United States supplies dropped on Friday as even more information over an international IT failure flowed in and the significant standards stopped working to recoup from a sell-off that saw the Dow break a run of success.

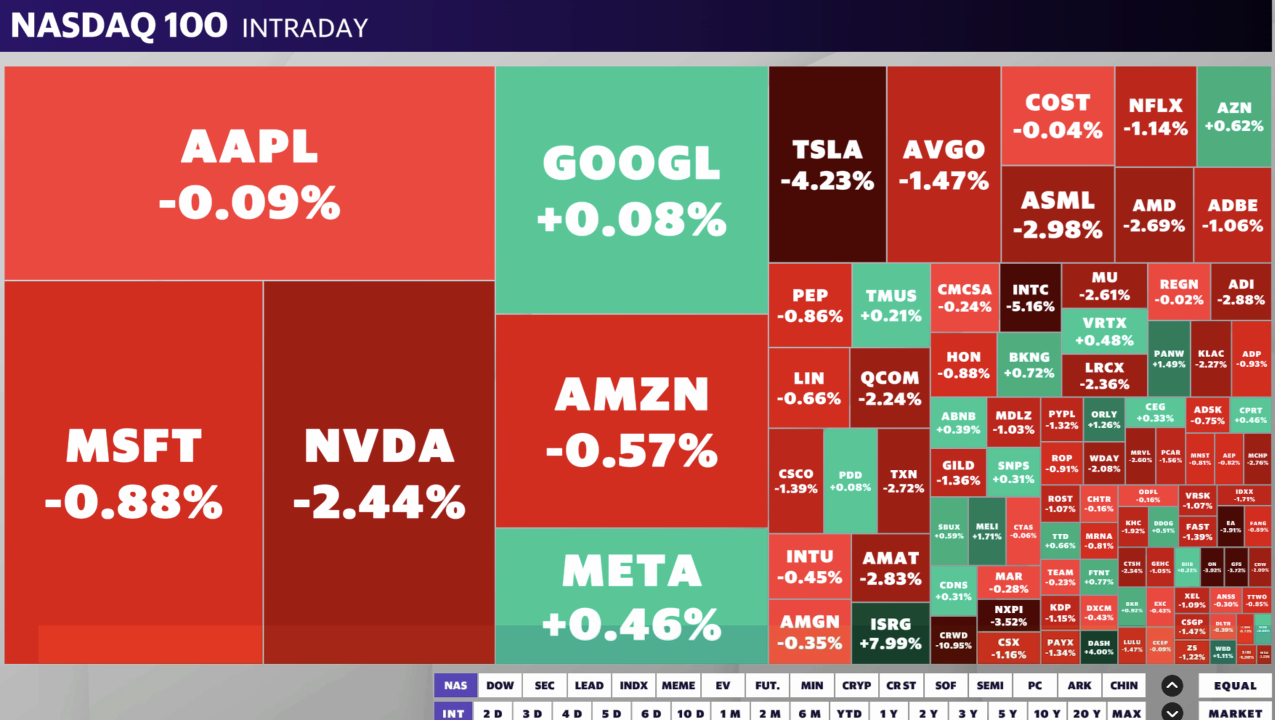

The S&P 500 (^ GSPC) dropped 0.7% while the tech-heavy Nasdaq Compound (^ IXIC) decreased 0.8%. Both the Nasdaq and S&P 500 uploaded their worst week given that April. The Dow Jones Industrial Standard (^ DJI) slid virtually 1%.

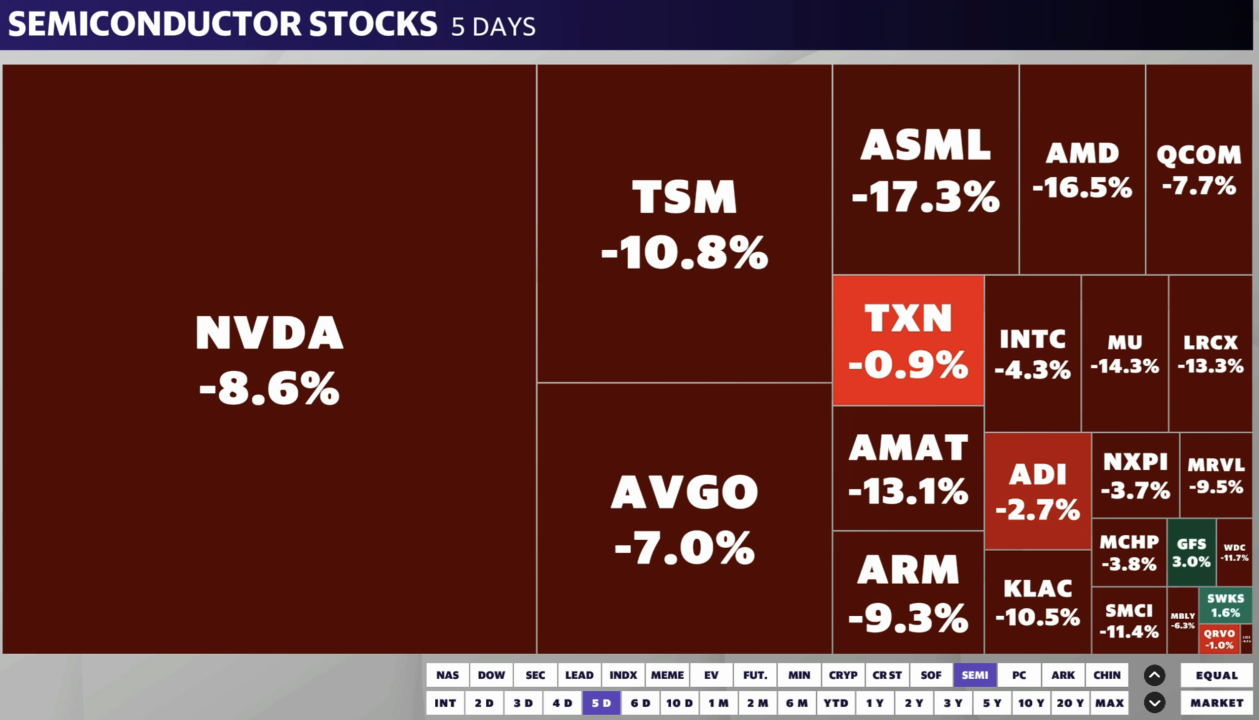

Supplies dropped after a shaky handful of sessions that saw a dive in technology, with AI-focused chip supplies birthing the burden. Financiers are turning out of the technology heavyweights that have actually sustained the current rally and right into little caps, seen by some as profiting a lot more from interest-rate cuts.

In the very early hours, financiers evaluated the possible influence of an “unmatched” failing in computer system systems worldwide that based trips and struck financial institutions, telecommunications and media business, to name a few. However worries relieved after CrowdStrike (CRWD) claimed a solution remained in location for the problem, a messed up upgrade that influenced Microsoft-based (MSFT) systems.

CrowdStrike shares dove as long as 20% as the failure spread, however pared losses to 11%. Shares of Microsoft– which was servicing troubles with its Azure cloud solutions– were down much less than 1%.

On the other hand, Republican governmental competitor Donald Trump utilized his election speech on Thursday to claim he would certainly “finish the electrical lorry required on the first day.” His remark comes as the marketplace awakens to the “Trump profession”– the effects of his plans for possessions if the previous head of state takes the White Residence.

Following week financiers will certainly obtain an additional glance at the state of the customer and economic climate when even more revenues roll in, consisting of quarterly arise from drink large Coca-Cola (KO), distribution solution UPS (UPS) and EV manufacturer (TSLA).

Live 12 updates

-

-

-

Bitcoin rises to $66,000 per token

As various other property courses decreased on Friday, bitcoin (BTC-US) increased greater than 4% to float near $66,000 per token.

Crypto relevant supplies likewise increased throughout the session. Trouble Systems (TROUBLE), MicroStrategy (MSTR) and Coinbase (COIN) each climbed up a minimum of 10%.

-

-

-

-

-

-

-

-

-

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.