Friendliness market software program service provider Agilysys (NASDAQ: AGYS) will certainly be revealing revenues outcomes tomorrow after market close. Below’s what financiers need to understand.

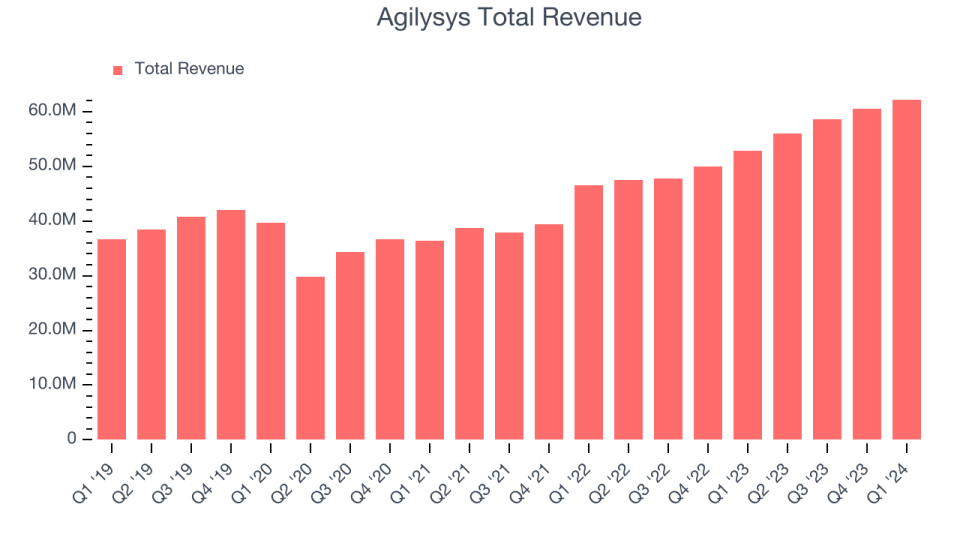

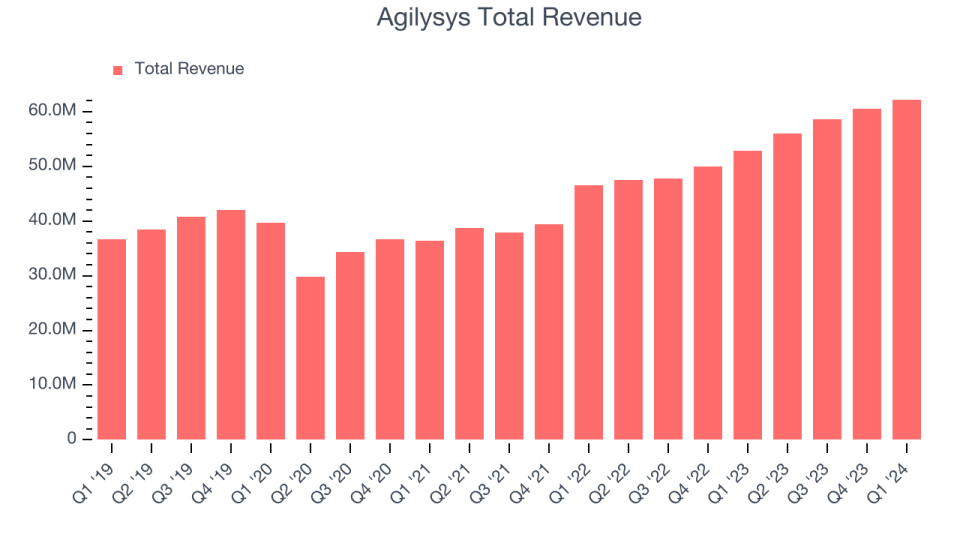

Agilysys fulfilled experts’ earnings assumptions last quarter, reporting earnings of $62.22 million, up 17.6% year on year. It was an okay quarter for the firm, with administration projecting respectable development.

Is Agilysys a buy or market entering into revenues? Read our full analysis here, it’s free.

This quarter, experts are anticipating Agilysys’s earnings to expand 15% year on year to $64.44 million, reducing from the 18% rise it taped in the exact same quarter in 2015. Readjusted revenues are anticipated to find in at $0.26 per share.

Most of experts covering the firm have actually reconfirmed their price quotes over the last 1 month, recommending they expect business to persevere heading right into revenues. Agilysys has a background of surpassing Wall surface Road’s assumptions, defeating earnings price quotes every time over the previous 2 years by 2.4% generally.

Considering Agilysys’s peers in the upright software program section, just Adobe has actually reported outcomes until now. It fulfilled experts’ earnings price quotes, providing year-on-year sales development of 10.2%. The supply traded up 14.5% on the outcomes.

Review our complete evaluation of Adobe’s earnings results here.

There has actually declared view amongst financiers in the upright software program section, with share costs up 5% generally over the last month. Agilysys is up 9.6% throughout the exact same time and is heading right into revenues with a typical expert cost target of $117.2 (contrasted to the present share cost of $107.89).

Today’s young financiers likely have not check out the ageless lessons in Gorilla Video game: Choosing Victors In High Modern Technology due to the fact that it was composed greater than two decades earlier when Microsoft and Apple were initial developing their preeminence. However if we use the exact same concepts, after that business software program supplies leveraging their very own generative AI abilities might well be the Gorillas of the future. So, because spirit, we are thrilled to provide our Unique Free Record on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.