Taiwan Semiconductor Production (TSM), the globe’s biggest maker of AI chips, briefly got to a $1 trillion market cap recently, surpassing Tesla (TSLA) in market capitalization. Significantly, the supply has actually gotten 20% considering that I mentioned in April thatTSM’s impending growth is being overlooked I am still favorable on TSM, provided several tailwinds of pressing AI need, numerous development drivers, its monopoly-like placement in sophisticated microprocessors, and capability development.

Several Stimulants Cultivating Development at TSM

TSM stays the essential manufacturer and vendor to AI stalwarts like Nvidia (NVDA), Advanced Micro Gadget (AMD), Apple (AAPL), and Qualcomm(QCOM) Noticeably, TSM is additionally the leading maker of NVDA’s newest line of sophisticated Blackwell chips.

High need for making chips from these AI titans has actually brought about TSM’s supply cost gain lately. TSM will certainly remain to gain from solid AI need as various sectors remain to incorporate AI right into their organization facilities.

Furthermore, an intermittent recuperation popular for computers and durable energy in AI chips will certainly drive sales development. Mobile phone sales increased worldwide throughout the very first quarter, resulting in greater orders for mobile chips.

Because of this, sales of mobile phone chips for Apple’s apple iphone along with premium Android phones have actually been greater than anticipated. Because of this, TSM has actually brought big orders from a variety of its first-class customers consisting of AMD, Apple, Broadcom (AVGO), and so on

Most importantly, TSM stated it will certainly probably rise the cost of its chips being provided to Nvidia. Provided the perpetual need and supply restrictions, the cost rise might be considerable. Much better rates will certainly increase TSM’s margins in the coming quarters.

Favorably, NVDA’s administration is open to TSM’s cost rises and has actually not commented versus them. Consequently, various other AI gamers will likely approve the cost rise in the coming months.

Thinking about the rising need, TSM will likely enhance its capital expense to $37 billion, a 15% year-over-year rise from the $32 billion anticipated for 2024. TSM will certainly make use of the added investing towards capability development and creating advanced procedures with greater computer power, like the 2-nanometer innovation chips. Its 2nm innovation is much waited for and is forecasted to lead the market with its sophisticated abilities.

With the boosted financial investments, TSM will certainly guarantee its market management in the production of AI chips. Competitors is developing with peers like Samsung Electronic devices (GB:SMSN) and Intel (INTC) looking at a larger piece of the pie in the semiconductor shop market. Nonetheless, TSM’s range and innovative innovation make it get a clear industry-wide side with a market share at over 60% versus a much reduced market share for its closest rival, Samsung, at 11%, according to Statista

Significantly, TSM is making geographical diversity its essential method. It is broadening right into various other worldwide regions to minimize geopolitical danger. For example, TSM introduced its very first chip manufacturing facility in Kumamoto, Japan, to ease U.S.-China issues. Manufacturing at the manufacture plant is anticipated to begin by the end of 2024, while a 2nd Japanese plant is additionally anticipated to start building around 2024-end.

Previously this year, TSM obtained yet one more increase in its production procedures. The firm obtained authorization for straight government financing worth $11.6 billion under the united state federal government’s CHIPS Act, along with $6.6 billion in grants to broaden its production center in Phoenix az, Arizona.

Provided those elements, TSM is bound to gain from durable AI need, as the overview for semiconductors stays brilliant.

Q2 Earnings and Incomes Assumptions

On July 6, TSM revealed that its Might sales boosted 30% year-over-year in neighborhood money, though they were down 2.7% sequentially from April. For the June quarter, sales are anticipated to expand 32.9% year-over-year (down 9.5% sequentially). Integrated, sales for the very first fifty percent are anticipated to rise 28% year-over-year, defeating experts’ assumptions.

On the EPS front, TSM is expected to report EPS of $1.50 for the 2nd quarter. Noticeably, TSM has a solid performance history of defeating the road’s EPS assumptions for the previous 11 quarters.

Ahead of TSM’s Q2 incomes anticipated tomorrow, several Wall surface Road experts have actually currently boosted cost targets on TSM. Even more, TSM supply has an extremely favorable signal from hedge fund supervisors, that added 5.8 million shares during the last quarter

TSM Is Trading at an Appealing Evaluation

In regards to its appraisal, TSM looks economical. Presently, it’s trading at an eye-catching onward P/E proportion of 26.7 x contrasted to a lot greater multiples of its colleagues. Semiconductor firm Advanced Micro Instruments is trading at a greater onward P/E several (52x), while the AI natural born player Nvidia is trading at an ahead P/E of 47x.

Wall surface Road experts anticipate TSM’s EPS to get to $8.20 in FY2025 (finishing December). If TSM maintains the exact same onward P/E several already, its share cost will certainly have to do with $219, around 28% greater than the present cost. Consequently, it makes good sense to take into consideration acquiring TSM supply at present degrees, provided the solid development possibility in the AI area.

Is TSM a Buy, Market, or Hold, According to Experts?

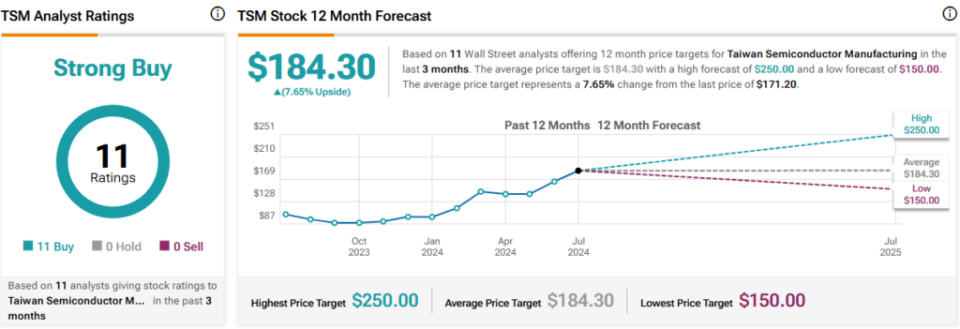

The Wall surface Road area is plainly positive regarding Taiwan Semiconductor Production supply. In general, the supply regulates a Solid Buy agreement ranking based upon 11 consentaneous Buys. Nonetheless, TSM stock’s average price target of $184.30 indicates 7.65% upside prospective.

Final Thought: Think About TSM for the Long-Term AI Possible

A continual outcry popular for whatever AI has actually brought about considerable need for AI chips. TSM’s supremacy in the production of AI chips stays provable, making it an essential factor along with a straight recipient of the AI boom.

With its comprehensive capability development strategies and geographical diversity, extremely expected 2-nm innovation, and greater rates, TSM is established on a development trajectory for the following couple of years. Consequently, I will certainly purchase the supply at present degrees.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.