United States supplies dropped on Friday as concerns over a worldwide IT interruption relaxed, with Wall surface Road searching for recuperation from a sell-off that saw the Dow break a run of success and a technology thrashing proceed.

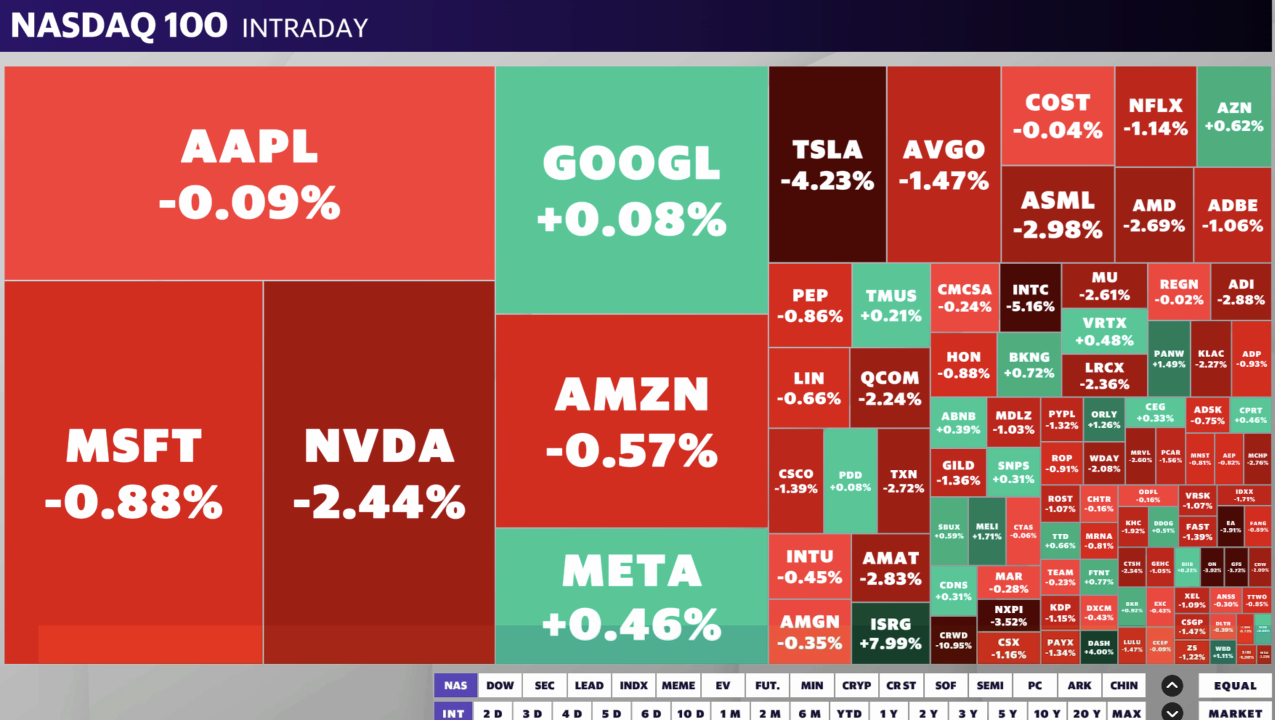

The Dow Jones Industrial Standard (^ DJI) slid about 0.9%, coming off a decrease of over 1% for the excellent index. The S&P 500 (^ GSPC) dropped 0.5%, while the tech-heavy Nasdaq Compound (^ IXIC) decreased 0.5%.

Supplies are dealing with regular losses after an unsteady handful of sessions that saw a dive in technologies, with AI-focused chip supplies birthing the burden. Capitalists are revolving out of the technology heavyweights that have actually sustained the current rally and right into little caps, seen by some as profiting a lot more from interest-rate cuts.

In the very early hours, capitalists analyzed the possible effect of an “unmatched” failing in computer system systems worldwide that based trips and struck financial institutions, telecommunications and media firms, to name a few. Yet issues relieved after CrowdStrike (CRWD) claimed a repair remained in area for the problem, a messed up upgrade that impacted Microsoft-based (MSFT) systems.

CrowdStrike shares dove as high as 20% as the interruption spread, yet pared losses to around 10% by mid-day trading. Shares in Microsoft– which was servicing troubles with its Azure cloud solutions– were down much less than 1%.

At the same time, Republican governmental challenger Donald Trump utilized his election speech on Thursday to state he would certainly “finish the electrical lorry required on the first day.” His remark comes as the marketplace awakens to the “Trump profession”– the effects of his plans for properties if the previous head of state takes the White Home.

Shares of Tesla (TSLA) and various other EV manufacturers dropped on Friday, in addition to the wider market.

Live 8 updates

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.