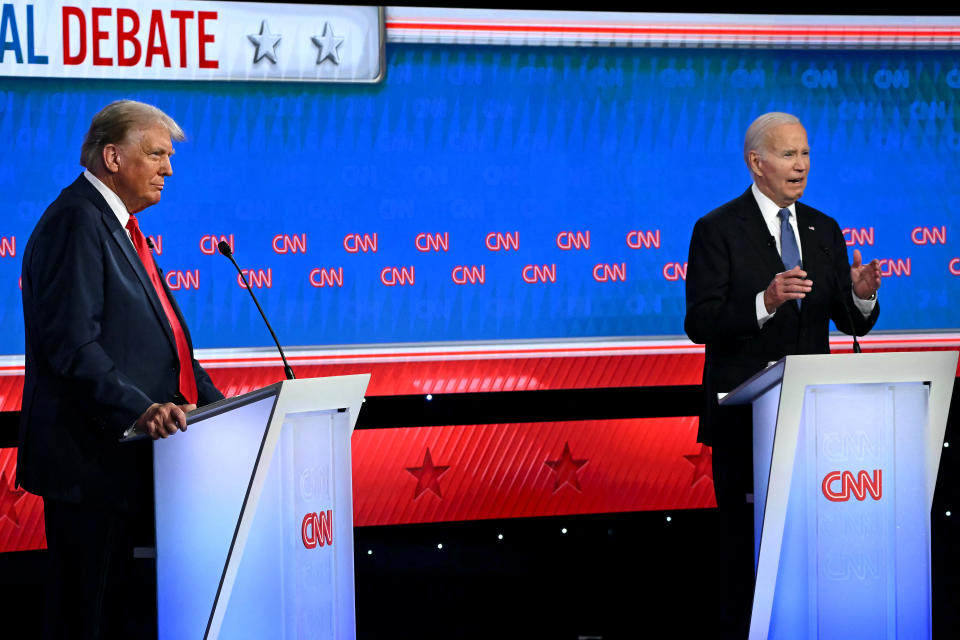

Is a united state head of state from one political event much better for the stock exchange than one from one more event?

So points were that straightforward.

The response to this concern commonly differs depending upon whom you ask. And the majority of solutions will include all kind of cautions consisting of: “Well, this head of state acquired the plans of the last head of state” or “That head of state’s term was influenced by an exogenous shock” or “Does the head of state’s event control Congress?” or “Are we determining from Political election Day or Commencement Day?” and more.

Below’s my solution: Background recommends that a united state head of state’s political angle might not be as crucial for stock exchange efficiency as you could presume.

Take Into Consideration this simple chart from Truist’s Keith Lerner. It’s the trajectory of the S&P 500 considering that 1948 with durations shaded depending upon the Head of state’s political event. There aren’t any kind of evident patterns that leap out– with the exception of the reality that the market spends a lot of time trending higher.

” Markets have actually provided possibilities and dangers under both political celebrations,” Lerner created in a July 2 note. “Political elections issue, yet it is essential not to consider them alone. Business cycle issues, as do evaluations, geopolitics, financial plan, and various other variables.”

Undoubtedly, the individual that inhabits the White Residence is simply among several variables capitalists ought to take into consideration when placing cash to operate in the stock exchange.

In instance you’re seeking an extra granular consider what supplies did under each Head of state, Carson Group’s Ryan Detrick has you covered.

” What matters much more is just how the economic situation, earnings, rising cost of living, and Fed plan all align, not that remains in the White Residence,” Detrick created.

If you need to recognize, you will certainly locate that traditionally head of states from one event have actually been connected with much better returns than those from one more. Below’s Schwab’s Liz Ann Sonders and Kevin Gordon: “Treatment the contemporary duration for the S&P 500, spending just when a Republican politician remained in the White Residence, a $10K first financial investment in 1961 would certainly have expanded to greater than $102K by 2023. On the various other hand, the exact same $10K first financial investment would certainly have expanded to greater than $500K, spending just when a Democrat remained in the White Residence.”

So is the transfer to just have cash out there when the head of state is a Democrat? For capitalists aiming to develop riches with time, the solution is in fact no.

” The exact same $10K at first purchased 1961 would certainly have expanded to greater than $5.1 M by simply remaining spent, without respect for the political event in power,” Sonders and Gordon created.

As they state, time in the market beats timing the market.

The huge image

You do not need to look extremely much back in background to see a head of state you really did not choose or would not have actually chosen. And probabilities are, the stock exchange carried out quite well throughout his term.

To be clear, certainly it issues that is head of state of the USA: It has an instant effect on view, might have temporary and lasting social effects, and might also relocate the needle on the possibility for financial development.

However from a long-lasting financier’s point of view ¹, the individual that inhabits the Oval Workplace has a probably low effect on the currently existing pressures driving the marketplaces.

I personally think component of why that holds true is that everybody desires points to be much better despite genuine or regarded difficulties. All of us desire much better lives for ourselves and those we like. Generally, this entails owning items and accessing solutions. Customers and companies frequently require much more and much better points, which incentivizes business owners and trendsetters to constantly establish and supply much better items and solutions.

The champions in organization grow as their profits expands. Some obtain huge sufficient to be noted in the stock exchange. In this procedure, living requirements enhance, the economic situation expands, and incomes expand. Additionally, incomes drive supply rates.

Where the people differs is just how we tackle this quest, and just how we stabilize it versus our various other wants and needs. And subsequently, these differences have us enacting various instructions.

Depending upon that comes to be head of state, one team will certainly really feel much more tested than the various other. And of course, some firms and markets might do much better than others.

However despite that winds up in the White Residence, it appears that everybody will certainly proceed this quest of desiring points to be much better. It’s what all of us share that relocates the economic situation onward and drives markets greater.

At the end of the day, life seems to go on.

A minimum of that’s what background recommends.

Examining the macro crosscurrents

There were a couple of significant information factors and macroeconomic growths from recently to take into consideration:

Buying maintains near document degrees Retail sales inched reduced in June to $704.3 billion.

Trick groups consisting of online, developing products, health and wellness and individual treatment, furnishings, clothing, and electronic devices expanded. Filling station led weak point, dropping 3.0%. Car and components sales decreased by 2.0%.

The print was much more proof that the economy has gone from very hot to pretty good.

Card costs information is combined From JPMorgan: “Since 08 Jul 2024, our Chase Customer Card investing information (unadjusted) was 0.3% over the exact same day in 2014. Based upon the Chase Customer Card information via 08 Jul 2024, our quote of the united state Demographics July control procedure of retail sales m/m is 0.15%.”

From Bank of America: “Overall card costs per HH was down 1.6% y/y in the week finishing Jul 13, according to BAC aggregated credit history & & debit card information. Retail ex lover automobile costs per HH was available in at -3.0% y/y in the week finishing Jul 13. The decrease contrasted to recently was most likely a minimum of partially because of the influence of Storm Beryl.”

Joblessness declares increase Preliminary insurance claims for welfare leapt to 243,000 throughout the week finishing July 13, up from 223,000 the week prior. And while current prints stays over the September 2022 reduced of 187,000, they remain to trend at degrees traditionally connected with financial development.

Commercial task surges. Industrial production activity in June enhanced 0.6% from the previous month. Production result increased 0.4%.

Homebuilder view drops. From the NAHB’s Carl Harris: “While purchasers seem waiting on reduced rates of interest, the six-month sales assumption for home builders relocated higher, showing that home builders anticipate home loan prices to border reduced later on this year as rising cost of living information are revealing indicators of relieving.”

Ne w home building and construction surges Real estate begins increased 3.0% in June to an annualized price of 1.35 million systems, according tothe Census Bureau Structure licenses expanded 3.4% to an annualized price of 1.45 million systems.

Home loan prices tick reduced According to Freddie Mac, the ordinary 30-year fixed-rate home loan decreased to 6.77% from 6.89% the week prior. From Freddie Mac: “Home loan prices are headed in the best instructions and the economic situation stays durable, 2 favorable step-by-step indicators for the real estate market. Nevertheless, buyers have yet to reply to reduced prices, as acquisition application need is still about 5 percent listed below Springtime, when prices were about the exact same. This is not unusual: in some cases as prices decrease, require compromises, and the evident mystery is driven by purchasers seeing to it prices do not decrease additionally prior to they determine to buy.”

There are 146 million real estate systems in the united state, of which 86 million are owner-occupied and 39% of which are mortgage-free. Of those lugging home loan financial obligation, nearly all have fixed-rate home mortgages, and a lot of those home mortgages have prices that were secured prior to prices rose from 2021 lows. Every one of this is to state: A lot of home owners are not specifically conscious activities in home rates or home loan prices.

Gas rates tick up From AAA: “The nationwide standard for a gallon of gas dropped 4 cents to $3.50 considering that recently. The most likely reason is the dreadful need number for gas, as people might be stopping driving amidst searing summertime temperature levels.”

Workplaces are still reasonably vacant From Kastle Equipments: “The regular ordinary optimal continued to be the same at 56% tenancy, this previous week on Wednesday. Friday– the ordinary reduced day– just got to 15.1%, contrasted to 33.5% the previous week. The July 5th post-holiday dip complies with a comparable fad as in previous years. Houston experienced an abnormally reduced standard reduced day on Monday at simply 4.7% tenancy– much less than half that of any kind of various other city. This was likely because of severe climate and power outages from Storm Beryl.”

This is right stuff pros are fretted about According to BofA’s May Global Fund Supervisor Study, fund supervisors recognized “geopolitical dispute” as the “greatest tail threat.”

The fact is we’re constantly fretted about something. That’s simply the nature of investing.

Near-term GDP development approximates continue to be favorable The Atlanta Fed’s GDPNow model sees genuine GDP development climbing up at a 2.7% price in Q2.

Placing everything with each other

We remain to obtain proof that we are experiencing a favorable “Goldilocks” soft touchdown situation where rising cost of living cools down to convenient degrees without the economic situation needing to penetrate economic downturn.

This comes as the Federal Get remains to utilize extremely limited financial plan in its continuous initiative to obtain rising cost of living controlled. While it holds true that the Fed has actually taken a much less hawkish tone in 2023 and 2024 than in 2022, which the majority of economic experts concur that the last rates of interest walking of the cycle has either currently took place, rising cost of living still needs to remain trendy momentarily prior to the reserve bank fits with rate security.

So we ought to anticipate the reserve bank to maintain financial plan tight, which implies we ought to be planned for reasonably limited economic problems (e.g., greater rates of interest, tighter loaning requirements, and reduced supply evaluations) to stick around. All this implies financial plan will certainly be hostile to markets for the time being, and the threat the economic situation gets on an economic downturn will certainly be reasonably raised.

At the exact same time, we likewise recognize that supplies are marking down systems– implying that rates will certainly have bottomed prior to the Fed signifies a significant dovish kip down financial plan.

Additionally, it is essential to keep in mind that while economic downturn dangers might rise, customers are originating from an extremely solid economic setting. Unemployed individuals are obtaining work, and those with work are obtaining increases.

In a similar way, organization funds are healthy and balanced as several companies secured reduced rates of interest on their financial obligation in recent times. Also as the hazard of greater financial obligation maintenance prices impends, raised revenue margins provide companies space to take in greater prices.

Now, any kind of slump is not likely to develop into financial disaster considered that the economic health and wellness of customers and companies stays extremely solid.

And as constantly, lasting capitalists ought to keep in mind that economic crises and bearish market are simply component of the offer when you get in the stock exchange with the purpose of creating lasting returns. While markets have actually lately had some rough years, the long-run overview for supplies stays favorable.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.