The current comments by leading United States governmental prospect Donald Trump pertaining to Bitcoin’s prospective function as a calculated book property for the USA have actually fired up significant conversations amongst policymakers, lawful professionals, and monetary experts. While Forbes reported on the prospective step, it is David Bailey, Chief Executive Officer of Bitcoin Publication and consultant to the Trump project, that goes to the leading edge of supporting for an extensive Bitcoin (BTC) structure under Trump’s prospective management.

As a consultant to Trump, Bailey has actually checked out the academic effects of the United States taking on Bitcoin as a calculated book property in June, as reported by Bitcoinist. In his vision, Donald Trump can safeguard a substantial BTC book for the United States Treasury by taking the 210,000 BTC currently held by the U.S.A. and timelock those coins for 100 years.

Just How Trump Can Transform Bitcoin Into A Book Possession

Increasing on the prospective systems to execute this technique, Matthew Pines, Supervisor at Guard One and a National Protection Other at the Bitcoin Plan Institute, shared his ideas on X today. Pines described 2 primary lawful structures under which Trump can possibly perform this unmatched step.

# 1 Using the Exchange Stablizing Fund (ESF): The ESF, developed under the Gold Book Act of 1934, accredits the Assistant of the Treasury to “sell gold and forex, and such various other tools of credit score or safety and security as he might regard required to perform the objective of this area.”

Pines suggests that an exec order can be composed to consist of Bitcoin as a kind of “forex” or a “safety and security.” This would certainly make it possible for the Treasury Assistant to buy Bitcoin straight, leveraging the fund’s wide required to support the exchange worth of the buck. The classification of Bitcoin as a fx can be validated by its fostering as a lawful money by nations like El Salvador and its extensive usage in worldwide purchases.

# 2 Pressing the Federal Book to utilize its emergency situation powers under Area 13( 3 ): The Federal Book Act’s Area 13( 3) permits the Fed to deal with “uncommon and exigent conditions” by producing loaning centers. Pines recommends that Trump can advise the Fed to establish an Unique Objective Car (SPV) for the objective of buying Bitcoin on the competitive market.

This strategy mirrors techniques utilized throughout the COVID-19 pandemic when the Fed acquired company bonds that had actually dropped in ranking. Nevertheless, Pines recognizes that this would certainly extend the Fed’s lawful authority and can possibly prompt lawful difficulties.

Steven Kelly, Affiliate Supervisor of Study at the Yale Program on Financial Security, reacted to Pines and doubted the expediency of the Fed’s participation under Area 13( 3 ). “The 13( 3) course is generally difficult. Along with the human barriers presently manning the Fed, the “uncommon and exigent conditions” need will certainly be specifically binding.” Kelly highlighted and included, “ESF course a lot more practical, specifically if mounted merely reapportioning the gets to consist of BTC.”

David Beckworth, Elder Study Other at Mercatus Facility, quized whether federal government pension plan funds can be urged to buy Bitcoin. Pines resolved this by referencing the Federal Personnel’ Retired Life System Act of 1986 (FERSA), which lays out the fiduciary responsibilities restricting the sorts of financial investments enabled.

Nevertheless, he kept in mind, “The Board will suggest policies under which amounts in the Second hand Cost savings Fund are assigned to numerous funds, to name a few funds, as figured out by policies suggested by the Board,” leaving a slim opportunity for regulative changes.

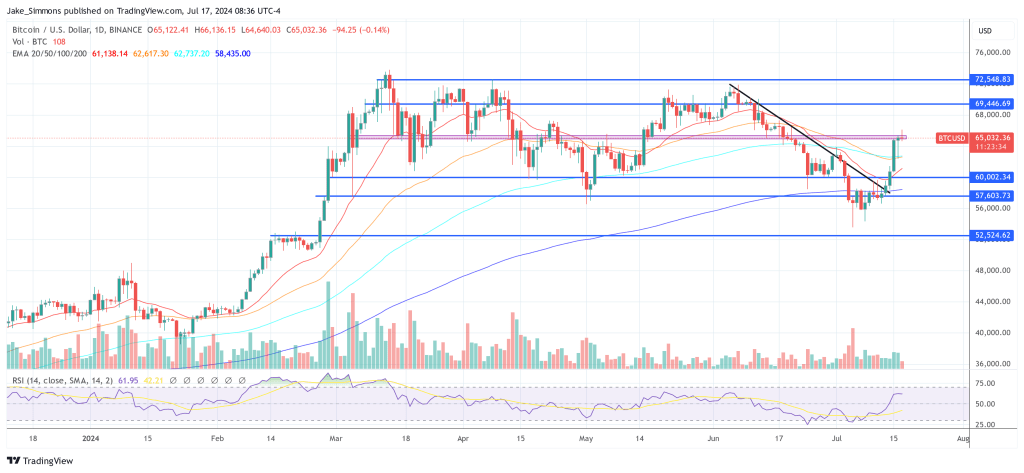

At press time, BTC traded at $65,032.

Included picture developed with DALL · E, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.