This is The Takeaway from today’s Early morning Short, which you can join to obtain in your inbox every early morning in addition to:

Tiny caps are fixing Wall surface Road’s focus issue.

Though tiny caps stumbled Wednesday, in the 5 previous trading days, the Russell 2000 (^ RUT) soared an eyewatering 12% as the Nasdaq Compound (^ IXIC) hardly stayed eco-friendly. It was a rise that had never been surpassed by any type of of the significant United States supply indexes, according to Bespoke.

The militarizing occasion was recently’s dovish Customer Rate Index, which reported a real decrease in costs of 0.1%. The indication modification in rising cost of living sufficed to encourage holdouts on Wall surface Road that there’s even more to supplies in 2024 than the widely known staff of technology titans riding the expert system wave.

However laggards are once more transforming to leaders, evoking the “whatever rally” that controlled the 4th quarter in 2014.

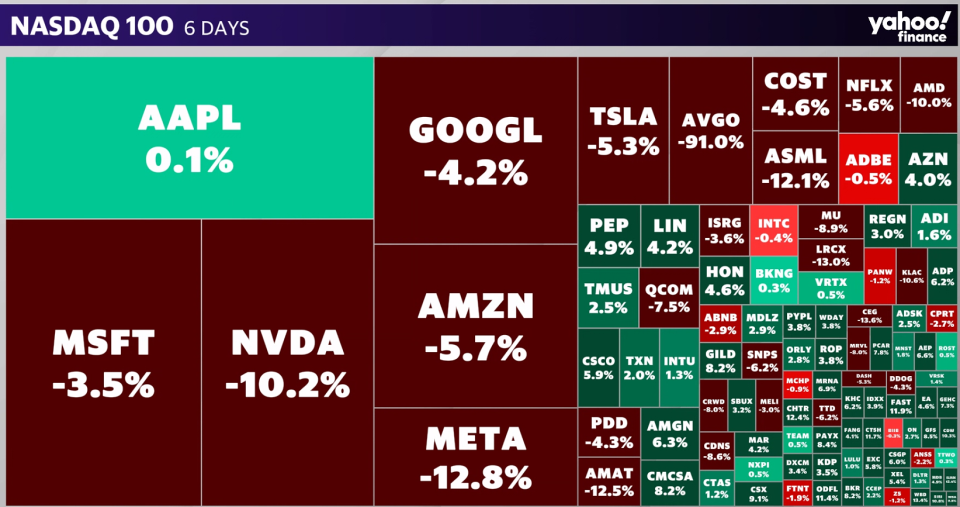

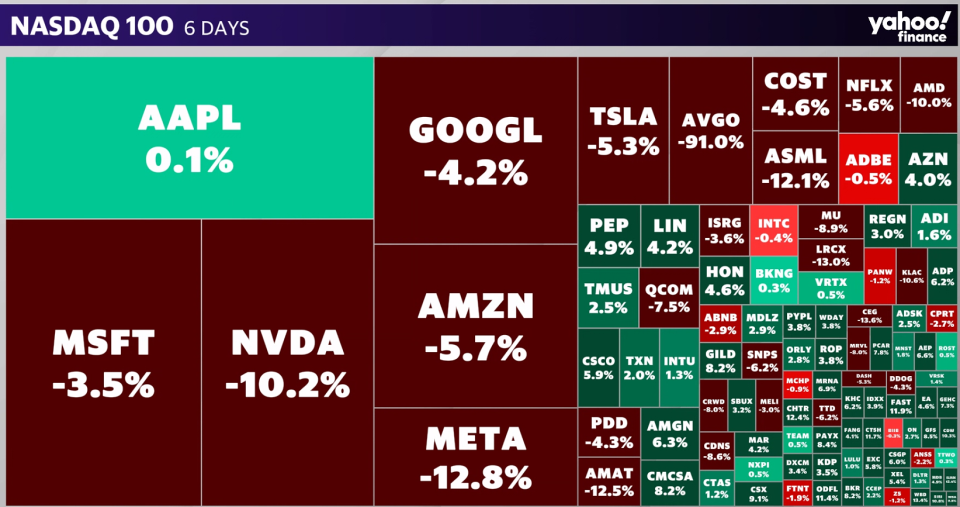

As the Splendid titans shrivel, smaller sized pockets of stamina fill up the management gap. Industry turning is the lifeline of booming market, they claim.

Given that last Tuesday’s close, Realty has actually led the large-cap fields, up 7%. On its heels, cyclicals and worths are well stood for– as Products, Industrials, Power, and Financials are all up concerning 5%.

The only 2 losers are additionally the highest-returning fields for the year– Technology (XLK) and Interaction Solutions (XLC)– down 4% and 2%, specifically.

Looking into the monetary market, we see the SPDR S&P Regional Financial ETF (KRE) has actually currently clawed its back to the drop-off factor from in 2014’s web financial institution dilemma. The 16% rise is a remarkable action for regionals, which have actually had a harsh 2 years considering that their 2022 highs.

The SPDR S&P Homebuilders ETF (XHB) additionally leapt greater than 14% on Monday, and scratched its very first document high considering that March.

While the possibility of tamer rising cost of living lags much of the action, Trump’s rise in appeal after the weekend break murder effort is additionally a variable. Financiers think financial institutions will certainly gain from a lighter regulative touch, and the steepening return contour over the recently additionally aids.

After that there’s crypto. For all the speak about place ether ETFs, the bitcoin halving, and Gary Gensler, Trump’s crypto assistance has actually aided bring bitcoin (BTC-USD) back from an awful sell-off that could have had bearish legs.

Besides the revolutions over the recently, both leading fields in 2024 stay Technology and Interaction Solutions– each hanging on to gains of concerning 17%. However the handwringing over focus can ultimately relax– at the very least, in the meantime.

Click On This Link for the most recent securities market information and comprehensive evaluation, consisting of occasions that relocate supplies

Review the most recent monetary and service information from Yahoo Financing

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.