Quarterly profits outcomes are a great time to sign in on a firm’s development, particularly contrasted to its peers in the very same market. Today we are checking out Product packaging Company of America (NYSE: PKG) and the very best and worst entertainers in the commercial product packaging sector.

Commercial product packaging business have actually constructed affordable benefits from economic climates of range that bring about advantaged acquiring and capital expense that are challenging and pricey to duplicate. Lately, environmentally friendly product packaging and preservation are driving consumers choices and advancement. As an example, plastic is not as preferable a product as it when was. In spite of being important to durable goods varying from beer to tooth paste to washing cleaning agent, these business are still at the impulse of the macro, particularly customer wellness and customer readiness to invest.

The 9 commercial product packaging supplies we track reported a blended Q1; typically, earnings missed out on expert agreement price quotes by 1.6%. while following quarter’s earnings advice was 2.1% listed below agreement. Evaluation multiples for several development supplies have actually not yet returned to their very early 2021 highs, yet the marketplace was positive at the end of 2023 as a result of cooling down rising cost of living. The beginning of 2024 has actually been a various tale as combined signals have actually resulted in market volatility, yet commercial product packaging supplies have actually revealed durability, with share rates up 5.5% typically given that the previous profits outcomes.

Ideal Q1: Product Packaging Company of America (NYSE: PKG)

Established In 1959, Product Packaging Company of America (NYSE: PKG) generates containerboard and corrugated product packaging items, likewise providing screens and safety product packaging remedies.

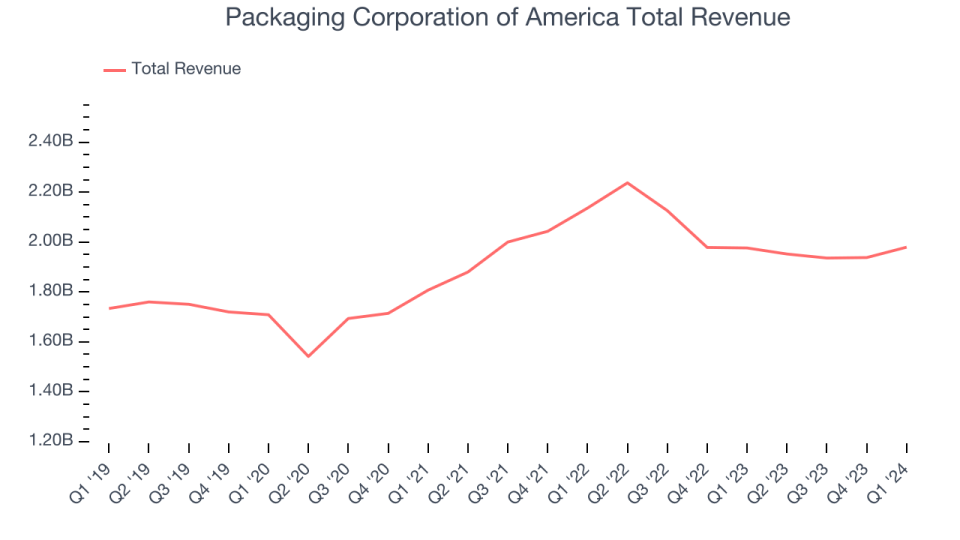

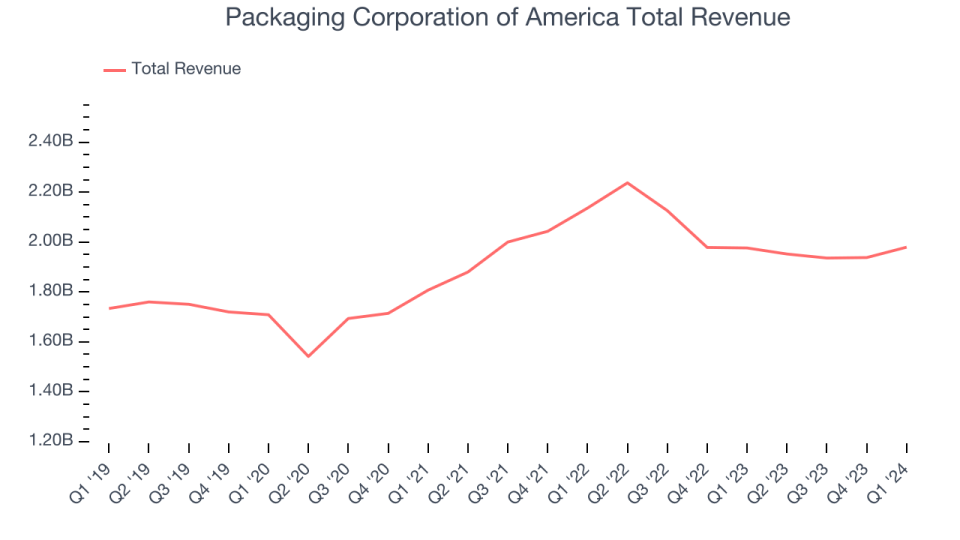

Product Packaging Company of America reported earnings of $1.98 billion, level year on year, surpassing experts’ assumptions by 3.7%. On the whole, it was a phenomenal quarter for the firm with an outstanding beat of experts’ quantity price quotes and a slim beat of experts’ profits price quotes.

Discussing reported outcomes, Mark W. Kowlzan, Chairman and chief executive officer, stated, “Throughout the quarter, containerboard and corrugated items require surpassed our assumptions. We had the ability to service this greater need from solid functional efficiency at our box plants and containerboard mills in addition to from outstanding implementation of the conversion blackout at our Jackson, AL mill which allowed us to reactivate both equipments earlier than prepared. In spite of these initiatives, with the greater need, we finished the quarter at a document reduced weeks-of-inventory supply for this moment of year. Rates and mix in the Product packaging sector relocated a little greater from 4th quarter 2023 degrees, although much less than we prepared for as a result of our overall reported rise not being acknowledged in the released standard rates. Quantity in the Paper sector was excellent at regarding 13% over advice price quotes, and a boosted mix relocated rates a little greater from the previous quarter, as anticipated. Furthermore, throughout the quarter we introduced a rate rise of $100 per load throughout every one of our paper qualities, and we started executing these rises on April 1st. The solid quantity in both the Product packaging and Paper sectors together with the proceeded focus on price administration and procedure performances throughout our production and transforming centers drove operating and transforming prices reduced, despite the consistent rising cost of living we remain to experience throughout the majority of our price framework.”

The supply is up 6.8% given that reporting and presently trades at $191.35.

Is currently the moment to get Product packaging Company of America? Access our full analysis of the earnings results here, it’s free.

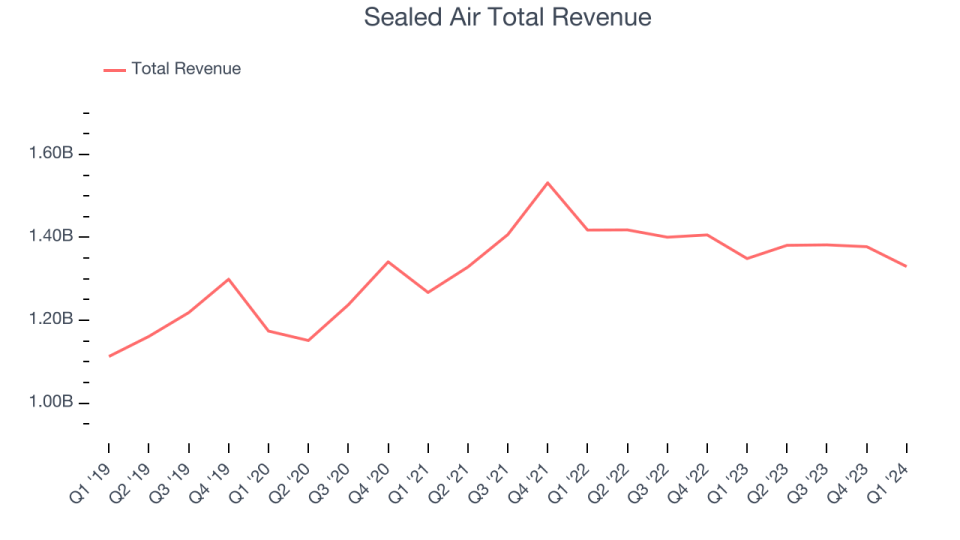

Sealed Air (NYSE: SEE)

Established In 1960, Sealed Air Company (NYSE: SEE) focuses on the growth and manufacturing of safety and food product packaging remedies, offering a range of markets.

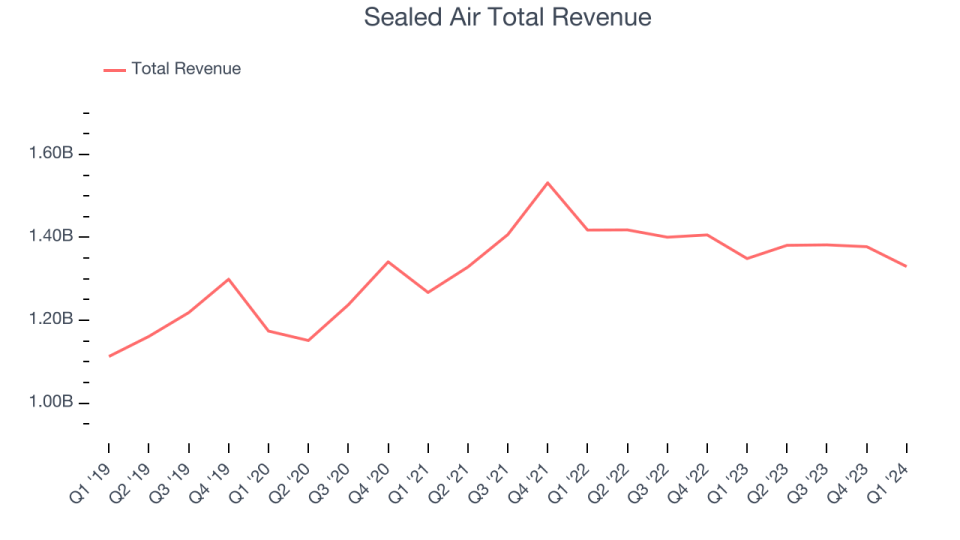

Sealed Air reported earnings of $1.33 billion, down 1.4% year on year, exceeding experts’ assumptions by 3.8%. It was a really solid quarter for the firm with an outstanding beat of experts’ quantity and profits price quotes.

Sealed Air managed the most significant expert approximates defeat amongst its peers. The marketplace appears delighted with the outcomes as the supply is up 14.9% given that coverage. It presently trades at $36.85.

Is currently the moment to get Sealed Air? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Silgan Holdings (NYSE: SLGN)

Developed in 1987, Silgan Holdings (NYSE: SLGN) is a provider of inflexible product packaging for durable goods items, concentrating on steel containers, closures, and plastic product packaging.

Silgan Holdings reported earnings of $1.32 billion, down 7.1% year on year, disappointing experts’ assumptions by 4.1%. It was a weak quarter for the firm with a miss out on of experts’ natural earnings price quotes.

As anticipated, the supply is down 2% given that the outcomes and presently trades at $45.75.

Read our full analysis of Silgan Holdings’s results here.

International Paper (NYSE: IP)

Developed in 1898, International Paper (NYSE: IP) generates containerboard, pulp, paper, and products made use of in product packaging and printing applications.

International Paper reported earnings of $4.62 billion, down 8% year on year, going beyond experts’ assumptions by 2.7%. Earnings apart, it was a great quarter for the firm with a strong beat of experts’ Cellulose Fibers earnings price quotes.

The supply is up 32.5% given that reporting and presently trades at $45.60.

Read our full, actionable report on International Paper here, it’s free.

Crown Holdings (NYSE: CCK)

Previously Crown Cork & & Seal, Crown Holdings (NYSE: CCK) generates product packaging items for customer advertising and marketing business, consisting of food, drink, house, and commercial items.

Crown Holdings reported earnings of $2.78 billion, down 6.4% year on year, disappointing experts’ assumptions by 5.1%. Taking a go back, it was a weak quarter for the firm with a miss out on of experts’ earnings price quotes.

The supply is down 3.8% given that reporting and presently trades at $78.04.

Read our full, actionable report on Crown Holdings here, it’s free.

Sign Up With Paid Supply Capitalist Study

Assist us make StockStory a lot more valuable to financiers like on your own. Join our paid customer research study session and get a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.