Technology supplies fell short to rebound on Thursday adhering to the Nasdaq’s worst day because 2022, also as chip maker TSMC (TSM) published better-than-expected outcomes.

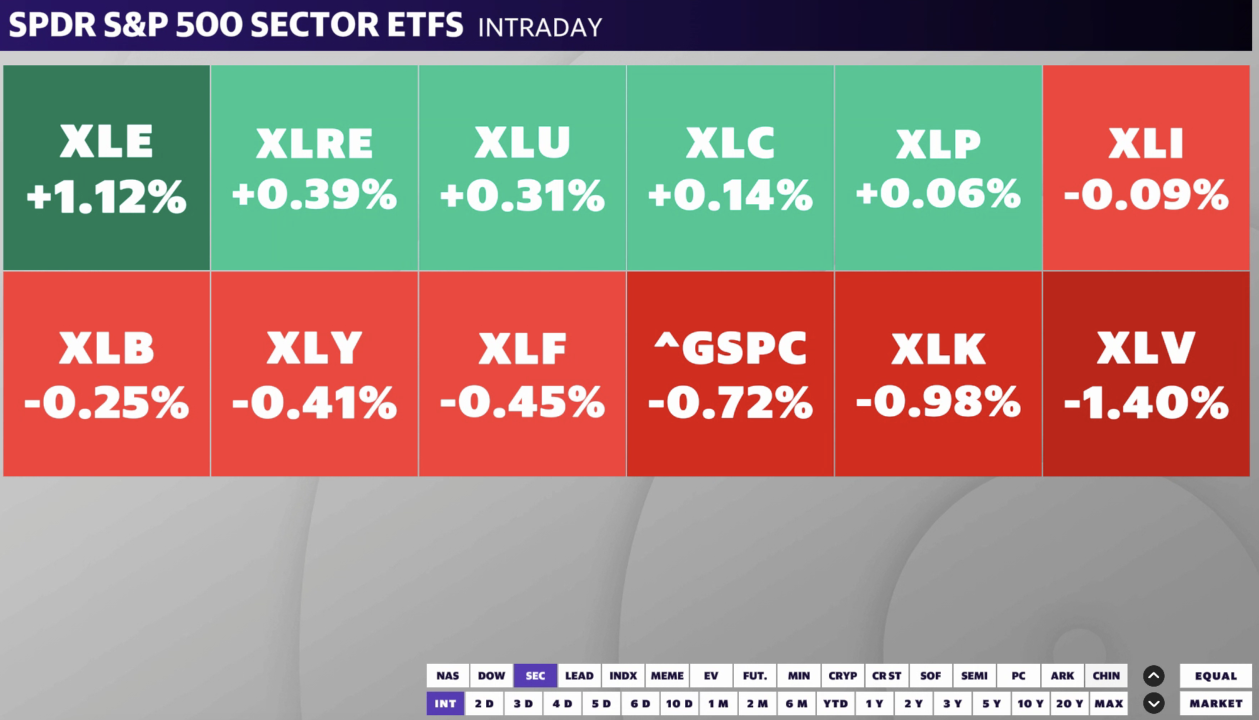

The tech-heavy Nasdaq Compound (^ IXIC) removed earlier gains to tip over 1%, while the S&P 500 (^ GSPC) additionally dropped 0.7%. The Dow Jones Industrial Standard (^ DJI) slid 0.4% adhering to an all-time closing document for the leading index in the previous session.

The rally on Wall surface Road has actually struck raising disturbance today as political, geopolitical, and profession dangers agitate a market ultimately certain that the Fed will certainly reduce rate of interest this year.

An indication the labor market is cooling down better reinforced those rate-cut hopes on Thursday. The variety of proceeding applications for welfare once more strike its highest degree because November 2021.

Learn More: Exactly how does the labor market impact rising cost of living?

Thursday’s losses on the Nasdaq adhere to a 2.7% decrease in the previous session, partially because of a possible rise in United States aesthetics on exports to China. Chip supplies Nvidia (NVDA), TSMC, and ASML (ASML) all obtained hammered in the middle of a turning from technology leaders right into much less features of the marketplace. All 3 were down better on Thursday.

TSMC’s solid quarterly profits briefly assisted raise the state of mind throughout the session. The Taiwanese chip gigantic beat on earnings with a 36% dive, and it elevated its 2024 sales overview to indicate self-confidence in the AI boom.

Netflix (NFLX) is the emphasize on Thursday’s profits docket, due after the marketplace close. Assumptions are high for the banner, though some on Wall surface Road keep in mind the supply is currently teasing with document degrees.

Somewhere else, financiers are maintaining a careful eye on the United States governmental race, offered Republican politician candidate Donald Trump’s prospective to relocate markets. Head Of State Joe Biden has actually fallen victim to COVID-19 at a bottom line in his project, and essential Autonomous leaders have actually revitalized broach a leave.

Live 10 updates

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.