Information from the on-chain analytics strong Glassnode has actually disclosed just how the Bitcoin deal quantity compares to conventional repayment cpus.

Bitcoin Is Currently Witnessing On-Chain Quantity Of $46.4 Billion Each Day

As clarified by Glassnode in a brand-new post on X, BTC’s on-chain deal quantity presently stands at $46.4 billion each day. The on-chain deal quantity below normally describes a statistics that keeps an eye on the complete quantity of Bitcoin ending up being associated with network transfers.

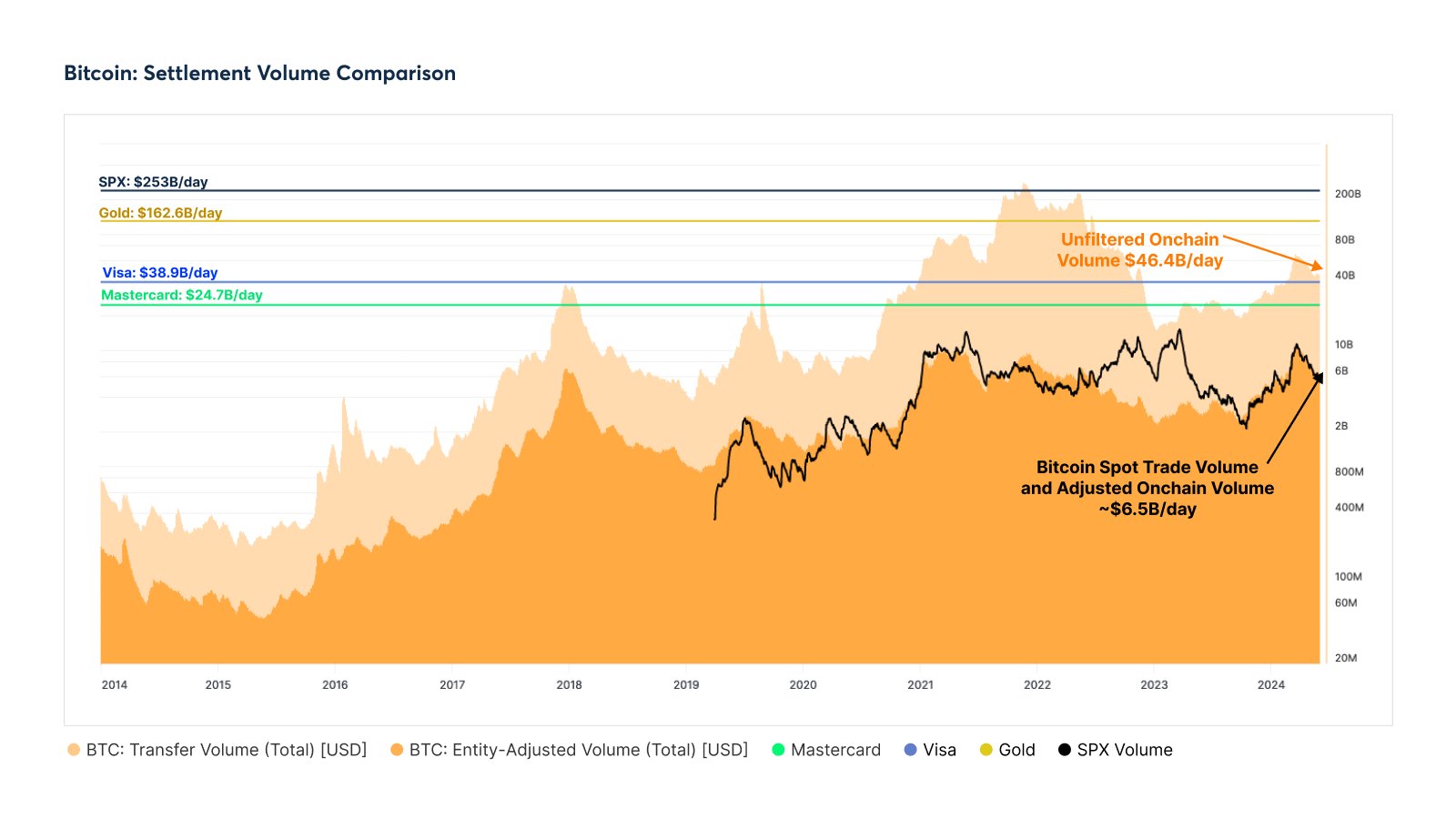

Below is the graph shared by the analytics company that presents just how the on-chain deal quantity of BTC contrasts versus some conventional repayment cpus.

The fad in the BTC transfer quantity over the previous years|Resource: Glassnode on X

As shows up in the chart, Bitcoin’s existing on-chain quantity of $46.4 billion each day is greater than Visa and Mastercard’s $38.9 billion each day and $24.7 billion each day, specifically.

Something to keep in mind, however, is that this BTC quantity consists of all kind of on-chain tasks the individuals could be joining. Therefore, it consists of info regarding means greater than simply financial transfers.

In the graph, Glassnode has actually additionally affixed the information for a filteringed system quantity of cryptocurrency, which offers an estimate for economy-based purchases.

The analytics company has actually incorporated 2 quantities to get to this evaluation: the area profession quantity (the quantity obtaining associated with professions on the different area exchanges) and the readjusted on-chain quantity.

The modified on-chain quantity describes the quantity composed of purchases in between various entities. Glassnode specifies an entity as a collection of addresses the analytics company has actually identified to come from the exact same financier via its evaluation.

Deals in between the addresses of the exact same financier do not bring the exact same definition as those in between various financiers, which is why Glassnode has actually opted for the entity-adjusted strategy.

The mixed area and entity-adjusted quantity presently stands at $6.5 billion each day. Hence, it would certainly show up that in regards to financial deal quantity, Bitcoin is much listed below Mastercard and Visa.

The analytics company has actually additionally affixed the information for the quantities of Gold and SPX in the exact same chart, and it shows up that both have quantities much over the remainder at $162.6 billion each day and $253 billion each day, specifically.

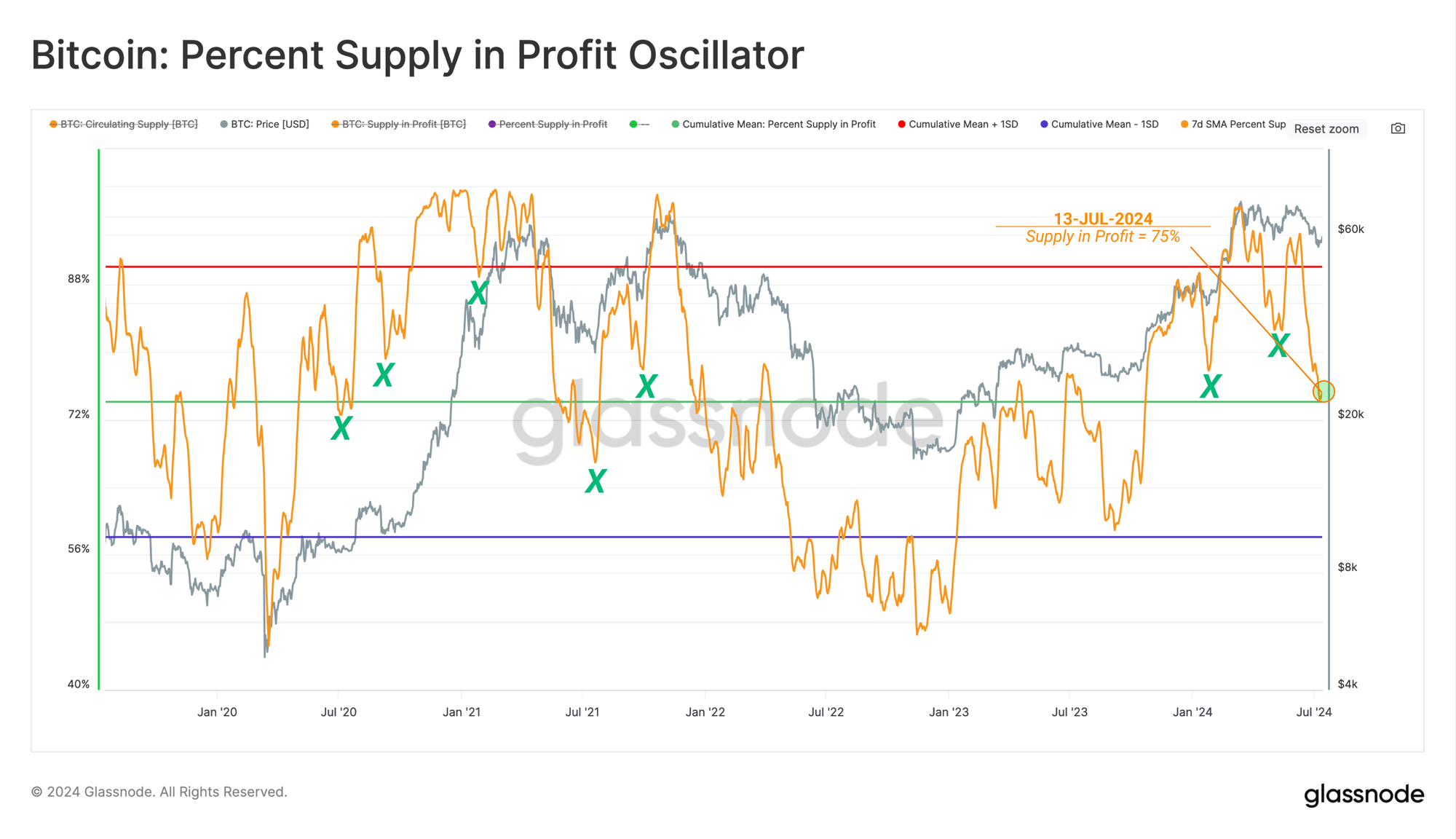

In a few other information, the complete percent of the BTC supply bring some internet latent revenue dove to the 75% mark throughout the current collision, as Glassnode has actually explained in its most current once a week record.

Resembles the worth of the statistics took a sharp dive throughout the collision|Resource: Glassnode's The Week Onchain - Week 29, 2024

As appears from the chart, this current plunge in the supply of revenue was to a degree that Bitcoin has actually additionally checked out in previous booming market improvements.

BTC Rate

At the time of composing, Bitcoin is trading at around $65,200, up virtually 13% over the previous week.

The rate of the coin appears to have actually been rising over the last couple of days|Resource: BTCUSD on TradingView

Included picture from Dall-E, Glassnode.com, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.